The Trinidad & Tobago Business Guide (TTBG, 2009-10)

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL MARKETS<br />

A year to remember<br />

<strong>Trinidad</strong> and <strong>Tobago</strong>’s markets tended to take fright in<br />

the second half of 2008, but confidence and optimism<br />

could well return during <strong>2009</strong> By Nesha Debysingh<br />

It was a historic year. Global financial markets came under extreme strain after the US financial<br />

crisis, triggered by the bursting of an incredibly inflated real estate bubble, led to recession<br />

and sparked global panic and economic slowdown. <strong>The</strong> net effect was mounting investor<br />

fears, unprecedented volatility, and steep declines in the value of all major asset classes. Local<br />

capital markets, which initially demonstrated impressive resilience in the face of a deteriorating<br />

international economic picture, eventually succumbed in the latter half of 2008.<br />

Stock market<br />

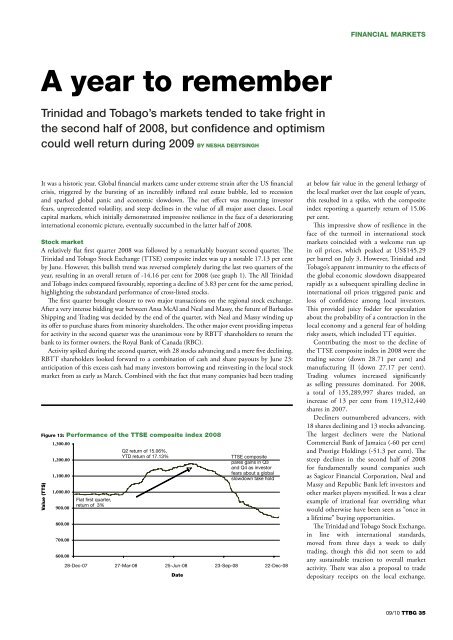

A relatively flat first quarter 2008 was followed by a remarkably buoyant second quarter. <strong>The</strong><br />

<strong>Trinidad</strong> and <strong>Tobago</strong> Stock Exchange (TTSE) composite index was up a notable 17.13 per cent<br />

by June. However, this bullish trend was reversed completely during the last two quarters of the<br />

year, resulting in an overall return of -14.16 per cent for 2008 (see graph 1). <strong>The</strong> All <strong>Trinidad</strong><br />

and <strong>Tobago</strong> index compared favourably, reporting a decline of 3.83 per cent for the same period,<br />

highlighting the substandard performance of cross-listed stocks.<br />

<strong>The</strong> first quarter brought closure to two major transactions on the regional stock exchange.<br />

After a very intense bidding war between Ansa McAl and Neal and Massy, the future of Barbados<br />

Shipping and Trading was decided by the end of the quarter, with Neal and Massy winding up<br />

its offer to purchase shares from minority shareholders. <strong>The</strong> other major event providing impetus<br />

for activity in the second quarter was the unanimous vote by RBTT shareholders to return the<br />

bank to its former owners, the Royal Bank of Canada (RBC).<br />

Activity spiked during the second quarter, with 28 stocks advancing and a mere five declining.<br />

RBTT shareholders looked forward to a combination of cash and share payouts by June 23:<br />

anticipation of this excess cash had many investors borrowing and reinvesting in the local stock<br />

market from as early as March. Combined with the fact that many companies had been trading<br />

Figure 13: Performance of the TTSE composite index 2008<br />

at below fair value in the general lethargy of<br />

the local market over the last couple of years,<br />

this resulted in a spike, with the composite<br />

index reporting a quarterly return of 15.06<br />

per cent.<br />

This impressive show of resilience in the<br />

face of the turmoil in international stock<br />

markets coincided with a welcome run up<br />

in oil prices, which peaked at US$145.29<br />

per barrel on July 3. However, <strong>Trinidad</strong> and<br />

<strong>Tobago</strong>’s apparent immunity to the effects of<br />

the global economic slowdown disappeared<br />

rapidly as a subsequent spiralling decline in<br />

international oil prices triggered panic and<br />

loss of confidence among local investors.<br />

This provided juicy fodder for speculation<br />

about the probability of a contraction in the<br />

local economy and a general fear of holding<br />

risky assets, which included TT equities.<br />

Contributing the most to the decline of<br />

the TTSE composite index in 2008 were the<br />

trading sector (down 28.71 per cent) and<br />

manufacturing II (down 27.17 per cent).<br />

Trading volumes increased significantly<br />

as selling pressures dominated. For 2008,<br />

a total of 135,289,997 shares traded, an<br />

increase of 13 per cent from 119,312,440<br />

shares in 2007.<br />

Decliners outnumbered advancers, with<br />

18 shares declining and 13 stocks advancing.<br />

<strong>The</strong> largest decliners were the National<br />

Commercial Bank of Jamaica (-60 per cent)<br />

and Prestige Holdings (-51.3 per cent). <strong>The</strong><br />

steep declines in the second half of 2008<br />

for fundamentally sound companies such<br />

as Sagicor Financial Corporation, Neal and<br />

Massy and Republic Bank left investors and<br />

other market players mystified. It was a clear<br />

example of irrational fear overriding what<br />

would otherwise have been seen as “once in<br />

a lifetime” buying opportunities.<br />

<strong>The</strong> <strong>Trinidad</strong> and <strong>Tobago</strong> Stock Exchange,<br />

in line with international standards,<br />

moved from three days a week to daily<br />

trading, though this did not seem to add<br />

any sustainable traction to overall market<br />

activity. <strong>The</strong>re was also a proposal to trade<br />

depositary receipts on the local exchange.<br />

09/<strong>10</strong> <strong>TTBG</strong> 35