The Trinidad & Tobago Business Guide (TTBG, 2009-10)

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Table 23 Arrivals in the Caribbean 2002-2007 by source market (million)<br />

Market 2002 2003 2004 2005 2006 2007<br />

% change<br />

06/’07<br />

USA <strong>10</strong>.1 <strong>10</strong>.7 11.4 11.4 11.5 11.6 0.95%<br />

Canada 1.3 1.5 1.7 1.8 1.8 2.0 12.5%<br />

Europe 4.5 5.1 5.3 5.5 5.5 5.5 2.5%<br />

Other 3.1 3.2 3.3 3.7 3.5 3.4 - 4.0%<br />

TOTAL 19.0 20.4 21.8 22.2 22.2 22.5 1.49%<br />

Cruise<br />

passengers<br />

15.9 18.0 19.9 19.0 19.2 19.5 +2.0%<br />

Source: Caribbean Tourism Organisation; 2007 estimates; figures rounded to nearest ‘000,000<br />

Table 24 <strong>Trinidad</strong> and <strong>Tobago</strong> arrivals 2002-7<br />

Stopover 2002 2003 2004 2005 2006 2007<br />

<strong>Tobago</strong> 51,828 68,155 78,729 86,467 83,460 63,000<br />

<strong>Trinidad</strong> 332,384 340,914 363,826 376,723 377,591 386,452<br />

Total 384,212 409,069 442,555 463,191 461,051 449,453<br />

% change 0.3 6.5 8.2 4.7 -0.5 -2.5<br />

Cruise<br />

<strong>Tobago</strong> 8,242 15,916 24,953 34,428 40,709 11,644<br />

<strong>Trinidad</strong> 51,805 39,616 29,301 32,768 43,404 63,467<br />

Total 60,047 55,532 54,254 67,196 84,113 75,111<br />

Cruise ship 96 88 86 82 94 86<br />

calls<br />

Sources: Central Statistical Office, Port Authority, Tourism Development Company<br />

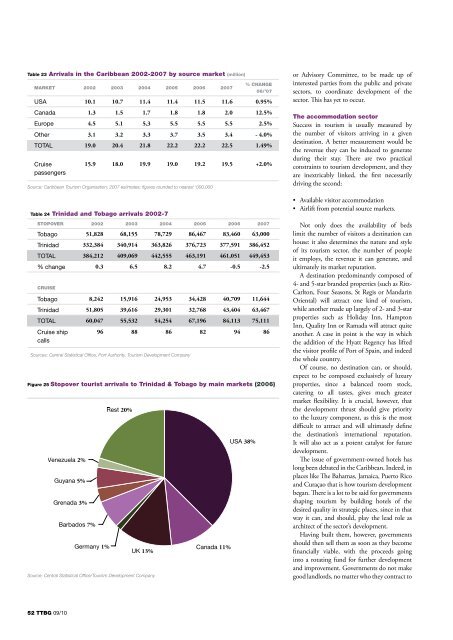

Figure 25 Stopover tourist arrivals to <strong>Trinidad</strong> & <strong>Tobago</strong> by main markets (2006)<br />

Source: Central Statistical Office/Tourism Development Company<br />

or Advisory Committee, to be made up of<br />

interested parties from the public and private<br />

sectors, to coordinate development of the<br />

sector. This has yet to occur.<br />

<strong>The</strong> accommodation sector<br />

Success in tourism is usually measured by<br />

the number of visitors arriving in a given<br />

destination. A better measurement would be<br />

the revenue they can be induced to generate<br />

during their stay. <strong>The</strong>re are two practical<br />

constraints to tourism development, and they<br />

are inextricably linked, the first necessarily<br />

driving the second:<br />

• Available visitor accommodation<br />

• Airlift from potential source markets.<br />

Not only does the availability of beds<br />

limit the number of visitors a destination can<br />

house: it also determines the nature and style<br />

of its tourism sector, the number of people<br />

it employs, the revenue it can generate, and<br />

ultimately its market reputation.<br />

A destination predominantly composed of<br />

4- and 5-star branded properties (such as Ritz-<br />

Carlton, Four Seasons, St Regis or Mandarin<br />

Oriental) will attract one kind of tourism,<br />

while another made up largely of 2- and 3-star<br />

properties such as Holiday Inn, Hampton<br />

Inn, Quality Inn or Ramada will attract quite<br />

another. A case in point is the way in which<br />

the addition of the Hyatt Regency has lifted<br />

the visitor profile of Port of Spain, and indeed<br />

the whole country.<br />

Of course, no destination can, or should,<br />

expect to be composed exclusively of luxury<br />

properties, since a balanced room stock,<br />

catering to all tastes, gives much greater<br />

market flexibility. It is crucial, however, that<br />

the development thrust should give priority<br />

to the luxury component, as this is the most<br />

difficult to attract and will ultimately define<br />

the destination’s international reputation.<br />

It will also act as a potent catalyst for future<br />

development.<br />

<strong>The</strong> issue of government-owned hotels has<br />

long been debated in the Caribbean. Indeed, in<br />

places like <strong>The</strong> Bahamas, Jamaica, Puerto Rico<br />

and Curaçao that is how tourism development<br />

began. <strong>The</strong>re is a lot to be said for governments<br />

shaping tourism by building hotels of the<br />

desired quality in strategic places, since in that<br />

way it can, and should, play the lead role as<br />

architect of the sector’s development.<br />

Having built them, however, governments<br />

should then sell them as soon as they become<br />

financially viable, with the proceeds going<br />

into a rotating fund for further development<br />

and improvement. Governments do not make<br />

good landlords, no matter who they contract to<br />

52 <strong>TTBG</strong> 09/<strong>10</strong>