Brown & Brown Insurance 2016 Annual Report

2016 Annual Report

2016 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes<br />

to Consolidated Financial Statements<br />

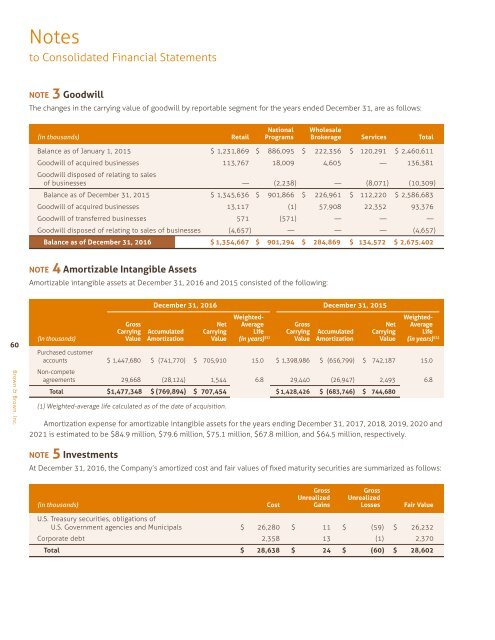

NOTE 3 Goodwill<br />

The changes in the carrying value of goodwill by reportable segment for the years ended December 31, are as follows:<br />

National Wholesale<br />

(in thousands) Retail Programs Brokerage Services Total<br />

Balance as of January 1, 2015 $ 1,231,869 $ 886,095 $ 222,356 $ 120,291 $ 2,460,611<br />

Goodwill of acquired businesses 113,767 18,009 4,605 — 136,381<br />

Goodwill disposed of relating to sales<br />

of businesses — (2,238) — (8,071) (10,309)<br />

Balance as of December 31, 2015 $ 1,345,636 $ 901,866 $ 226,961 $ 112,220 $ 2,586,683<br />

Goodwill of acquired businesses 13,117 (1) 57,908 22,352 93,376<br />

Goodwill of transferred businesses 571 (571) — — —<br />

Goodwill disposed of relating to sales of businesses (4,657) — — — (4,657)<br />

Balance as of December 31, <strong>2016</strong> $ 1,354,667 $ 901,294 $ 284,869 $ 134,572 $ 2,675,402<br />

NOTE 4 Amortizable Intangible Assets<br />

Amortizable intangible assets at December 31, <strong>2016</strong> and 2015 consisted of the following:<br />

60<br />

<strong>Brown</strong> & <strong>Brown</strong>, Inc.<br />

December 31, <strong>2016</strong> December 31, 2015<br />

Weighted-<br />

Weighted-<br />

Gross Net Average Gross Net Average<br />

Carrying Accumulated Carrying Life Carrying Accumulated Carrying Life<br />

(in thousands) Value Amortization Value (in years) (1) Value Amortization Value (in years) (1)<br />

Purchased customer<br />

accounts $ 1,447,680 $ (741,770) $ 705,910 15.0 $ 1,398,986 $ (656,799) $ 742,187 15.0<br />

Non-compete<br />

agreements 29,668 (28,124) 1,544 6.8 29,440 (26,947) 2,493 6.8<br />

Total $1,477,348 $ (769,894) $ 707,454 $ 1,428,426 $ (683,746) $ 744,680<br />

(1) Weighted-average life calculated as of the date of acquisition.<br />

Amortization expense for amortizable intangible assets for the years ending December 31, 2017, 2018, 2019, 2020 and<br />

2021 is estimated to be $84.9 million, $79.6 million, $75.1 million, $67.8 million, and $64.5 million, respectively.<br />

NOTE 5 Investments<br />

At December 31, <strong>2016</strong>, the Company’s amortized cost and fair values of fixed maturity securities are summarized as follows:<br />

Gross<br />

Gross<br />

Unrealized Unrealized<br />

(in thousands) Cost Gains Losses Fair Value<br />

U.S. Treasury securities, obligations of<br />

U.S. Government agencies and Municipals $ 26,280 $ 11 $ (59) $ 26,232<br />

Corporate debt 2,358 13 (1) 2,370<br />

Total $ 28,638 $ 24 $ (60) $ 28,602