Brown & Brown Insurance 2016 Annual Report

2016 Annual Report

2016 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(Unaudited) For the Year Ended December 31,<br />

(in thousands, except per share data) 2014 2013<br />

Total revenues $ 1,630,162 $ 1,520,858<br />

Income before income taxes $ 358,229 $ 409,522<br />

Net income $ 218,150 $ 248,628<br />

Net income per share:<br />

Basic $ 1.51 $ 1.72<br />

Diluted $ 1.49 $ 1.70<br />

Weighted-average number of shares outstanding:<br />

Basic 140,944 141,033<br />

Diluted 142,891 142,624<br />

As of December 31, <strong>2016</strong>, the maximum future contingency payments related to all acquisitions totaled $117.2 million,<br />

all of which relates to acquisitions consummated subsequent to January 1, 2009.<br />

ASC Topic 805 — Business Combinations is the authoritative guidance requiring an acquirer to recognize 100% of<br />

the fair values of acquired assets, including goodwill, and assumed liabilities (with only limited exceptions) upon initially<br />

obtaining control of an acquired entity. Additionally, the fair value of contingent consideration arrangements (such as<br />

earn-out purchase arrangements) at the acquisition date must be included in the purchase price consideration. As a result,<br />

the recorded purchase prices for all acquisitions consummated after January 1, 2009 include an estimation of the fair value<br />

of liabilities associated with any potential earn-out provisions. Subsequent changes in these earn-out obligations will be<br />

recorded in the Consolidated Statement of Income when incurred. Potential earn-out obligations are typically based upon<br />

future earnings of the acquired entities, usually between one and three years.<br />

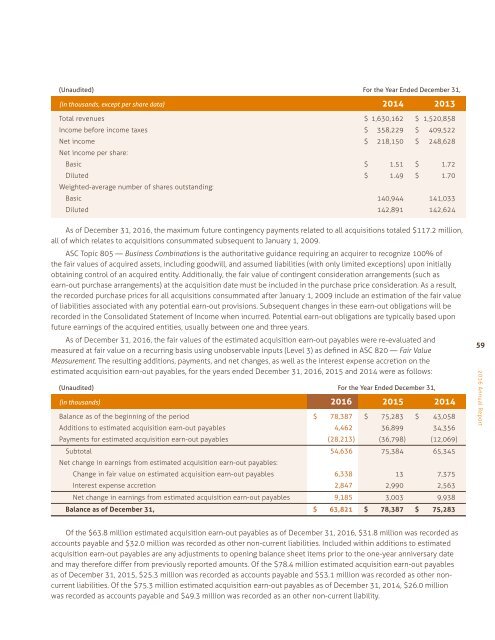

As of December 31, <strong>2016</strong>, the fair values of the estimated acquisition earn-out payables were re-evaluated and<br />

measured at fair value on a recurring basis using unobservable inputs (Level 3) as defined in ASC 820 — Fair Value<br />

Measurement. The resulting additions, payments, and net changes, as well as the interest expense accretion on the<br />

estimated acquisition earn-out payables, for the years ended December 31, <strong>2016</strong>, 2015 and 2014 were as follows:<br />

(Unaudited) For the Year Ended December 31,<br />

(in thousands) <strong>2016</strong> 2015 2014<br />

Balance as of the beginning of the period $ 78,387 $ 75,283 $ 43,058<br />

Additions to estimated acquisition earn-out payables 4,462 36,899 34,356<br />

Payments for estimated acquisition earn-out payables (28,213) (36,798) (12,069)<br />

Subtotal 54,636 75,384 65,345<br />

Net change in earnings from estimated acquisition earn-out payables:<br />

Change in fair value on estimated acquisition earn-out payables 6,338 13 7,375<br />

Interest expense accretion 2,847 2,990 2,563<br />

Net change in earnings from estimated acquisition earn-out payables 9,185 3,003 9,938<br />

Balance as of December 31, $ 63,821 $ 78,387 $ 75,283<br />

59<br />

<strong>2016</strong> <strong>Annual</strong> <strong>Report</strong><br />

Of the $63.8 million estimated acquisition earn-out payables as of December 31, <strong>2016</strong>, $31.8 million was recorded as<br />

accounts payable and $32.0 million was recorded as other non-current liabilities. Included within additions to estimated<br />

acquisition earn-out payables are any adjustments to opening balance sheet items prior to the one-year anniversary date<br />

and may therefore differ from previously reported amounts. Of the $78.4 million estimated acquisition earn-out payables<br />

as of December 31, 2015, $25.3 million was recorded as accounts payable and $53.1 million was recorded as other noncurrent<br />

liabilities. Of the $75.3 million estimated acquisition earn-out payables as of December 31, 2014, $26.0 million<br />

was recorded as accounts payable and $49.3 million was recorded as an other non-current liability.