Annual Report 2009 Royal BAM Group nv

Annual Report 2009 Royal BAM Group nv

Annual Report 2009 Royal BAM Group nv

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

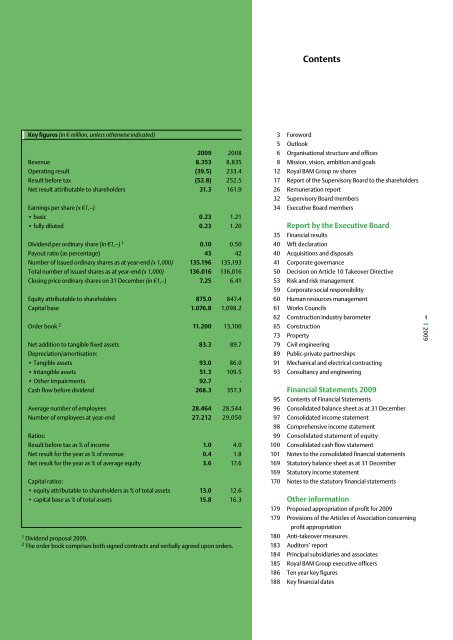

Key figures (in € million, unless otherwise indicated)<br />

Revenue<br />

Operating result<br />

Result before tax<br />

Net result attributable to shareholders<br />

Earnings per share (x €1,–)<br />

• basic<br />

• fully diluted<br />

Dividend per ordinary share (in €1,–) 1<br />

Payout ratio (as percentage)<br />

Number of issued ordinary shares as at year-end (x 1,000)<br />

Total number of issued shares as at year-end (x 1,000)<br />

Closing price ordinary shares on 31 December (in €1,–)<br />

Equity attributable to shareholders<br />

Capital base<br />

Order book 2<br />

Net addition to tangible fixed assets<br />

Depreciation/amortisation:<br />

• Tangible assets<br />

• Intangible assets<br />

• Other impairments<br />

Cash flow before dividend<br />

Average number of employees<br />

Number of employees at year-end<br />

Ratios:<br />

Result before tax as % of income<br />

Net result for the year as % of revenue<br />

Net result for the year as % of average equity<br />

Capital ratios:<br />

• equity attributable to shareholders as % of total assets<br />

• capital base as % of total assets<br />

<strong>2009</strong><br />

8.353<br />

(39.5)<br />

(52.8)<br />

31.3<br />

0.23<br />

0.23<br />

0.10<br />

43<br />

135.196<br />

136.016<br />

7.25<br />

875.0<br />

1.076.8<br />

11.200<br />

83.3<br />

93.0<br />

51.3<br />

92.7<br />

268.3<br />

28.464<br />

27.212<br />

1.0<br />

0.4<br />

3.6<br />

13.0<br />

15.8<br />

2008<br />

8,835<br />

233.4<br />

252.5<br />

161.9<br />

1.21<br />

1.20<br />

0.50<br />

42<br />

135,193<br />

136,016<br />

6.41<br />

847.4<br />

1,098.2<br />

13,100<br />

89.7<br />

86.0<br />

109.5<br />

-<br />

357.3<br />

28,544<br />

29,050<br />

1 Dividend proposal <strong>2009</strong>.<br />

2 The order book comprises both signed contracts and verbally agreed upon orders.<br />

4.0<br />

1.8<br />

17.6<br />

12.6<br />

16.3<br />

3<br />

5<br />

6<br />

8<br />

12<br />

17<br />

26<br />

32<br />

34<br />

35<br />

40<br />

40<br />

41<br />

50<br />

53<br />

59<br />

60<br />

61<br />

62<br />

65<br />

73<br />

79<br />

89<br />

91<br />

93<br />

95<br />

96<br />

97<br />

98<br />

99<br />

100<br />

101<br />

169<br />

169<br />

170<br />

179<br />

179<br />

180<br />

183<br />

184<br />

185<br />

186<br />

188<br />

Foreword<br />

Outlook<br />

Organisational structure and offices<br />

Mission, vision, ambition and goals<br />

<strong>Royal</strong> <strong>BAM</strong> <strong>Group</strong> <strong>nv</strong> shares<br />

<strong>Report</strong> of the Supervisory Board to the shareholders<br />

Remuneration report<br />

Supervisory Board members<br />

Executive Board members<br />

<strong>Report</strong> by the Executive Board<br />

Financial results<br />

Wft declaration<br />

Acquisitions and disposals<br />

Corporate governance<br />

Decision on Article 10 Takeover Directive<br />

Risk and risk management<br />

Corporate social responsibility<br />

Human resources management<br />

Works Councils<br />

Construction industry barometer<br />

Construction<br />

Property<br />

Contents<br />

Civil engineering<br />

Public-private partnerships<br />

Mechanical and electrical contracting<br />

Consultancy and engineering<br />

Financial Statements <strong>2009</strong><br />

Contents of Financial Statements<br />

Consolidated balance sheet as at 31 December<br />

Consolidated income statement<br />

Comprehensive income statement<br />

Consolidated statement of equity<br />

Consolidated cash flow statement<br />

Notes to the consolidated financial statements<br />

Statutory balance sheet as at 31 December<br />

Statutory income statement<br />

Notes to the statutory financial statements<br />

Other information<br />

Proposed appropriation of profit for <strong>2009</strong><br />

Provisions of the Articles of Association concerning<br />

profit appropriation<br />

Anti-takeover measures<br />

Auditors’ report<br />

Principal subsidiaries and associates<br />

<strong>Royal</strong> <strong>BAM</strong> <strong>Group</strong> executive officers<br />

Ten year key figures<br />

Key financial dates<br />

1<br />

<strong>2009</strong>