Investment strategies for volatile markets

Global Investor, 03/2007 Credit Suisse

Global Investor, 03/2007

Credit Suisse

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

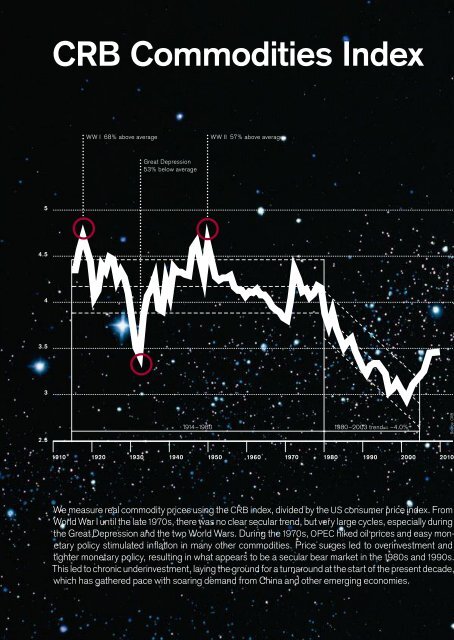

CRB Commodities Index<br />

Moody’s default rate<br />

WW I 68% above average<br />

WW II 57% above average<br />

Great Depression<br />

Great Depression<br />

53% below average<br />

5<br />

200<br />

4.5<br />

160<br />

4<br />

120<br />

3.5<br />

80<br />

3<br />

40<br />

2.5<br />

1914–1980 1980–2003 trend = –4.0%<br />

Source: CRB<br />

0<br />

Source: Moody’s<br />

1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 2010<br />

1920 1926 1932 1938 1944 1950 1956 1962 1968 1974 1980 1986 1992 1998 2004<br />

We measure real commodity prices using the CRB index, divided by the US consumer price index. From<br />

World War I until the late 1970s, there was no clear secular trend, but very large cycles, especially during<br />

the Great Depression and the two World Wars. During the 1970s, OPEC hiked oil prices and easy mon-<br />

<br />

tighter monetary policy, resulting in what appears to be a secular bear market in the 1980s and 1990s.<br />

This led to chronic underinvestment, laying the ground <strong>for</strong> a turnaround at the start of the present decade,<br />

which has gathered pace with soaring demand from China and other emerging economies.<br />

Default rates on corporate bonds generally fall in the early stages of an economic expansion. They<br />

then tend to rise in the later years of the upswing, as companies raise leverage and interest rates trend<br />

ingly,<br />

the highest default rate was recorded during the Great Depression, with other noteworthy peaks<br />

as the 1960s expansion slowed into the 1970s, and during 1970 and 2001. Since then, default rates<br />

have fallen to historic lows as the economy has expanded. Looking ahead, however, a slow increase<br />

is likely over the next few years, as leverage rises and interest rates remain well above earlier lows.