Brown & Brown Insurance 2016 Annual Report

2016 Annual Report

2016 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes<br />

to Consolidated Financial Statements<br />

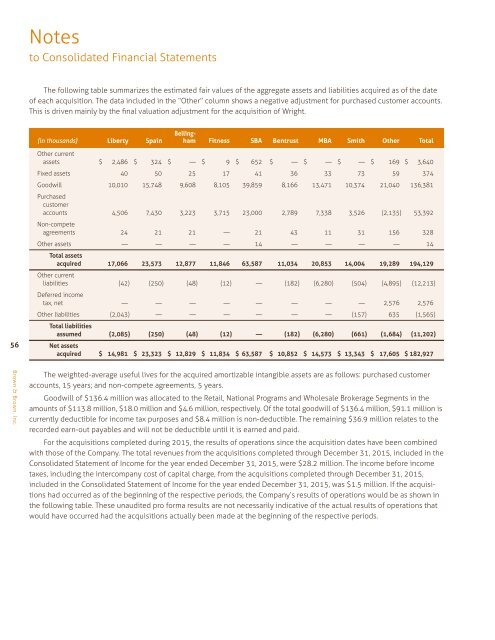

The following table summarizes the estimated fair values of the aggregate assets and liabilities acquired as of the date<br />

of each acquisition. The data included in the “Other” column shows a negative adjustment for purchased customer accounts.<br />

This is driven mainly by the final valuation adjustment for the acquisition of Wright.<br />

Belling-<br />

(in thousands) Liberty Spain ham Fitness SBA Bentrust MBA Smith Other Total<br />

56<br />

Other current<br />

assets $ 2,486 $ 324 $ — $ 9 $ 652 $ — $ — $ — $ 169 $ 3,640<br />

Fixed assets 40 50 25 17 41 36 33 73 59 374<br />

Goodwill 10,010 15,748 9,608 8,105 39,859 8,166 13,471 10,374 21,040 136,381<br />

Purchased<br />

customer<br />

accounts 4,506 7,430 3,223 3,715 23,000 2,789 7,338 3,526 (2,135) 53,392<br />

Non-compete<br />

agreements 24 21 21 — 21 43 11 31 156 328<br />

Other assets — — — — 14 — — — — 14<br />

Total assets<br />

acquired 17,066 23,573 12,877 11,846 63,587 11,034 20,853 14,004 19,289 194,129<br />

Other current<br />

liabilities (42) (250) (48) (12) — (182) (6,280) (504) (4,895) (12,213)<br />

Deferred income<br />

tax, net — — — — — — — — 2,576 2,576<br />

Other liabilities (2,043) — — — — — — (157) 635 (1,565)<br />

Total liabilities<br />

assumed (2,085) (250) (48) (12) — (182) (6,280) (661) (1,684) (11,202)<br />

Net assets<br />

acquired $ 14,981 $ 23,323 $ 12,829 $ 11,834 $ 63,587 $ 10,852 $ 14,573 $ 13,343 $ 17,605 $ 182,927<br />

<strong>Brown</strong> & <strong>Brown</strong>, Inc.<br />

The weighted-average useful lives for the acquired amortizable intangible assets are as follows: purchased customer<br />

accounts, 15 years; and non-compete agreements, 5 years.<br />

Goodwill of $136.4 million was allocated to the Retail, National Programs and Wholesale Brokerage Segments in the<br />

amounts of $113.8 million, $18.0 million and $4.6 million, respectively. Of the total goodwill of $136.4 million, $91.1 million is<br />

currently deductible for income tax purposes and $8.4 million is non-deductible. The remaining $36.9 million relates to the<br />

recorded earn-out payables and will not be deductible until it is earned and paid.<br />

For the acquisitions completed during 2015, the results of operations since the acquisition dates have been combined<br />

with those of the Company. The total revenues from the acquisitions completed through December 31, 2015, included in the<br />

Consolidated Statement of Income for the year ended December 31, 2015, were $28.2 million. The income before income<br />

taxes, including the intercompany cost of capital charge, from the acquisitions completed through December 31, 2015,<br />

included in the Consolidated Statement of Income for the year ended December 31, 2015, was $1.5 million. If the acquisitions<br />

had occurred as of the beginning of the respective periods, the Company’s results of operations would be as shown in<br />

the following table. These unaudited pro forma results are not necessarily indicative of the actual results of operations that<br />

would have occurred had the acquisitions actually been made at the beginning of the respective periods.