consolidated annual report - Gruppo Banca Sella

consolidated annual report - Gruppo Banca Sella

consolidated annual report - Gruppo Banca Sella

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

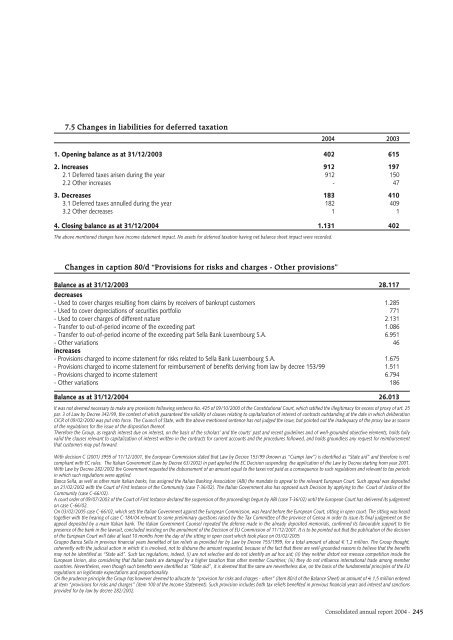

7.5 Changes in liabilities for deferred taxation<br />

2004 2003<br />

1. Opening balance as at 31/12/2003 402 615<br />

2. Increases 912 197<br />

2.1 Deferred taxes arisen during the year 912 150<br />

2.2 Other increases - 47<br />

3. Decreases 183 410<br />

3.1 Deferred taxes annulled during the year 182 409<br />

3.2 Other decreases 1 1<br />

4. Closing balance as at 31/12/2004 1.131 402<br />

The above mentioned changes have income statement impact. No assets for deferred taxation having net balance sheet impact were recorded.<br />

Changes in caption 80/d “Provisions for risks and charges - Other provisions”<br />

Balance as at 31/12/2003 28.117<br />

decreases<br />

- Used to cover charges resulting from claims by receivers of bankrupt customers 1.285<br />

- Used to cover depreciations of securities portfolio 771<br />

- Used to cover charges of different nature 2.131<br />

- Transfer to out-of-period income of the exceeding part 1.086<br />

- Transfer to out-of-period income of the exceeding part <strong>Sella</strong> Bank Luxembourg S.A. 6.951<br />

- Other variations 46<br />

increases<br />

- Provisions charged to income statement for risks related to <strong>Sella</strong> Bank Luxembourg S.A. 1.675<br />

- Provisions charged to income statement for reimbursement of benefits deriving from law by decree 153/99 1.511<br />

- Provisions charged to income statement 6.794<br />

- Other variations 186<br />

Balance as at 31/12/2004 26.013<br />

It was not deemed necessary to make any provisions following sentence No. 425 of 09/10/2000 of the Constitutional Court, which ratified the illegitimacy for excess of proxy of art. 25<br />

par. 3 of Law by Decree 342/99, the content of which guaranteed the validity of clauses relating to capitalization of interest of contracts outstanding at the date in which deliberation<br />

CICR of 09/02/2000 was put into force. The Council of State, with the above mentioned sentence has not judged the issue, but pointed out the inadequacy of the proxy law as source<br />

of the regulations for the issue of the disposition thereof.<br />

Therefore the Group, as regards interest due on interest, on the basis of the scholars’ and the courts’ past and recent guidelines and of well-grounded objective elements, holds fully<br />

valid the clauses relevant to capitalization of interest written in the contracts for current accounts and the procedures followed, and holds groundless any request for reimbursement<br />

that customers may put forward.<br />

With decision C (2001) 3955 of 11/12/2001, the European Commission stated that Law by Decree 153/99 (known as “Ciampi law”) is identified as “State aid” and therefore is not<br />

compliant with EC rules. The Italian Government (Law by Decree 63/2002) in part applied the EC Decision suspending the application of the Law by Decree starting from year 2001.<br />

With Law by Decree 282/2002 the Government requested the disbursement of an amount equal to the taxes not paid as a consequence to such regulations and relevant to tax periods<br />

in which such regulations were applied.<br />

<strong>Banca</strong> <strong>Sella</strong>, as well as other main Italian banks, has assigned the Italian Banking Association (ABI) the mandate to appeal to the relevant European Court. Such appeal was deposited<br />

on 21/02/2002 with the Court of First Instance of the Community (case T-36/02). The Italian Government also has opposed such Decision by applying to the Court of Justice of the<br />

Community (case C-66/02).<br />

A court order of 09/07/2003 of the Court of First Instance declared the suspension of the proceedings begun by ABI (case T-36/02) until the European Court has delivered its judgement<br />

on case C-66/02.<br />

On 03/02/2005 case C-66/02, which sets the Italian Government against the European Commission, was heard before the European Court, sitting in open court. The sitting was heard<br />

together with the hearing of case C-184/04 relevant to some preliminary questions raised by the Tax Committee of the province of Genoa in order to issue its final judgement on the<br />

appeal deposited by a main Italian bank. The Italian Government Counsel repeated the defense made in the already deposited memorials, confirmed its favourable support to the<br />

presence of the bank in the lawsuit, concluded insisting on the annulment of the Decision of EU Commission of 11/12/2001. It is to be pointed out that the publication of the decision<br />

of the European Court will take at least 10 months from the day of the sitting in open court which took place on 03/02/2005.<br />

<strong>Gruppo</strong> <strong>Banca</strong> <strong>Sella</strong> in previous financial years benefited of tax reliefs as provided for by Law by Decree 153/1999, for a total amount of about € 1,2 million. The Group thought,<br />

coherently with the judicial action in which it is involved, not to disburse the amount requested, because of the fact that there are well-grounded reasons to believe that the benefits<br />

may not be identified as “State aid”. Such tax regulations, indeed, (i) are not selective and do not identify an ad hoc aid; (ii) they neither distort nor menace competition inside the<br />

European Union, also considering that Italian banks are damaged by a higher taxation than other member Countries; (iii) they do not influence international trade among member<br />

countries. Nevertheless, even though such benefits were identified as “State aid”, it is deemed that the same are nevertheless due, on the basis of the fundamental principles of the EU<br />

regulations on legitimate expectations and proportionality.<br />

On the prudence principle the Group has however deemed to allocate to “provision for risks and charges - other” (item 80/d of the Balance Sheet) an amount of € 1,5 million entered<br />

at item “provisions for risks and charges” (item 100 of the Income Statement). Such provision includes both tax reliefs benefited in previous financial years and interest and sanctions<br />

provided for by law by decree 282/2002.<br />

Consolidated <strong>annual</strong> <strong>report</strong> 2004 - 245