T2K_02-17_OnlinEdition

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FEBRUARY 20<strong>17</strong><br />

GENERAL MANAGER<br />

Megan Hicks<br />

SALES MANAGER<br />

Jerry Critser<br />

ADMINISTRATIVE STAFF<br />

Tammy Borrelli<br />

Charlene Abernathy<br />

CREATIVE DIRECTOR<br />

Chad Singleton<br />

EDITOR<br />

Sean O’Connell<br />

ADVERTISING ACCOUNT EXECUTIVES<br />

Meg Larcinese<br />

1.678.325.1<strong>02</strong>5<br />

megl@targetmediapartners.com<br />

John Hicks<br />

1.770.418.9789<br />

johnh@targetmediapartners.com<br />

Greg McClendon<br />

1.678.325.1<strong>02</strong>3<br />

gregmc@targetmediapartners.com<br />

Roger Fair<br />

1.256.676.3688<br />

rogerf@targetmediapartners.com<br />

Sean Hayes<br />

1.256.405.40<strong>17</strong><br />

seanh@htwoservices.com<br />

COLUMNS<br />

Bulletin Board...........................14<br />

Highway Angel..........................24<br />

Bottom Line..............................36<br />

Advertiser’s Index.....................48<br />

COPYRIGHT: Copyright 20<strong>17</strong> Wilshire Classifieds,<br />

LLC. Publisher as sumes no responsibility for<br />

unsolicited material. Reproduction in whole or in<br />

part without written permis sion is prohibited. All<br />

advertisements, and/or editorials are accepted and<br />

published by Publisher on the representation that<br />

the advertiser, its advertising agency, and/or the<br />

supplier of the contents are authorized to publish<br />

the entire contents and subject matter thereof.<br />

The advertiser, its advertising agency and/or the<br />

supplier of the contents will defend, indemnify and<br />

hold Publisher harmless from and against any loss,<br />

expense or other liability, resulting from any claims<br />

or suits for libel, violation of privacy, plagiarism,<br />

copyright or trademark infringement and any other<br />

claims or suits that may rise out of publication<br />

of such contents. Press releases are expressly<br />

covered within the definition of contents.<br />

TRUCKING 20<strong>17</strong> • (256) 835-7610<br />

4 TRUCKING 20<strong>17</strong>

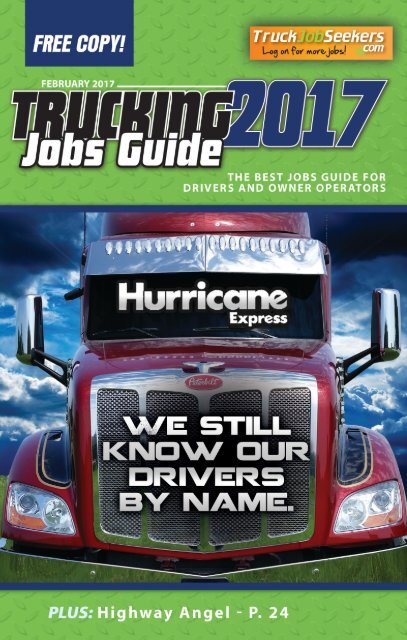

You’re not just a number at Hurricane Express.<br />

“You’re no longer a number. They actually<br />

know who you are. Your face. Your name.<br />

When you pick up the phone, they know your<br />

voice. You are part of the family.”<br />

That’s how Damian Hunsaker describes<br />

Hurricane Express, a family-owned company<br />

based out of Colcord, Oklahoma that has been<br />

in business since 1988. Hurricane specializes<br />

in lease-purchase trucking and in refrigerated<br />

freight going coast-to-coast--mainly produce,<br />

poultry, and seafood. And like Hunsaker says<br />

(and the company’s website proudly proclaims),<br />

“We still know our drivers by name, not by the<br />

number on their truck.”<br />

This sentiment is shared by fellow Hurricane<br />

Express driver Cliff Thomas, who has been with<br />

the company for almost four years.<br />

“They’re great people,” he said. “They treat<br />

you like family. They know everybody’s name.<br />

You’re not just a number with them. Not just<br />

the office people, but even the owner of the<br />

company is accessible.<br />

“The freight is good. It’s always consistent.<br />

The miles are always good,” Thomas added. “It<br />

is coast-to-coast trucking. It’s over the road,<br />

and I do like that, as opposed to regional. For<br />

anyone looking for an over-the-road job, it’s<br />

perfect.”<br />

Hunsaker has been driving for Hurricane for<br />

almost a year, operating out of his home base in<br />

Phoenix, Arizona.<br />

“Hurricane has been very supportive, as they<br />

seem to be with everybody, because they’d<br />

like everybody to be successful and be able<br />

to move forward. It has been a wonderful<br />

experience. They’re very supportive. They’re<br />

very encouraging. If you have any questions,<br />

someone is always there to help, and if that<br />

person doesn’t have the answer, they will seek<br />

out the answer,” Hunsaker said. “Overall, it has<br />

that small, family atmosphere, which attracts<br />

me quite a bit.”<br />

As for other perks, Thomas reports that the<br />

ease with which he can obtain time off is crucial.<br />

Any time that he needs to be off the road, for<br />

personal or professional reasons, the company is<br />

always willing to work with him.<br />

However, if you are ready to earn money,<br />

Hunsaker says that Hurricane Express is the<br />

place to be.<br />

“Be ready to work,” Hunsaker said. The<br />

company is constantly looking to revise its lease<br />

programs to make business opportunities more<br />

appetizing for drivers who want to own their<br />

own truck and continuously earn.<br />

“A lot of drivers like to do maybe 2,000 or<br />

2,400 miles a week. And that’s in a seven-day<br />

period. And they’re totally comfortable doing<br />

that,” Hunsaker said. “Hurricane doesn’t<br />

operate in that environment. So a driver really<br />

needs to have the willingness to succeed. And<br />

as long as the driver is willing to do that,<br />

Hurricane will be there every step of the way, to<br />

help guide you.”<br />

To find out more, visit www.<br />

hurricaneexpressinc.com. •

6 Professional Truck Drivers<br />

Named Finalists In TCA’s 2016<br />

Driver Of The Year Contest<br />

Six professional truck drivers have been<br />

named finalists in the Truckload Carriers<br />

Association’s 2016 Driver of the Year contest.<br />

There are three finalists in each of the two<br />

categories.<br />

The finalists and grand prize winners are<br />

selected based on their ability to operate safely<br />

on public highways, their efforts to enhance the<br />

public image of the trucking industry, and their<br />

positive contributions to the communities in<br />

which they live.<br />

The two overall winners will receive $25,000<br />

each, while the two runners-up in each division<br />

will win $2,500.<br />

Company Driver of the Year contest finalists<br />

are:<br />

- Murray Manuliak of Bison Transport<br />

- David McGowan of WEL Companies, who<br />

was also a finalist in the 2015 contest, and<br />

- William Poteet of Saddle Creek Logistics<br />

Services.<br />

Owner-Operator of the Year contest finalists<br />

include:<br />

- Gary Buchs of Landstar System<br />

- Philip Keith of WEL Companies, and<br />

- Kevin Kocmich of Diamond Transportation<br />

System.<br />

To be eligible for the contests, driver<br />

applicants were required to meet strict standards,<br />

such as one million consecutive accident-free<br />

miles.<br />

Judges<br />

examined<br />

each<br />

driver’s<br />

operating<br />

information,<br />

work<br />

history<br />

and safety<br />

record,<br />

and each finalist was asked to write a 300-<br />

word essay explaining why he or she is a good<br />

“trucking citizen” and should be considered<br />

for the grand prize. For the owner-operator<br />

candidates judges also reviewed equipment<br />

specifications, business plans, and financial<br />

statements.<br />

The names of the grand prize winners will<br />

be announced at TCA’s Annual Convention to<br />

be held at the Gaylord Opryland in Nashville,<br />

Tennessee, March 26-29.<br />

Dillon Transportation Seeks<br />

Exemption From HOS For Split<br />

Sleeper Periods<br />

Dillon Transportation has filed a request with<br />

the Federal Motor Carrier Safety Administration<br />

for an exemption from the Hours of Service<br />

regulations, seeking permission for its team<br />

drivers to be allowed to take the equivalent<br />

of 10 consecutive hours off duty by splitting<br />

sleeper berth time into two periods totaling 10<br />

hours, provided neither of the two periods is<br />

less than three hours.<br />

The FMCSA is seeking public comments on<br />

the request.<br />

Dillon Transportation is a privately owned and<br />

14 www.TruckDriverMagazines.com TRUCKING 20<strong>17</strong>

operated company founded in 1997 by Donnie<br />

Dillon in his hometown of Mt. Juliet, Tennessee.<br />

Dillon spent 20 years as an over-the-road<br />

driver.<br />

Dillon operates a fleet of 103 vehicles with 50<br />

team drivers. It delivers products to 48 states<br />

from a diversified customer base.<br />

According to Dillon, the majority of the fleet<br />

drivers are home weekly with 34-48 hours off.<br />

The fact that some divers stay out longer is their<br />

choice to do so; Dillon says it does not require<br />

its drivers to stay on the road for more than five<br />

days.<br />

Dillon’s tractors are equipped with doublebunk<br />

sleepers in the event both drivers need<br />

or want to rest at the same time. Drivers are<br />

allowed to make their own decisions about<br />

when and where to take short rest breaks based<br />

on their personal needs and preferences in<br />

conformance with regulatory requirements.<br />

Dillon asserts that it takes safety, health and<br />

wellness seriously, and only hires well-qualified<br />

drivers who go through a comprehensive<br />

orientation/new-hire training program. Dillon’s<br />

trucks are all equipped with electronic logging<br />

devices for monitoring Hours of Service<br />

compliance.<br />

Dillon said in its request that it is common<br />

knowledge that sleeping in a moving vehicle<br />

is more difficult than for a single driver who<br />

is able to stop the truck during sleeper time.<br />

According to Dillon, having the flexibility to<br />

switch with a partner allows each driver to take<br />

advantage of shorter driver periods when they<br />

feel fatigued even though they have available<br />

driving time. This will result in a more flexible<br />

work pattern improving personal and vehicular<br />

safety. The exemption request would not apply<br />

to trips driven by a single driver.<br />

U.S. Adds 156,000 Jobs in<br />

December; For-Hire Trucking<br />

Adds 1,400<br />

U.S. employers added 156,000 jobs in<br />

December, capping a year of slower but solid<br />

hiring. The report is the last major snapshot of<br />

the economy President-elect Donald Trump will<br />

inherit from President Barack Obama.<br />

The Labor Department says the<br />

unemployment rate ticked up to 4.7 percent<br />

from a nine-year low of 4.6 percent.<br />

Hourly pay jumped 2.9 percent from a<br />

year earlier, the biggest increase in more<br />

than seven years. That is a positive sign that<br />

the low unemployment rate is forcing some<br />

businesses to offer higher wages to attract and<br />

keep workers. Sluggish growth in Americans’<br />

paychecks has been a longstanding weak spot in<br />

the seven-year economic recovery.<br />

The for-hire trucking industry added 1,400<br />

jobs in December bringing the total net added in<br />

2016 to 10,400. The industry lost jobs the first<br />

six months of 2016, and in the last six months<br />

alone added 19,800 jobs.<br />

Auto sales rose for a seventh straight year in<br />

2016 to a record high. Industry analysts expect<br />

sales to slip a bit this year but to remain at a<br />

healthy level.<br />

And home sales reached their highest point in<br />

nearly a decade in November. Mortgage rates<br />

have jumped since the election but dipped this<br />

week, suggesting that rates might level off.<br />

16 www.TruckDriverMagazines.com TRUCKING 20<strong>17</strong>

Illinois Driver Named Highway<br />

Angel For Efforts To Revive<br />

Fellow Trucker<br />

Mark McConachie, of Sparta, Illinois,<br />

a professional truck driver for Maverick<br />

Transportation of North Little Rock,<br />

Arkansas, has been named a Highway Angel<br />

by the Truckload<br />

Carriers Association<br />

for administering<br />

CPR to another<br />

professional driver<br />

who was suffering<br />

from a heart attack.<br />

McConachie is<br />

in his sixth year as<br />

a professional truck<br />

driver after working<br />

many years in the Mark McConachie<br />

HVAC industry.<br />

When asked<br />

about performing<br />

CPR, McConachie<br />

said, “I was taught<br />

to never stop until<br />

a professional gets<br />

there, and I will do<br />

whatever I need to do<br />

when someone is in distress.”<br />

On March 3, 2016, just after lunch,<br />

McConachie was waiting on his load at<br />

the Atlas Tube in Chicago, Illinois, making<br />

small talk with another driver.<br />

A few minutes later he noticed that the<br />

driver he had been talking to leaned against<br />

a steal beam. “I asked him if he was okay<br />

several times, but he didn’t respond back,”<br />

McConachie said.<br />

The driver then fell backwards and<br />

McConachie told an Atlas Tube employee to<br />

call 911.<br />

He rushed to the driver’s side and noticed<br />

his chest was immobile and his eyes rolled<br />

back in his head.<br />

“I was<br />

taught to<br />

never stop<br />

until a<br />

professional<br />

gets there,<br />

and I will<br />

do whatever<br />

I need to do<br />

when<br />

someone is<br />

in distress.”<br />

McConachie<br />

began<br />

performing CPR,<br />

which he learned<br />

years ago while<br />

in basic training<br />

for the Army.<br />

He continued<br />

performing<br />

CPR along with<br />

an Atlas Tube<br />

employee until<br />

EMS arrived.<br />

When the<br />

ambulance pulled away from Atlas Tube, the<br />

driver was still breathing, but unfortunately,<br />

McConachie found out later that the driver<br />

had passed away at the hospital.<br />

For his willingness to assist his fellow<br />

driver, TCA has presented McConachie<br />

with a certificate, patch, lapel pin, and truck<br />

24 www.TruckDriverMagazines.com TRUCKING 20<strong>17</strong>

decals. Maverick<br />

Transportation<br />

also received<br />

a certificate<br />

acknowledging<br />

Mark McConachie<br />

as a Highway<br />

Angel.<br />

EpicVue<br />

sponsors TCA’s Highway Angel program.<br />

Since the program’s<br />

inception in August<br />

1997, hundreds<br />

of drivers have<br />

been recognized as<br />

Highway Angels<br />

for the exemplary<br />

kindness, courtesy,<br />

and courage they<br />

have displayed while on the job.<br />

26 www.TruckDriverMagazines.com TRUCKING 20<strong>17</strong>

EXCEPTIONAL<br />

BENEFITS<br />

HUGE<br />

SIGN-ON BONUS<br />

PAID<br />

TRAINING<br />

$5,000 Sign On Bonus<br />

Immediate Need for OTR and Local Drivers<br />

(must live near terminals for local work)<br />

GENEROUS BENEFIT PACKAGE:<br />

• Sign on bonus, Up to $5,000 for<br />

Experienced Car Haulers<br />

• Paid Vacation & Personal time<br />

• Paid Holidays<br />

• Employer Paid Medical & Life Ins.<br />

• 401K Matching<br />

• Paid Training<br />

Terminal Locations<br />

•Detroit, MI •San Antonio, TX •Hapeville/Lawrenceville, GA<br />

•Wentzville, MO •Centreveille, IL<br />

SEEKING:<br />

•Experienced car haulers with<br />

minimum 1 year of experience<br />

•Drivers interested in becoming<br />

car haulers, must have 1 year<br />

of CDL experience<br />

Hiring<br />

map<br />

TRANSPORTATION<br />

Equal Opportunity Employer<br />

<br />

866-385-4046

30 www.TruckDriverMagazines.com TRUCKING 20<strong>17</strong>

The<br />

Bottom Line<br />

By Shasta D. May<br />

TAX TIME<br />

TIPS<br />

It’s time to start gathering the necessary<br />

information to have your tax return prepared.<br />

For many this is a difficult task. If you are<br />

one of the many people who simply hate to<br />

deal with paperwork it may be better for you<br />

to just box all your paperwork and send it to<br />

your tax preparer so that they can prepare a<br />

summary to reflect the year’s tax activities.<br />

Once the summary is done you will be ready<br />

to get your taxes prepared.<br />

For those of you who don’t have any<br />

problem gathering paperwork, you should<br />

be able to complete the income tax organizer<br />

you received from your tax preparer. If<br />

you did not receive a tax organizer from<br />

your preparer you can call various tax<br />

preparers, including us, and request one. A<br />

tax organizer simplifies the information<br />

gathering process and helps to prevent you<br />

from forgetting or overlooking important tax<br />

deductions. It is best to get a tax organizer<br />

from a preparer who specializes in your<br />

industry.<br />

If you haven’t filed in several years and<br />

are hesitant to file now, don’t be. Now is the<br />

time to get past returns done as well. Even if<br />

you know you will owe taxes and are unable<br />

to pay you should get your tax returns<br />

prepared and filed. If you are going to owe<br />

and you can’t afford to pay your tax liability<br />

you can request an, “Installment Agreement”<br />

to set up a payment plan. This is something<br />

to discuss with your tax preparer when the<br />

results of your tax return are reviewed. To be<br />

eligible for an “Installment Agreement” you<br />

must have all back taxes completed and filed.<br />

Many taxpayers that have fallen behind<br />

are reluctant to come forward and discuss<br />

their tax issues. What you may not know<br />

is that the IRS wants taxpayers back on<br />

track and will work with you and your tax<br />

representative to reach workable resolutions.<br />

Many of you are company drivers and<br />

you may be missing out on larger refunds<br />

because you aren’t itemizing. Most people<br />

think they can’t itemize unless they own<br />

a house, this is not always the case. For<br />

example, if you don’t itemize and you are<br />

36 www.TruckDriverMagazines.com TRUCKING 20<strong>17</strong>

Single the Standard Deduction for 2016 is<br />

$6,300 and your refund is based on that<br />

amount. What this means is that the IRS<br />

allows you $6,300 in deductions with no<br />

receipts, no questions. But if you have more<br />

than $6,300 in deductions you can itemize<br />

(with receipts and/or backup documentation)<br />

that you have over $6,300 in legitimate<br />

deductions.<br />

A good example of someone who should<br />

itemize would be the single company driver<br />

with non- reimbursed expenses, such as<br />

Bottom Line<br />

The<br />

MANY OF YOU ARE<br />

COMPANY DRIVERS AND<br />

YOU MAY BE MISSING<br />

OUT ON LARGER<br />

REFUNDS BECAUSE YOU<br />

AREN’T ITEMIZING.<br />

meals. Let’s say you are away from home<br />

working and are not reimbursed for your<br />

meals (per diem) and you’re out 250 days<br />

on the road working. 250 x $63. (per diem/<br />

meal allowance) = $15,750. The deduction<br />

allowed is 80% which equals $12,600<br />

that’s $6,300 more in deductions if you<br />

itemize and $945 more in refund if you’re<br />

in the 15% tax bracket (more if your tax<br />

bracket is higher). Please note if you are<br />

reimbursed for meals you are not able to<br />

take the deduction. In addition to meals you<br />

can deduct other non-reimbursed business<br />

expenses such as, work boots, gloves,<br />

weather/safety gear, cell phone (business<br />

use only), motels, union and professional<br />

dues. Do some research and make sure you<br />

are getting the best results possible for your<br />

situation.<br />

If you don’t feel your tax preparer is<br />

looking out for you and providing the best<br />

service possible, look around for someone<br />

new. You should be able to call and talk with<br />

your tax preparer and feel confident in the<br />

service being provided and a sense of trust<br />

in the individual you’ve chosen to handle<br />

your tax matters.<br />

This article has been presented by MBA<br />

Tax & Bookkeeping Service, a company proud<br />

to provide Corporate/LLC filings, income tax,<br />

bookkeeping and IRS problem resolution<br />

services to truckers in all states. If you would<br />

like additional information or have questions,<br />

calls are always welcome. Contact us at<br />

888-407-1669 or visit our website at www.<br />

mbataxhelp.com.<br />

This article is provided for informational<br />

purposes only and is not intended as legal or<br />

tax advice. Each individual business situation<br />

is different and the information contained<br />

herein is meant for general information<br />

purposes only. Specific tax and legal<br />

recommendations can only be made after an<br />

individual has consulted his or her qualified<br />

tax or legal professional.<br />

38 www.TruckDriverMagazines.com TRUCKING 20<strong>17</strong>

42 www.TruckDriverMagazines.com TRUCKING 20<strong>17</strong>

ADVERTISERS INDEX<br />

Alabama Motor Express.......................26<br />

ATS....................................................... 37<br />

Beacon Transport.................................10<br />

Bennett Motor Group...........................50<br />

CalArk............................................ 15, 51<br />

Carrier One..........................................20<br />

Celadon .........................................<strong>17</strong>, 29<br />

Central Hauling.................................... 27<br />

Covenant Transport.............................. 23<br />

Freight Logistics..................................18<br />

Harris Quality................................30, 42<br />

Heartland.............................................. 43<br />

Hurricane Express............. Cover, 6-7, 41<br />

JK Hackl................................................. 5<br />

JMN......................................................28<br />

Johnsrud Transport...............................42<br />

K & B Transportation.........................8-9<br />

Lilly Trucking of VA............................ 47<br />

Marten Transport.................... 2-3, 44-45<br />

MATS................................................... 35<br />

Melton Truck Lines........................12, 39<br />

Minstar................................................. 33<br />

MTS.....................................................49<br />

Petro/TA...............................................34<br />

PGS 360...............................................22<br />

Redneck Trailer Supplies.....................19<br />

RTI.................................................13, 52<br />

Schuster................................................ 31<br />

Smith....................................................32<br />

The Trucker..........................................40<br />

Trans Am.............................................. 11<br />

Transport Design..................................30<br />

TruckJobSeekers.com..........................46<br />

UPS...................................................... 21<br />

Koch Trucking..................................... 25<br />

48 www.TruckDriverMagazines.com TRUCKING 20<strong>17</strong>