Employer Further Guide to PAYE and NICs - HM Revenue & Customs

Employer Further Guide to PAYE and NICs - HM Revenue & Customs

Employer Further Guide to PAYE and NICs - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Payments paid ‘free of tax or <strong>NICs</strong>’<br />

27 All of an employee’s earnings paid ‘free of tax’<br />

If you enter in<strong>to</strong> an arrangement with an employee that<br />

all of his or her earnings are <strong>to</strong> be paid ‘free of tax’, you<br />

should note that:<br />

• it is your responsibility <strong>to</strong> make sure that your employee<br />

underst<strong>and</strong>s <strong>and</strong> agrees with the terms under which the<br />

payment is made 'free of tax’<br />

• payments made 'free of tax’ can increase your costs<br />

• there are extra <strong>PAYE</strong> duties involved.<br />

For example, the tax due is worked out by reference <strong>to</strong> the<br />

‘true gross pay’, not the amount your employee is actually<br />

paid. It is your responsibility <strong>to</strong> work out the ‘true gross<br />

pay’ figure.<br />

Where you have such an arrangement with any<br />

employee(s), contact us for a package containing:<br />

• forms P11(FOT)<br />

• special ‘free of tax’ (FOT) Tax Tables, Tables G<br />

• a leaflet FOT 1 which will help you work out the ‘true<br />

gross pay’ figure <strong>and</strong> show you how <strong>to</strong> complete form<br />

P11(FOT).<br />

28 All of an employee’s earnings paid ‘free of tax<br />

<strong>and</strong> <strong>NICs</strong>’<br />

If you enter in<strong>to</strong> an arrangement with an employee that all<br />

of his or her earnings are <strong>to</strong> be paid ‘free of tax <strong>and</strong> <strong>NICs</strong>’,<br />

you should contact us for advice.<br />

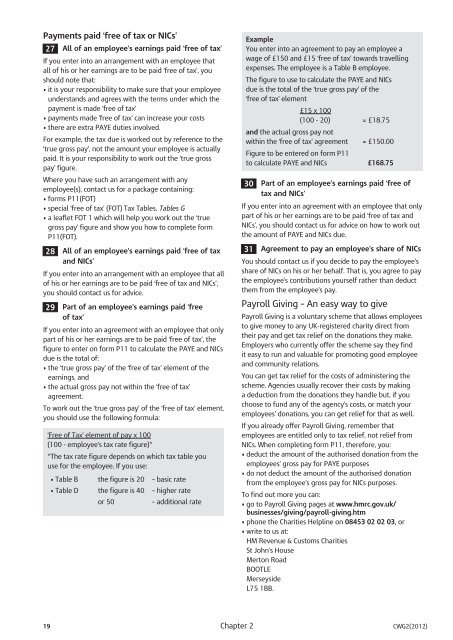

29 Part of an employee’s earnings paid ‘free<br />

of tax’<br />

If you enter in<strong>to</strong> an agreement with an employee that only<br />

part of his or her earnings are <strong>to</strong> be paid ‘free of tax’, the<br />

figure <strong>to</strong> enter on form P11 <strong>to</strong> calculate the <strong>PAYE</strong> <strong>and</strong> <strong>NICs</strong><br />

due is the <strong>to</strong>tal of:<br />

• the ‘true gross pay’ of the ‘free of tax’ element of the<br />

earnings, <strong>and</strong><br />

• the actual gross pay not within the ‘free of tax’<br />

agreement.<br />

To work out the ‘true gross pay’ of the ‘free of tax’ element,<br />

you should use the following formula:<br />

‘Free of Tax’ element of pay x 100<br />

(100 - employee’s tax rate figure)*<br />

*The tax rate figure depends on which tax table you<br />

use for the employee. If you use:<br />

• Table B the figure is 20 – basic rate<br />

• Table D the figure is 40 – higher rate<br />

or 50 – additional rate<br />

Example<br />

You enter in<strong>to</strong> an agreement <strong>to</strong> pay an employee a<br />

wage of £150 <strong>and</strong> £15 ‘free of tax’ <strong>to</strong>wards travelling<br />

expenses. The employee is a Table B employee.<br />

The figure <strong>to</strong> use <strong>to</strong> calculate the <strong>PAYE</strong> <strong>and</strong> <strong>NICs</strong><br />

due is the <strong>to</strong>tal of the ‘true gross pay’ of the<br />

‘free of tax’ element<br />

£15 x 100<br />

(100 - 20) = £18.75<br />

<strong>and</strong> the actual gross pay not<br />

within the ‘free of tax’ agreement = £150.00<br />

Figure <strong>to</strong> be entered on form P11<br />

<strong>to</strong> calculate <strong>PAYE</strong> <strong>and</strong> <strong>NICs</strong> £168.75<br />

30 Part of an employee’s earnings paid ‘free of<br />

tax <strong>and</strong> <strong>NICs</strong>’<br />

If you enter in<strong>to</strong> an agreement with an employee that only<br />

part of his or her earnings are <strong>to</strong> be paid ‘free of tax <strong>and</strong><br />

<strong>NICs</strong>’, you should contact us for advice on how <strong>to</strong> work out<br />

the amount of <strong>PAYE</strong> <strong>and</strong> <strong>NICs</strong> due.<br />

31 Agreement <strong>to</strong> pay an employee’s share of <strong>NICs</strong><br />

You should contact us if you decide <strong>to</strong> pay the employee’s<br />

share of <strong>NICs</strong> on his or her behalf. That is, you agree <strong>to</strong> pay<br />

the employee’s contributions yourself rather than deduct<br />

them from the employee’s pay.<br />

Payroll Giving – An easy way <strong>to</strong> give<br />

Payroll Giving is a voluntary scheme that allows employees<br />

<strong>to</strong> give money <strong>to</strong> any UK-registered charity direct from<br />

their pay <strong>and</strong> get tax relief on the donations they make.<br />

<strong>Employer</strong>s who currently offer the scheme say they find<br />

it easy <strong>to</strong> run <strong>and</strong> valuable for promoting good employee<br />

<strong>and</strong> community relations.<br />

You can get tax relief for the costs of administering the<br />

scheme. Agencies usually recover their costs by making<br />

a deduction from the donations they h<strong>and</strong>le but, if you<br />

choose <strong>to</strong> fund any of the agency’s costs, or match your<br />

employees’ donations, you can get relief for that as well.<br />

If you already offer Payroll Giving, remember that<br />

employees are entitled only <strong>to</strong> tax relief, not relief from<br />

<strong>NICs</strong>. When completing form P11, therefore, you:<br />

• deduct the amount of the authorised donation from the<br />

employees’ gross pay for <strong>PAYE</strong> purposes<br />

• do not deduct the amount of the authorised donation<br />

from the employee’s gross pay for <strong>NICs</strong> purposes.<br />

To find out more you can:<br />

• go <strong>to</strong> Payroll Giving pages at www.hmrc.gov.uk/<br />

businesses/giving/payroll-giving.htm<br />

• phone the Charities Helpline on 08453 02 02 03, or<br />

• write <strong>to</strong> us at:<br />

<strong>HM</strong> <strong>Revenue</strong> & Cus<strong>to</strong>ms Charities<br />

St John’s House<br />

Mer<strong>to</strong>n Road<br />

BOOTLE<br />

Merseyside<br />

L75 1BB.<br />

19 Chapter 2 CWG2(2012)