Employer Further Guide to PAYE and NICs - HM Revenue & Customs

Employer Further Guide to PAYE and NICs - HM Revenue & Customs

Employer Further Guide to PAYE and NICs - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

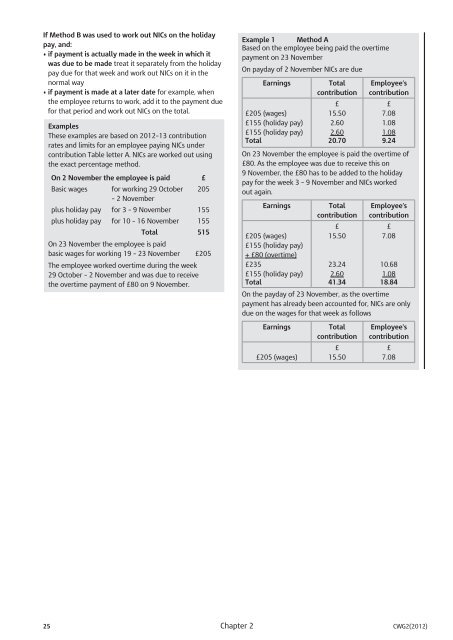

If Method B was used <strong>to</strong> work out <strong>NICs</strong> on the holiday<br />

pay, <strong>and</strong>:<br />

• if payment is actually made in the week in which it<br />

was due <strong>to</strong> be made treat it separately from the holiday<br />

pay due for that week <strong>and</strong> work out <strong>NICs</strong> on it in the<br />

normal way<br />

• if payment is made at a later date for example, when<br />

the employee returns <strong>to</strong> work, add it <strong>to</strong> the payment due<br />

for that period <strong>and</strong> work out <strong>NICs</strong> on the <strong>to</strong>tal.<br />

Examples<br />

These examples are based on 2012–13 contribution<br />

rates <strong>and</strong> limits for an employee paying <strong>NICs</strong> under<br />

contribution Table letter A. <strong>NICs</strong> are worked out using<br />

the exact percentage method.<br />

On 2 November the employee is paid £<br />

Basic wages for working 29 Oc<strong>to</strong>ber<br />

– 2 November<br />

205<br />

plus holiday pay for 3 – 9 November 155<br />

plus holiday pay for 10 – 16 November 155<br />

Total 515<br />

On 23 November the employee is paid<br />

basic wages for working 19 – 23 November £205<br />

The employee worked overtime during the week<br />

29 Oc<strong>to</strong>ber – 2 November <strong>and</strong> was due <strong>to</strong> receive<br />

the overtime payment of £80 on 9 November.<br />

Example 1 Method A<br />

Based on the employee being paid the overtime<br />

payment on 23 November<br />

On payday of 2 November <strong>NICs</strong> are due<br />

Earnings Total<br />

contribution<br />

£205 (wages)<br />

£155 (holiday pay)<br />

£155 (holiday pay)<br />

Total<br />

£<br />

15.50<br />

2.60<br />

2.60<br />

20.70<br />

Employee’s<br />

contribution<br />

£<br />

7.08<br />

1.08<br />

1.08<br />

9.24<br />

On 23 November the employee is paid the overtime of<br />

£80. As the employee was due <strong>to</strong> receive this on<br />

9 November, the £80 has <strong>to</strong> be added <strong>to</strong> the holiday<br />

pay for the week 3 – 9 November <strong>and</strong> <strong>NICs</strong> worked<br />

out again.<br />

Earnings Total<br />

contribution<br />

£205 (wages)<br />

£155 (holiday pay)<br />

+ £80 (overtime)<br />

£235<br />

£155 (holiday pay)<br />

Total<br />

£<br />

15.50<br />

23.24<br />

2.60<br />

41.34<br />

Employee’s<br />

contribution<br />

£<br />

7.08<br />

10.68<br />

1.08<br />

18.84<br />

On the payday of 23 November, as the overtime<br />

payment has already been accounted for, <strong>NICs</strong> are only<br />

due on the wages for that week as follows<br />

Earnings Total<br />

contribution<br />

£<br />

£205 (wages) 15.50<br />

Employee’s<br />

contribution<br />

£<br />

7.08<br />

25 Chapter 2 CWG2(2012)