consolidated annual report - Gruppo Banca Sella

consolidated annual report - Gruppo Banca Sella

consolidated annual report - Gruppo Banca Sella

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

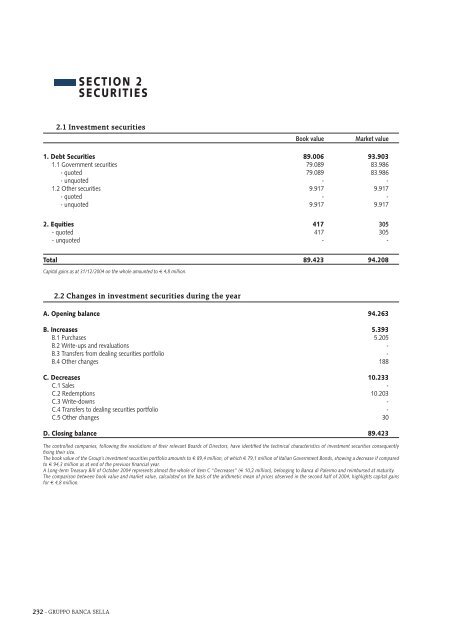

2.1 Investment securities<br />

232 - GRUPPO BANCA SELLA<br />

SECTION 2<br />

SECURITIES<br />

Book value Market value<br />

1. Debt Securities 89.006 93.903<br />

1.1 Government securities 79.089 83.986<br />

- quoted 79.089 83.986<br />

- unquoted - -<br />

1.2 Other securities 9.917 9.917<br />

- quoted - -<br />

- unquoted 9.917 9.917<br />

2. Equities 417 305<br />

- quoted 417 305<br />

- unquoted - -<br />

Total 89.423 94.208<br />

Capital gains as at 31/12/2004 on the whole amounted to € 4,8 million.<br />

2.2 Changes in investment securities during the year<br />

A. Opening balance 94.263<br />

B. Increases 5.393<br />

B.1 Purchases 5.205<br />

B.2 Write-ups and revaluations -<br />

B.3 Transfers from dealing securities portfolio -<br />

B.4 Other changes 188<br />

C. Decreases 10.233<br />

C.1 Sales -<br />

C.2 Redemptions 10.203<br />

C.3 Write-downs -<br />

C.4 Transfers to dealing securities portfolio -<br />

C.5 Other changes 30<br />

D. Closing balance 89.423<br />

The controlled companies, following the resolutions of their relevant Boards of Directors, have identified the technical characteristics of investment securities consequently<br />

fixing their size.<br />

The book value of the Group’s investment securities portfolio amounts to € 89,4 million, of which € 79,1 million of Italian Government Bonds, showing a decrease if compared<br />

to € 94,3 million as at end of the previuos financial year.<br />

A Long-term Treasury Bill of October 2004 represents almost the whole of item C “Decreases” (€ 10,2 million), belonging to <strong>Banca</strong> di Palermo and reimbursed at maturity.<br />

The comparison between book value and market value, calculated on the basis of the arithmetic mean of prices observed in the second half of 2004, highlights capital gains<br />

for € 4,8 million.