Employer Further Guide to PAYE and NICs - HM Revenue & Customs

Employer Further Guide to PAYE and NICs - HM Revenue & Customs

Employer Further Guide to PAYE and NICs - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Tips, gratuities, service charges <strong>and</strong> troncs<br />

A tip or gratuity is an uncalled for <strong>and</strong> spontaneous<br />

payment offered by a cus<strong>to</strong>mer either in cash, as part of a<br />

cheque payment, or as a specific gratuity on a credit/debit<br />

card slip.<br />

A service charge is an amount added <strong>to</strong> a cus<strong>to</strong>mer’s bill<br />

before it is presented <strong>to</strong> the cus<strong>to</strong>mer. If it is made clear<br />

<strong>to</strong> the cus<strong>to</strong>mer that the charge is a purely discretionary<br />

amount <strong>and</strong> that there is no obligation <strong>to</strong> pay, the<br />

payment is a voluntary service charge. Where that is not<br />

the case, the payment is a m<strong>and</strong>a<strong>to</strong>ry service charge.<br />

To establish the correct <strong>PAYE</strong> <strong>and</strong> <strong>NICs</strong> treatment of the<br />

payments described above, you must identify both the<br />

nature of the payment <strong>and</strong> the arrangements under which<br />

it is paid.<br />

<strong>PAYE</strong> is not due if cash tips are received directly from<br />

cus<strong>to</strong>mers by your employees <strong>and</strong> are retained by them,<br />

<strong>and</strong> the monies never pass through your h<strong>and</strong>s. Such tips<br />

are, however, taxable directly on the employee who should<br />

tell us the amounts they have received.<br />

For <strong>PAYE</strong> purposes<br />

If, as an employer, you operate a scheme that pays<br />

your employees a share of tips/gratuities (including<br />

cash tips received by employees <strong>and</strong> h<strong>and</strong>ed <strong>to</strong> you by<br />

the employees for sharing) or service charges (whether<br />

voluntary or m<strong>and</strong>a<strong>to</strong>ry) you must include the amount<br />

paid <strong>to</strong> each employee in their gross pay <strong>and</strong> deduct<br />

<strong>PAYE</strong> accordingly.<br />

<strong>PAYE</strong> <strong>and</strong> tronc schemes<br />

A tronc is a separate organised pay arrangement used <strong>to</strong><br />

distribute tips, gratuities <strong>and</strong> service charges. You must<br />

tell us when you first become aware of the existence<br />

of a tronc, telling us the troncmaster’s name <strong>and</strong> the<br />

arrangements in place.<br />

If <strong>HM</strong>RC are satisfied that there is a tronc scheme for<br />

sharing tips/gratuities <strong>and</strong> service charges then we will<br />

set up a <strong>PAYE</strong> scheme in the troncmaster’s name. The<br />

troncmaster is responsible for operating <strong>PAYE</strong> on all<br />

payments made from the tronc, including any share of<br />

cash tips. The word ‘tronc’ should be written in the space<br />

for the works number on the employee’s form P11 End of<br />

year summary <strong>and</strong> any forms P46 or P45 Part 3 which the<br />

troncmaster should prepare.<br />

For <strong>NICs</strong> purposes<br />

If you impose a m<strong>and</strong>a<strong>to</strong>ry service charge <strong>and</strong> the money<br />

is paid out <strong>to</strong> your employees, <strong>NICs</strong> are due on the<br />

payments no matter what arrangements are in place <strong>to</strong><br />

share out the money.<br />

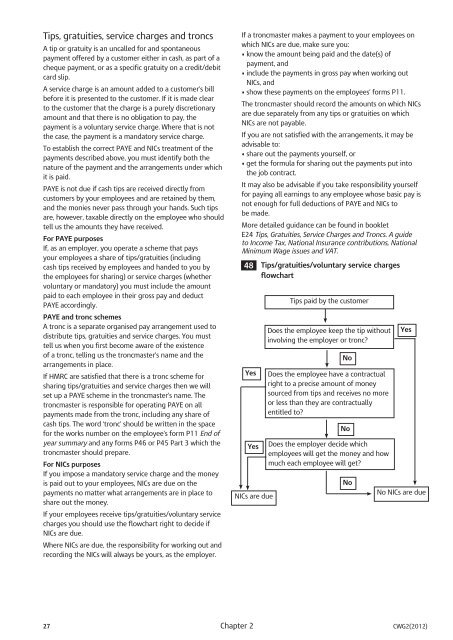

If your employees receive tips/gratuities/voluntary service<br />

charges you should use the flowchart right <strong>to</strong> decide if<br />

<strong>NICs</strong> are due.<br />

Where <strong>NICs</strong> are due, the responsibility for working out <strong>and</strong><br />

recording the <strong>NICs</strong> will always be yours, as the employer.<br />

If a troncmaster makes a payment <strong>to</strong> your employees on<br />

which <strong>NICs</strong> are due, make sure you:<br />

• know the amount being paid <strong>and</strong> the date(s) of<br />

payment, <strong>and</strong><br />

• include the payments in gross pay when working out<br />

<strong>NICs</strong>, <strong>and</strong><br />

• show these payments on the employees’ forms P11.<br />

The troncmaster should record the amounts on which <strong>NICs</strong><br />

are due separately from any tips or gratuities on which<br />

<strong>NICs</strong> are not payable.<br />

If you are not satisfied with the arrangements, it may be<br />

advisable <strong>to</strong>:<br />

• share out the payments yourself, or<br />

• get the formula for sharing out the payments put in<strong>to</strong><br />

the job contract.<br />

It may also be advisable if you take responsibility yourself<br />

for paying all earnings <strong>to</strong> any employee whose basic pay is<br />

not enough for full deductions of <strong>PAYE</strong> <strong>and</strong> <strong>NICs</strong> <strong>to</strong><br />

be made.<br />

More detailed guidance can be found in booklet<br />

E24 Tips, Gratuities, Service Charges <strong>and</strong> Troncs. A guide<br />

<strong>to</strong> Income Tax, National Insurance contributions, National<br />

Minimum Wage issues <strong>and</strong> VAT.<br />

48 Tips/gratuities/voluntary service charges<br />

flowchart<br />

Tips paid by the cus<strong>to</strong>mer<br />

Does the employee keep the tip without<br />

involving the employer or tronc?<br />

Does the employee have a contractual<br />

right <strong>to</strong> a precise amount of money<br />

sourced from tips <strong>and</strong> receives no more<br />

or less than they are contractually<br />

entitled <strong>to</strong>?<br />

27 Chapter 2 CWG2(2012)<br />

Yes<br />

Yes<br />

<strong>NICs</strong> are due<br />

No<br />

No<br />

Does the employer decide which<br />

employees will get the money <strong>and</strong> how<br />

much each employee will get?<br />

No<br />

Yes<br />

No <strong>NICs</strong> are due