consolidated annual report - Gruppo Banca Sella

consolidated annual report - Gruppo Banca Sella

consolidated annual report - Gruppo Banca Sella

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

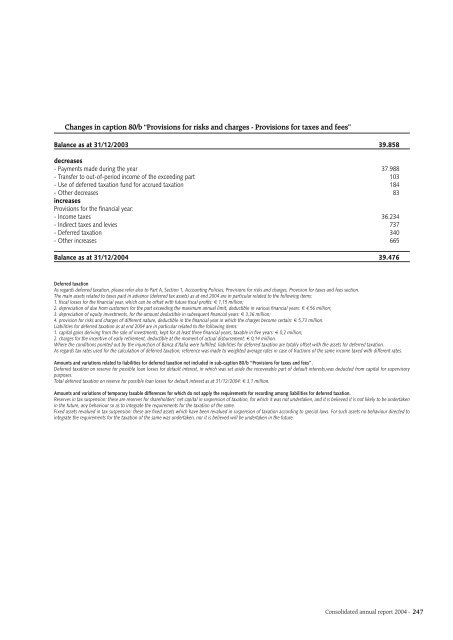

Changes in caption 80/b “Provisions for risks and charges - Provisions for taxes and fees”<br />

Balance as at 31/12/2003 39.858<br />

decreases<br />

- Payments made during the year 37.988<br />

- Transfer to out-of-period income of the exceeding part 103<br />

- Use of deferred taxation fund for accrued taxation 184<br />

- Other decreases 83<br />

increases<br />

Provisions for the financial year:<br />

- Income taxes 36.234<br />

- Indirect taxes and levies 737<br />

- Deferred taxation 340<br />

- Other increases 665<br />

Balance as at 31/12/2004 39.476<br />

Deferred taxation<br />

As regards deferred taxation, please refer also to Part A, Section 1, Accounting Policies, Provisions for risks and charges, Provision for taxes and fees section.<br />

The main assets related to taxes paid in advance (deferred tax assets) as at end 2004 are in particular related to the following items:<br />

1. fiscal losses for the financial year, which can be offset with future fiscal profits: € 1,15 million;<br />

2. depreciation of due from customers for the part exceeding the maximum <strong>annual</strong> limit, deductible in various financial years: € 4,56 million;<br />

3. depreciation of equity investments, for the amount deductible in subsequent financial years: € 3,36 million;<br />

4. provision for risks and charges of different nature, deductible in the financial year in which the charges become certain: € 5,73 million.<br />

Liabilities for deferred taxation as at end 2004 are in particular related to the following items:<br />

1. capital gains deriving from the sale of investments, kept for at least three financial years, taxable in five years: € 0,2 million;<br />

2. charges for the incentive of early retirement, deductible at the moment of actual disbursement: € 0,14 million.<br />

Where the conditions pointed out by the injunction of <strong>Banca</strong> d’Italia were fulfilled, liabilities for deferred taxation are totally offset with the assets for deferred taxation.<br />

As regards tax rates used for the calculation of deferred taxation, reference was made to weighted average rates in case of fractions of the same income taxed with different rates.<br />

Amounts and variations related to liabilities for deferred taxation not included in sub-caption 80/b “Provisions for taxes and fees”.<br />

Deferred taxation on reserve for possible loan losses for default interest, in which was set aside the recoverable part of default interests,was deducted from capital for supervisory<br />

purposes.<br />

Total deferred taxation on reserve for possible loan losses for default interest as at 31/12/2004: € 3,1 million.<br />

Amounts and variations of temporary taxable differences for which do not apply the requirements for recording among liabilities for deferred taxation.<br />

Reserves in tax suspension: these are reserves for shareholders’ net capital in suspension of taxation, for which it was not undertaken, and it is believed it is not likely to be undertaken<br />

in the future, any behaviour so as to integrate the requirements for the taxation of the same.<br />

Fixed assets revalued in tax suspension: these are fixed assets which have been revalued in suspension of taxation according to special laws. For such assets no behaviour directed to<br />

integrate the requirements for the taxation of the same was undertaken, nor it is believed will be undertaken in the future.<br />

Consolidated <strong>annual</strong> <strong>report</strong> 2004 - 247