Annual Report 2009 Royal BAM Group nv

Annual Report 2009 Royal BAM Group nv

Annual Report 2009 Royal BAM Group nv

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

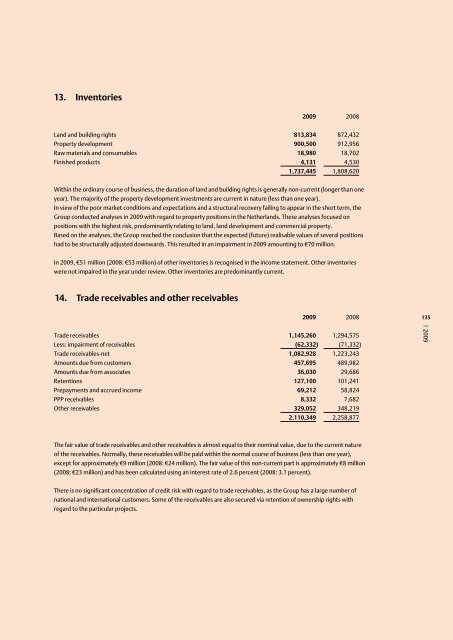

13. I<strong>nv</strong>entories<br />

Land and building rights<br />

Property development<br />

Raw materials and consumables<br />

Finished products<br />

Within the ordinary course of business, the duration of land and building rights is generally non-current (longer than one<br />

year). The majority of the property development i<strong>nv</strong>estments are current in nature (less than one year).<br />

In view of the poor market conditions and expectations and a structural recovery failing to appear in the short term, the<br />

<strong>Group</strong> conducted analyses in <strong>2009</strong> with regard to property positions in the Netherlands. These analyses focused on<br />

positions with the highest risk, predominantly relating to land, land development and commercial property.<br />

Based on the analyses, the <strong>Group</strong> reached the conclusion that the expected (future) realisable values of several positions<br />

had to be structurally adjusted downwards. This resulted in an impairment in <strong>2009</strong> amounting to €70 million.<br />

In <strong>2009</strong>, €51 million (2008: €53 million) of other i<strong>nv</strong>entories is recognised in the income statement. Other i<strong>nv</strong>entories<br />

were not impaired in the year under review. Other i<strong>nv</strong>entories are predominantly current.<br />

14. Trade receivables and other receivables<br />

Trade receivables<br />

Less: impairment of receivables<br />

Trade receivables-net<br />

Amounts due from customers<br />

Amounts due from associates<br />

Retentions<br />

Prepayments and accrued income<br />

PPP receivables<br />

Other receivables<br />

<strong>2009</strong><br />

1,145,260<br />

(62,332)<br />

1,082,928<br />

457,695<br />

36,030<br />

127,100<br />

69,212<br />

8,332<br />

329,052<br />

2,110,349<br />

2008<br />

1,294,575<br />

(71,332)<br />

1,223,243<br />

489,982<br />

29,686<br />

101,241<br />

58,824<br />

7,682<br />

348,219<br />

2,258,877<br />

The fair value of trade receivables and other receivables is almost equal to their nominal value, due to the current nature<br />

of the receivables. Normally, these receivables will be paid within the normal course of business (less than one year),<br />

except for approximately €9 million (2008: €24 million). The fair value of this non-current part is approximately €8 million<br />

(2008: €23 million) and has been calculated using an interest rate of 2.6 percent (2008: 3.1 percent).<br />

There is no significant concentration of credit risk with regard to trade receivables, as the <strong>Group</strong> has a large number of<br />

national and international customers. Some of the receivables are also secured via retention of ownership rights with<br />

regard to the particular projects.<br />

<strong>2009</strong><br />

813,834<br />

900,500<br />

18,980<br />

4,131<br />

1,737,445<br />

2008<br />

872,432<br />

912,956<br />

18,702<br />

4,530<br />

1,808,620<br />

135<br />

<strong>2009</strong>