Annual Report 2009 Royal BAM Group nv

Annual Report 2009 Royal BAM Group nv

Annual Report 2009 Royal BAM Group nv

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

100<br />

<strong>2009</strong><br />

29<br />

8<br />

9<br />

9, 26<br />

8, 26<br />

28<br />

28<br />

11<br />

21,22<br />

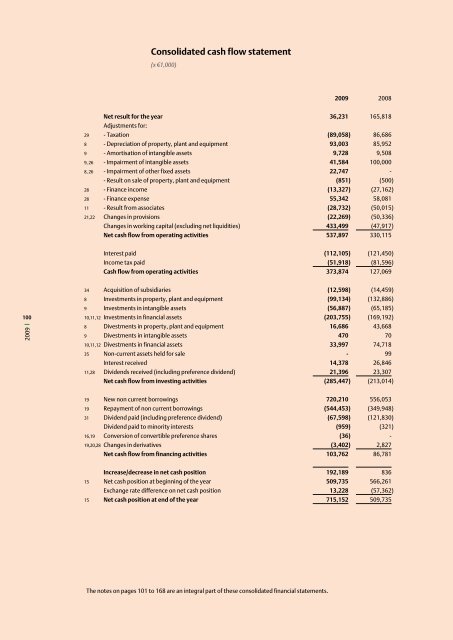

Consolidated cash flow statement<br />

(x €1,000)<br />

Net result for the year<br />

Adjustments for:<br />

- Taxation<br />

- Depreciation of property, plant and equipment<br />

- Amortisation of intangible assets<br />

- Impairment of intangible assets<br />

- Impairment of other fixed assets<br />

- Result on sale of property, plant and equipment<br />

- Finance income<br />

- Finance expense<br />

- Result from associates<br />

Changes in provisions<br />

Changes in working capital (excluding net liquidities)<br />

Net cash flow from operating activities<br />

Interest paid<br />

Income tax paid<br />

Cash flow from operating activities<br />

34 Acquisition of subsidiaries<br />

8 I<strong>nv</strong>estments in property, plant and equipment<br />

9 I<strong>nv</strong>estments in intangible assets<br />

10,11,12 I<strong>nv</strong>estments in financial assets<br />

8 Divestments in property, plant and equipment<br />

9 Divestments in intangible assets<br />

10,11,12 Divestments in financial assets<br />

35 Non-current assets held for sale<br />

Interest received<br />

11,28 Dividends received (including preference dividend)<br />

Net cash flow from i<strong>nv</strong>esting activities<br />

19 New non current borrowings<br />

19 Repayment of non current borrowings<br />

31 Dividend paid (including preference dividend)<br />

Dividend paid to minority interests<br />

16,19 Co<strong>nv</strong>ersion of co<strong>nv</strong>ertible preference shares<br />

19,20,28 Changes in derivatives<br />

Net cash flow from financing activities<br />

15<br />

15<br />

Increase/decrease in net cash position<br />

Net cash position at beginning of the year<br />

Exchange rate difference on net cash position<br />

Net cash position at end of the year<br />

The notes on pages 101 to 168 are an integral part of these consolidated financial statements.<br />

<strong>2009</strong><br />

36,231<br />

(89,058)<br />

93,003<br />

9,728<br />

41,584<br />

22,747<br />

(851)<br />

(13,327)<br />

55,342<br />

(28,732)<br />

(22,269)<br />

433,499<br />

537,897<br />

(112,105)<br />

(51,918)<br />

373,874<br />

(12,598)<br />

(99,134)<br />

(56,887)<br />

(203,755)<br />

16,686<br />

470<br />

33,997<br />

-<br />

14,378<br />

21,396<br />

(285,447)<br />

720,210<br />

(544,453)<br />

(67,598)<br />

(959)<br />

(36)<br />

(3,402)<br />

103,762<br />

192,189<br />

509,735<br />

13,228<br />

715,152<br />

2008<br />

165,818<br />

86,686<br />

85,952<br />

9,508<br />

100,000<br />

-<br />

(500)<br />

(27,162)<br />

58,081<br />

(50,015)<br />

(50,336)<br />

(47,917)<br />

330,115<br />

(121,450)<br />

(81,596)<br />

127,069<br />

(14,459)<br />

(132,886)<br />

(65,185)<br />

(169,192)<br />

43,668<br />

70<br />

74,718<br />

99<br />

26,846<br />

23,307<br />

(213,014)<br />

556,053<br />

(349,948)<br />

(121,830)<br />

(321)<br />

-<br />

2,827<br />

86,781<br />

836<br />

566,261<br />

(57,362)<br />

509,735