Employer Further Guide to PAYE and NICs - HM Revenue & Customs

Employer Further Guide to PAYE and NICs - HM Revenue & Customs

Employer Further Guide to PAYE and NICs - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

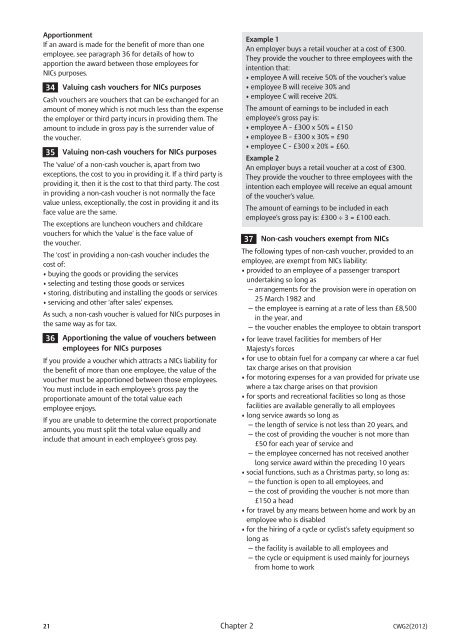

Apportionment<br />

If an award is made for the benefit of more than one<br />

employee, see paragraph 36 for details of how <strong>to</strong><br />

apportion the award between those employees for<br />

<strong>NICs</strong> purposes.<br />

34 Valuing cash vouchers for <strong>NICs</strong> purposes<br />

Cash vouchers are vouchers that can be exchanged for an<br />

amount of money which is not much less than the expense<br />

the employer or third party incurs in providing them. The<br />

amount <strong>to</strong> include in gross pay is the surrender value of<br />

the voucher.<br />

35 Valuing non-cash vouchers for <strong>NICs</strong> purposes<br />

The ‘value’ of a non-cash voucher is, apart from two<br />

exceptions, the cost <strong>to</strong> you in providing it. If a third party is<br />

providing it, then it is the cost <strong>to</strong> that third party. The cost<br />

in providing a non-cash voucher is not normally the face<br />

value unless, exceptionally, the cost in providing it <strong>and</strong> its<br />

face value are the same.<br />

The exceptions are luncheon vouchers <strong>and</strong> childcare<br />

vouchers for which the ‘value’ is the face value of<br />

the voucher.<br />

The ‘cost’ in providing a non-cash voucher includes the<br />

cost of:<br />

• buying the goods or providing the services<br />

• selecting <strong>and</strong> testing those goods or services<br />

• s<strong>to</strong>ring, distributing <strong>and</strong> installing the goods or services<br />

• servicing <strong>and</strong> other ‘after sales’ expenses.<br />

As such, a non-cash voucher is valued for <strong>NICs</strong> purposes in<br />

the same way as for tax.<br />

36 Apportioning the value of vouchers between<br />

employees for <strong>NICs</strong> purposes<br />

If you provide a voucher which attracts a <strong>NICs</strong> liability for<br />

the benefit of more than one employee, the value of the<br />

voucher must be apportioned between those employees.<br />

You must include in each employee’s gross pay the<br />

proportionate amount of the <strong>to</strong>tal value each<br />

employee enjoys.<br />

If you are unable <strong>to</strong> determine the correct proportionate<br />

amounts, you must split the <strong>to</strong>tal value equally <strong>and</strong><br />

include that amount in each employee’s gross pay.<br />

Example 1<br />

An employer buys a retail voucher at a cost of £300.<br />

They provide the voucher <strong>to</strong> three employees with the<br />

intention that:<br />

• employee A will receive 50% of the voucher’s value<br />

• employee B will receive 30% <strong>and</strong><br />

• employee C will receive 20%.<br />

The amount of earnings <strong>to</strong> be included in each<br />

employee’s gross pay is:<br />

• employee A – £300 x 50% = £150<br />

• employee B – £300 x 30% = £90<br />

• employee C – £300 x 20% = £60.<br />

Example 2<br />

An employer buys a retail voucher at a cost of £300.<br />

They provide the voucher <strong>to</strong> three employees with the<br />

intention each employee will receive an equal amount<br />

of the voucher’s value.<br />

The amount of earnings <strong>to</strong> be included in each<br />

employee’s gross pay is: £300 ÷ 3 = £100 each.<br />

37 Non-cash vouchers exempt from <strong>NICs</strong><br />

The following types of non-cash voucher, provided <strong>to</strong> an<br />

employee, are exempt from <strong>NICs</strong> liability:<br />

• provided <strong>to</strong> an employee of a passenger transport<br />

undertaking so long as<br />

— arrangements for the provision were in operation on<br />

25 March 1982 <strong>and</strong><br />

— the employee is earning at a rate of less than £8,500<br />

in the year, <strong>and</strong><br />

— the voucher enables the employee <strong>to</strong> obtain transport<br />

• for leave travel facilities for members of Her<br />

Majesty’s forces<br />

• for use <strong>to</strong> obtain fuel for a company car where a car fuel<br />

tax charge arises on that provision<br />

• for mo<strong>to</strong>ring expenses for a van provided for private use<br />

where a tax charge arises on that provision<br />

• for sports <strong>and</strong> recreational facilities so long as those<br />

facilities are available generally <strong>to</strong> all employees<br />

• long service awards so long as<br />

— the length of service is not less than 20 years, <strong>and</strong><br />

— the cost of providing the voucher is not more than<br />

£50 for each year of service <strong>and</strong><br />

— the employee concerned has not received another<br />

long service award within the preceding 10 years<br />

• social functions, such as a Christmas party, so long as:<br />

— the function is open <strong>to</strong> all employees, <strong>and</strong><br />

— the cost of providing the voucher is not more than<br />

£150 a head<br />

• for travel by any means between home <strong>and</strong> work by an<br />

employee who is disabled<br />

• for the hiring of a cycle or cyclist’s safety equipment so<br />

long as<br />

— the facility is available <strong>to</strong> all employees <strong>and</strong><br />

— the cycle or equipment is used mainly for journeys<br />

from home <strong>to</strong> work<br />

21 Chapter 2 CWG2(2012)