The-Accountant-Sep-Oct-2017-Final

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Governance<br />

• Promoting appropriate ethics and<br />

values within the organizations<br />

• Ensuring effective organizational<br />

performance management and<br />

accountability<br />

• Effective communicating risk and<br />

control information to appropriate areas<br />

of the organization.<br />

• Effectively, coordinating the activities<br />

of the communicating information<br />

among the board, external and internal<br />

auditors and management.<br />

Remember internal audit is more<br />

than an enterprise- wide engine of<br />

assurance, as critical as it is, it can<br />

also be used as a catalyst for creating<br />

value for your business. Internal audit<br />

can help in shaping new governance<br />

and risk paradigm-anticipating issues,<br />

increasing your effectiveness, eliminating<br />

duplication and identifying areas of<br />

potential performance improvement.<br />

Given the widespread call for greater<br />

board accountability and transparency<br />

– internal audit<br />

supports the BoD<br />

and its committees<br />

by independently<br />

assessing the<br />

effectiveness of an<br />

organization’s system<br />

of internal control as<br />

well as compliance<br />

with statutory, legal<br />

and regulatory<br />

requirements. <strong>The</strong><br />

internal auditor of an<br />

organization, should<br />

at least annually carry<br />

out an assessment<br />

of the overall<br />

effectiveness of the<br />

governance, risk and<br />

control frameworks<br />

of the organization.<br />

It’s upon the internal<br />

audit with the help of<br />

audit committee to set<br />

up the right priorities.<br />

It is therefore<br />

recommended that,<br />

internal audit adopts<br />

a risk based approach,<br />

focusing on the high<br />

risk areas, going<br />

down the ladder as<br />

a much as possible<br />

keeping in mind that<br />

a failure by internal<br />

audit is a failure to<br />

the board and finally may pose a high risk<br />

to the organization.<br />

According to Institute of Internal<br />

Auditors, standard No.2060 on internal<br />

audit reporting to senior management<br />

and the board requires that Chief<br />

Audit Executive must report to senior<br />

management and the board matters<br />

relating to significant risk exposures,<br />

and control issues, including fraud<br />

risk, governance issues and other<br />

matters needed or requested by senior<br />

management and the board.<br />

<strong>The</strong> internal auditor of a given<br />

organization should ensure that the main<br />

principles defined in the UK corporate<br />

governance code are adhered to namely;<br />

Leadership- Ensure that every company<br />

is headed by the right people with<br />

right minds and with clear definition<br />

of responsibilities to ensure balance of<br />

power and authority.<br />

Effectiveness- Ensure that the board<br />

and its team have an appropriate balance<br />

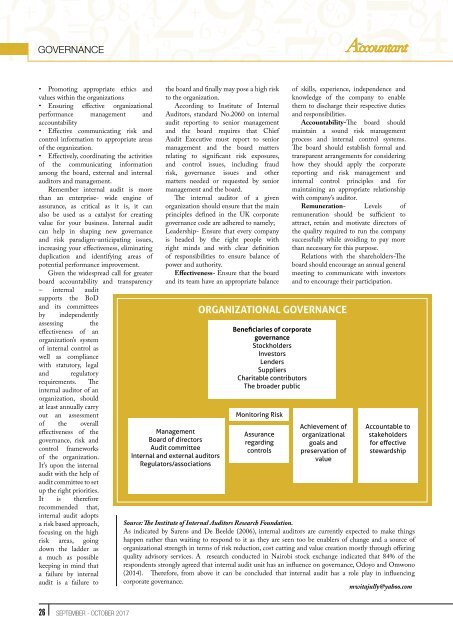

Management<br />

Board of directors<br />

Audit committee<br />

Internal and external auditors<br />

Regulators/associations<br />

ORGANIZATIONAL GOVERNANCE<br />

Beneficiaries of corporate<br />

governance<br />

Stockholders<br />

Investors<br />

Lenders<br />

Suppliers<br />

Charitable contributors<br />

<strong>The</strong> broader public<br />

Monitoring Risk<br />

Assurance<br />

regarding<br />

controls<br />

of skills, experience, independence and<br />

knowledge of the company to enable<br />

them to discharge their respective duties<br />

and responsibilities.<br />

Accountability-<strong>The</strong> board should<br />

maintain a sound risk management<br />

process and internal control systems.<br />

<strong>The</strong> board should establish formal and<br />

transparent arrangements for considering<br />

how they should apply the corporate<br />

reporting and risk management and<br />

internal control principles and for<br />

maintaining an appropriate relationship<br />

with company’s auditor.<br />

Remuneration- Levels of<br />

remuneration should be sufficient to<br />

attract, retain and motivate directors of<br />

the quality required to run the company<br />

successfully while avoiding to pay more<br />

than necessary for this purpose.<br />

Relations with the shareholders-<strong>The</strong><br />

board should encourage an annual general<br />

meeting to communicate with investors<br />

and to encourage their participation.<br />

Achievement of<br />

organizational<br />

goals and<br />

preservation of<br />

value<br />

Accountable to<br />

stakeholders<br />

for effective<br />

stewardship<br />

Source: <strong>The</strong> Institute of Internal Auditors Research Foundation.<br />

As indicated by Sarens and De Beelde (2006), internal auditors are currently expected to make things<br />

happen rather than waiting to respond to it as they are seen too be enablers of change and a source of<br />

organizational strength in terms of risk reduction, cost cutting and value creation mostly through offering<br />

quality advisory services. A research conducted in Nairobi stock exchange indicated that 84% of the<br />

respondents strongly agreed that internal audit unit has an influence on governance, Odoyo and Omwono<br />

(2014). <strong>The</strong>refore, from above it can be concluded that internal audit has a role play in influencing<br />

corporate governance.<br />

mwitajully@yahoo.com<br />

26 september - october <strong>2017</strong>