Brown & Brown Insurance 2016 Annual Report

2016 Annual Report

2016 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes<br />

to Consolidated Financial Statements<br />

70<br />

<strong>Brown</strong> & <strong>Brown</strong>, Inc.<br />

In 2010, 187,040 shares were granted under the SIP. This grant was conditioned upon the surrender of 187,040 shares<br />

previously granted under the PSP in 2009, which were accordingly treated as forfeited PSP shares. The vesting conditions<br />

of this grant were identical to those provided for in connection with the 2009 PSP grant; thus the target stock prices and<br />

the periods associated with satisfaction of the first and second conditions of vesting were unchanged. Additionally, grants<br />

totaling 5,205 shares were made in 2010 to Decus employees under the SIP sub-plan applicable to Decus.<br />

In 2011, 2,375,892 shares were granted under the SIP. Of this total, 24,670 shares were granted to Decus employees<br />

under the SIP sub-plan applicable to Decus.<br />

In 2012, 814,545 shares were granted under the SIP, primarily related to the Arrowhead acquisition.<br />

In 2013, 3,719,974 shares were granted under the SIP. Of the shares granted in 2013, 891,399 shares will vest upon<br />

the grantees’ completion of between three and seven years of service with the Company, and because grantees have the<br />

right to vote the shares and receive dividends immediately after the date of grant these shares are considered awarded and<br />

outstanding under the two-class method.<br />

In 2014, 422,572 shares were granted under the SIP. Of the shares granted in 2014, 113,088 shares will vest upon the<br />

grantees’ completion of between three and six years of service with the Company, and because grantees have the right to<br />

vote the shares and receive dividends immediately after the date of grant these shares are considered awarded and outstanding<br />

under the two-class method.<br />

In 2015, 481,166 shares were granted under the SIP. Of the shares granted in 2015, 164,646 shares will vest upon the<br />

grantees’ completion of between five and seven years of service with the Company, and because grantees have the right to<br />

vote the shares and receive dividends immediately after the date of grant these shares are considered awarded and outstanding<br />

under the two-class method.<br />

In <strong>2016</strong>, 972,099 shares were granted under the SIP. Of the shares granted in <strong>2016</strong>, 182,653 shares will vest upon the<br />

grantees’ completion of five years of service with the Company, and because grantees have the right to vote the shares and<br />

receive dividends immediately after the date of grant these shares are considered awarded and outstanding under the<br />

two-class method.<br />

Additionally, non-employee members of the Board of Directors received shares annually issued pursuant to the SIP<br />

as part of their annual compensation. A total of 36,919 SIP shares were issued to these directors in 2011 and 2012, of<br />

which 11,682 were issued in January 2011, 12,627 in January 2012, and 12,610 in December 2012. The shares issued in<br />

December 2012 were issued at that earlier time rather than in January 2013 pursuant to action of the Board of Directors.<br />

No additional shares were granted or issued to the non-employee members of the Board of Directors in 2013. A total of<br />

9,870 shares were issued to these directors in January 2014, 15,700 shares were issued in January 2015 and 16,860 shares<br />

were issued in January <strong>2016</strong>.<br />

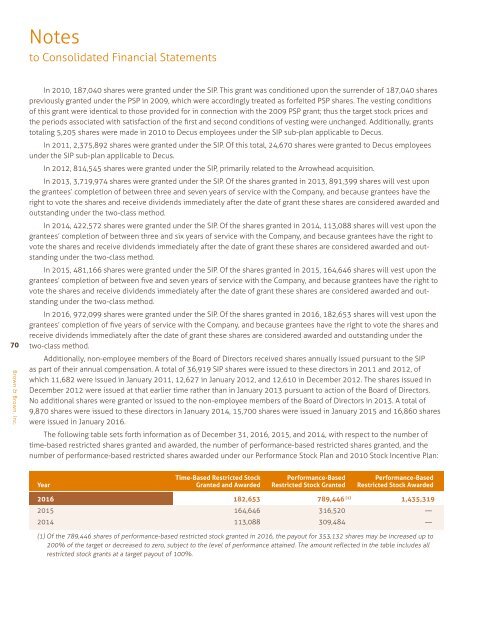

The following table sets forth information as of December 31, <strong>2016</strong>, 2015, and 2014, with respect to the number of<br />

time-based restricted shares granted and awarded, the number of performance-based restricted shares granted, and the<br />

number of performance-based restricted shares awarded under our Performance Stock Plan and 2010 Stock Incentive Plan:<br />

Time-Based Restricted Stock Performance-Based Performance-Based<br />

Year Granted and Awarded Restricted Stock Granted Restricted Stock Awarded<br />

<strong>2016</strong> 182,653 789,446 (1) 1,435,319<br />

2015 164,646 316,520 —<br />

2014 113,088 309,484 —<br />

(1) Of the 789,446 shares of performance-based restricted stock granted in <strong>2016</strong>, the payout for 353,132 shares may be increased up to<br />

200% of the target or decreased to zero, subject to the level of performance attained. The amount reflected in the table includes all<br />

restricted stock grants at a target payout of 100%.