Employer Further Guide to PAYE and NICs - HM Revenue & Customs

Employer Further Guide to PAYE and NICs - HM Revenue & Customs

Employer Further Guide to PAYE and NICs - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

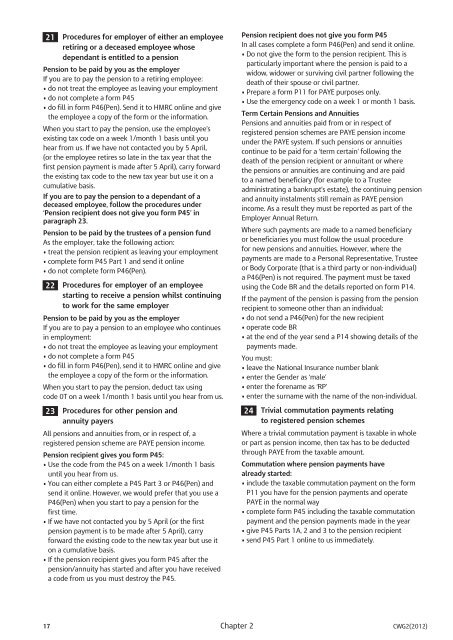

21 Procedures for employer of either an employee<br />

retiring or a deceased employee whose<br />

dependant is entitled <strong>to</strong> a pension<br />

Pension <strong>to</strong> be paid by you as the employer<br />

If you are <strong>to</strong> pay the pension <strong>to</strong> a retiring employee:<br />

• do not treat the employee as leaving your employment<br />

• do not complete a form P45<br />

• do fill in form P46(Pen). Send it <strong>to</strong> <strong>HM</strong>RC online <strong>and</strong> give<br />

the employee a copy of the form or the information.<br />

When you start <strong>to</strong> pay the pension, use the employee’s<br />

existing tax code on a week 1/month 1 basis until you<br />

hear from us. If we have not contacted you by 5 April,<br />

(or the employee retires so late in the tax year that the<br />

first pension payment is made after 5 April), carry forward<br />

the existing tax code <strong>to</strong> the new tax year but use it on a<br />

cumulative basis.<br />

If you are <strong>to</strong> pay the pension <strong>to</strong> a dependant of a<br />

deceased employee, follow the procedures under<br />

‘Pension recipient does not give you form P45’ in<br />

paragraph 23.<br />

Pension <strong>to</strong> be paid by the trustees of a pension fund<br />

As the employer, take the following action:<br />

• treat the pension recipient as leaving your employment<br />

• complete form P45 Part 1 <strong>and</strong> send it online<br />

• do not complete form P46(Pen).<br />

22 Procedures for employer of an employee<br />

starting <strong>to</strong> receive a pension whilst continuing<br />

<strong>to</strong> work for the same employer<br />

Pension <strong>to</strong> be paid by you as the employer<br />

If you are <strong>to</strong> pay a pension <strong>to</strong> an employee who continues<br />

in employment:<br />

• do not treat the employee as leaving your employment<br />

• do not complete a form P45<br />

• do fill in form P46(Pen), send it <strong>to</strong> <strong>HM</strong>RC online <strong>and</strong> give<br />

the employee a copy of the form or the information.<br />

When you start <strong>to</strong> pay the pension, deduct tax using<br />

code 0T on a week 1/month 1 basis until you hear from us.<br />

23 Procedures for other pension <strong>and</strong><br />

annuity payers<br />

All pensions <strong>and</strong> annuities from, or in respect of, a<br />

registered pension scheme are <strong>PAYE</strong> pension income.<br />

Pension recipient gives you form P45:<br />

• Use the code from the P45 on a week 1/month 1 basis<br />

until you hear from us.<br />

• You can either complete a P45 Part 3 or P46(Pen) <strong>and</strong><br />

send it online. However, we would prefer that you use a<br />

P46(Pen) when you start <strong>to</strong> pay a pension for the<br />

first time.<br />

• If we have not contacted you by 5 April (or the first<br />

pension payment is <strong>to</strong> be made after 5 April), carry<br />

forward the existing code <strong>to</strong> the new tax year but use it<br />

on a cumulative basis.<br />

• If the pension recipient gives you form P45 after the<br />

pension/annuity has started <strong>and</strong> after you have received<br />

a code from us you must destroy the P45.<br />

Pension recipient does not give you form P45<br />

In all cases complete a form P46(Pen) <strong>and</strong> send it online.<br />

• Do not give the form <strong>to</strong> the pension recipient. This is<br />

particularly important where the pension is paid <strong>to</strong> a<br />

widow, widower or surviving civil partner following the<br />

death of their spouse or civil partner.<br />

• Prepare a form P11 for <strong>PAYE</strong> purposes only.<br />

• Use the emergency code on a week 1 or month 1 basis.<br />

Term Certain Pensions <strong>and</strong> Annuities<br />

Pensions <strong>and</strong> annuities paid from or in respect of<br />

registered pension schemes are <strong>PAYE</strong> pension income<br />

under the <strong>PAYE</strong> system. If such pensions or annuities<br />

continue <strong>to</strong> be paid for a ‘term certain’ following the<br />

death of the pension recipient or annuitant or where<br />

the pensions or annuities are continuing <strong>and</strong> are paid<br />

<strong>to</strong> a named beneficiary (for example <strong>to</strong> a Trustee<br />

administrating a bankrupt’s estate), the continuing pension<br />

<strong>and</strong> annuity instalments still remain as <strong>PAYE</strong> pension<br />

income. As a result they must be reported as part of the<br />

<strong>Employer</strong> Annual Return.<br />

Where such payments are made <strong>to</strong> a named beneficiary<br />

or beneficiaries you must follow the usual procedure<br />

for new pensions <strong>and</strong> annuities. However, where the<br />

payments are made <strong>to</strong> a Personal Representative, Trustee<br />

or Body Corporate (that is a third party or non-individual)<br />

a P46(Pen) is not required. The payment must be taxed<br />

using the Code BR <strong>and</strong> the details reported on form P14.<br />

If the payment of the pension is passing from the pension<br />

recipient <strong>to</strong> someone other than an individual:<br />

• do not send a P46(Pen) for the new recipient<br />

• operate code BR<br />

• at the end of the year send a P14 showing details of the<br />

payments made.<br />

You must:<br />

• leave the National Insurance number blank<br />

• enter the Gender as ‘male’<br />

• enter the forename as ‘RP’<br />

• enter the surname with the name of the non-individual.<br />

24 Trivial commutation payments relating<br />

<strong>to</strong> registered pension schemes<br />

Where a trivial commutation payment is taxable in whole<br />

or part as pension income, then tax has <strong>to</strong> be deducted<br />

through <strong>PAYE</strong> from the taxable amount.<br />

Commutation where pension payments have<br />

already started:<br />

• include the taxable commutation payment on the form<br />

P11 you have for the pension payments <strong>and</strong> operate<br />

<strong>PAYE</strong> in the normal way<br />

• complete form P45 including the taxable commutation<br />

payment <strong>and</strong> the pension payments made in the year<br />

• give P45 Parts 1A, 2 <strong>and</strong> 3 <strong>to</strong> the pension recipient<br />

• send P45 Part 1 online <strong>to</strong> us immediately.<br />

17 Chapter 2 CWG2(2012)