- Page 1 and 2:

The e-Advocate Monthly …a Compila

- Page 3 and 4:

The Advocacy Foundation, Inc. Helpi

- Page 5 and 6:

Dedication ______ Every publication

- Page 7 and 8:

The Transformative Justice Project

- Page 9 and 10:

The Advocacy Foundation, Inc. Helpi

- Page 11 and 12:

Biblical Authority ______ Genesis 4

- Page 13 and 14:

Table of Contents …a compilation

- Page 15 and 16:

I. Introduction The U.S. Stock Mark

- Page 17 and 18:

The purpose of a stock exchange is

- Page 19 and 20:

Indirect vs. Direct Investment The

- Page 21 and 22:

men also traded with debts, they co

- Page 23 and 24:

Rising share prices, for instance,

- Page 25 and 26:

Behavior of The Stock Market Invest

- Page 27 and 28:

Many different academic researchers

- Page 29 and 30:

measures of control into the stock

- Page 31 and 32:

Regulation of margin requirements (

- Page 33 and 34:

II. Securities Regulation in The U.

- Page 35 and 36:

The federal securities laws govern

- Page 37 and 38:

disclosure of financial and other i

- Page 39 and 40:

longer be deceived and tricked and

- Page 41 and 42:

The Investment Management Division

- Page 43 and 44:

filings. The filer must reply to ea

- Page 45 and 46:

scheme because she was the firm's c

- Page 47 and 48:

Lehman Brothers, SAC Capital, and o

- Page 49 and 50:

1933: Securities Act of 1933 1934:

- Page 51 and 52:

outright. transaction. Retail clien

- Page 53 and 54:

Energy related derivatives - the In

- Page 55 and 56:

Intercontinental Exchange ICE for e

- Page 57 and 58:

National Futures Association (NFA)

- Page 59 and 60:

III. The New York Stock Exchange Th

- Page 61 and 62:

Notable Events The exchange was clo

- Page 63 and 64:

cyber breach," and the Department o

- Page 65 and 66:

(Level 1), 13% (Level 2), and 20% (

- Page 67 and 68:

Merger, Acquisition, and Control In

- Page 69 and 70:

Investment. On July 24, 2013, Secre

- Page 71 and 72:

IV. The Dow Jones Industrial Averag

- Page 73 and 74:

Company Exchange Symbol Industry IB

- Page 75 and 76:

Initial Components Dow calculated h

- Page 77 and 78:

Abyssinian War, the Soviet-Japanese

- Page 79 and 80:

War and the First Intifada in the M

- Page 81 and 82:

During 2002, the average remained s

- Page 83 and 84:

central-bank debt fueled record clo

- Page 85 and 86:

has the same effect as a $1 move in

- Page 87 and 88:

V. The S&P 500 Index The Standard &

- Page 89 and 90:

December 31, 2013, trading day at 1

- Page 91 and 92:

To prevent the value of the Index f

- Page 93 and 94:

Return Including Dividends Invested

- Page 95 and 96:

AXP AIG AMT AWK AMP ABC Power Ameri

- Page 97 and 98:

CCL Carnival Corp. reports Consumer

- Page 99 and 100:

DWDP DowDuPont reports Materials DP

- Page 101 and 102:

Rubber Discretionary GWW Grainger (

- Page 103 and 104:

LEG Leggett & Platt reports LEN Len

- Page 105 and 106:

NCLH Norwegian Cruise Line reports

- Page 107 and 108:

SCG SCANA Corp reports Utilities Mu

- Page 109 and 110:

Technology Services 02-01 Research

- Page 111 and 112:

2017 February 28, 2017 January 5, 2

- Page 113 and 114:

December 10, 2013 December 2, 2013

- Page 115 and 116:

December 5, 2000 INTU Intuit BS Bet

- Page 117 and 118:

VI. The NASDAQ The NASDAQ Stock Mar

- Page 119 and 120:

In November 2016, Nasdaq Chief Oper

- Page 121 and 122:

VII. The American Stock Exchange NY

- Page 123 and 124:

George Rea was approached about the

- Page 125 and 126:

y trading volume in the United Stat

- Page 127 and 128:

it's sold to a buyer. Therefore, ma

- Page 129 and 130:

VIII. The NYSE vs. The NASDAQ The N

- Page 131 and 132:

The NYSE collects a maximum yearly

- Page 133 and 134:

IX. Online Investing and Stock Sele

- Page 135 and 136:

Stock Selection Criteria Stock Sele

- Page 137 and 138:

2. Earnings growth which may be ref

- Page 139 and 140:

underlying companies. By focusing o

- Page 141 and 142:

to reveal levels of technical deter

- Page 143 and 144:

(25% debt compared to 75% equity) a

- Page 145 and 146:

about the movement of stock and com

- Page 147 and 148:

1. Fundamental Analysis maintains t

- Page 149 and 150:

Top-Down and Bottom-Up Approaches I

- Page 151 and 152:

Analysis of Technical Data In finan

- Page 153 and 154:

Contrasting with technical analysis

- Page 155 and 156:

Note that the sequence of lower low

- Page 157 and 158:

series of rules for generating entr

- Page 159 and 160:

Subsequently, a comprehensive study

- Page 161 and 162:

EMH advocates reply that while indi

- Page 163 and 164:

Among the most basic ideas of conve

- Page 165 and 166:

chalk, with the updates regarding s

- Page 167 and 168:

Parabolic SAR - Wilder's trailing s

- Page 169 and 170:

X. List of Stock Exchanges This is

- Page 171 and 172:

XI. Glossary of Investment Terms JP

- Page 173 and 174:

Capital gains reinvest NAV - The di

- Page 175 and 176:

Ex-Dividend date - The date on whic

- Page 177 and 178:

- L - Large-cap - The market capita

- Page 179 and 180:

Portfolio - A collection of investm

- Page 181 and 182:

Securities and Exchange Commission

- Page 183 and 184:

Treasury bond - Negotiable long-ter

- Page 185 and 186:

XII. References 1. https://en.wikip

- Page 187 and 188:

Notes _____________________________

- Page 189:

Attachment A Seven Steps to Underst

- Page 192 and 193:

Investing for Beginners 101: 7 Step

- Page 194 and 195:

Investing for Beginners 101: 7 Step

- Page 196 and 197:

Investing for Beginners 101: 7 Step

- Page 198 and 199:

Investing for Beginners 101: 7 Step

- Page 200 and 201:

Investing for Beginners 101: 7 Step

- Page 202 and 203:

Investing for Beginners 101: 7 Step

- Page 204 and 205:

Investing for Beginners 101: 7 Step

- Page 206 and 207:

Investing for Beginners 101: 7 Step

- Page 208 and 209:

Investing for Beginners 101: 7 Step

- Page 210 and 211:

Investing for Beginners 101: 7 Step

- Page 212 and 213:

Investing for Beginners 101: 7 Step

- Page 214 and 215:

Investing for Beginners 101: 7 Step

- Page 216 and 217:

Investing for Beginners 101: 7 Step

- Page 218 and 219:

Investing for Beginners 101: 7 Step

- Page 220 and 221:

Investing for Beginners 101: 7 Step

- Page 222 and 223:

Investing for Beginners 101: 7 Step

- Page 224 and 225:

Investing for Beginners 101: 7 Step

- Page 226 and 227:

Investing for Beginners 101: 7 Step

- Page 228 and 229:

Investing for Beginners 101: 7 Step

- Page 230 and 231:

Page 190 of 214

- Page 232:

Investing 101 A Complete Introducti

- Page 235 and 236:

wall street survivor • investing

- Page 237 and 238:

wall street survivor • investing

- Page 239 and 240:

wall street survivor • investing

- Page 241 and 242:

wall street survivor • investing

- Page 243 and 244:

wall street survivor • investing

- Page 245 and 246:

wall street survivor • investing

- Page 247 and 248:

wall street survivor • investing

- Page 249 and 250:

wall street survivor • investing

- Page 251 and 252:

wall street survivor • investing

- Page 253 and 254:

wall street survivor • investing

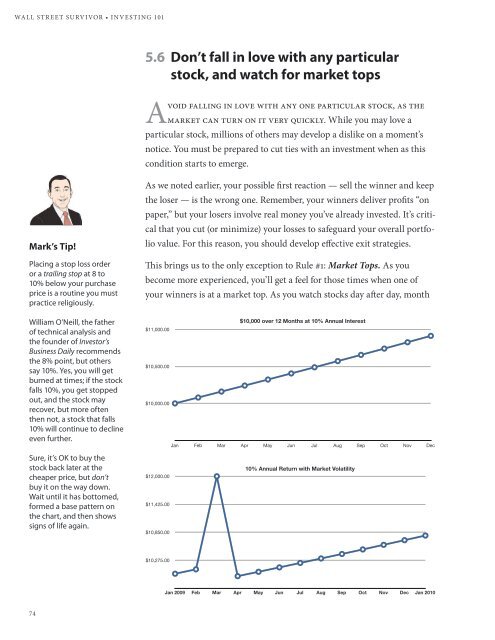

- Page 255 and 256: wall street survivor • investing

- Page 257 and 258: wall street survivor • investing

- Page 259 and 260: wall street survivor •• investi

- Page 261 and 262: wall street survivor • investing

- Page 263 and 264: wall street survivor • investing

- Page 265 and 266: wall street survivor • investing

- Page 267 and 268: wall street survivor • investing

- Page 269 and 270: wall street survivor • investing

- Page 271 and 272: wall street survivor • investing

- Page 273 and 274: wall street survivor • investing

- Page 275 and 276: wall street survivor • investing

- Page 277 and 278: wall Wall street Street survivor Su

- Page 279 and 280: wall street survivor • investing

- Page 281 and 282: wall street survivor • investing

- Page 283 and 284: wall street survivor • investing

- Page 285 and 286: wall street survivor • investing

- Page 287 and 288: wall street survivor • investing

- Page 289 and 290: wall street survivor • investing

- Page 291 and 292: wall street survivor •• investi

- Page 293 and 294: wall street survivor • investing

- Page 295 and 296: wall street survivor • investing

- Page 297 and 298: wall street survivor • investing

- Page 299 and 300: wall street survivor • investing

- Page 301 and 302: wall street survivor • investing

- Page 303 and 304: wall street survivor •• investi

- Page 305: wall street survivor • investing

- Page 309 and 310: wall street survivor • investing

- Page 311 and 312: wall street survivor • investing

- Page 313 and 314: wall street survivor • investing

- Page 315 and 316: wall street survivor •• investi

- Page 317 and 318: wall street survivor • investing

- Page 319 and 320: wall street survivor • investing

- Page 321 and 322: wall street survivor • investing

- Page 323 and 324: wall street survivor • investing

- Page 325 and 326: wall street survivor • investing

- Page 327 and 328: wall street survivor • investing

- Page 329 and 330: wall street survivor • investing

- Page 331 and 332: wall street survivor • investing

- Page 333 and 334: wall street survivor • investing

- Page 335 and 336: wall street survivor •• investi

- Page 337 and 338: wall street survivor • investing

- Page 339 and 340: wall street survivor • investing

- Page 341 and 342: wall street survivor • investing

- Page 343 and 344: wall street survivor • investing

- Page 345 and 346: wall street survivor • investing

- Page 347 and 348: wall street survivor • investing

- Page 349 and 350: wall street survivor • investing

- Page 351 and 352: wall street survivor • investing

- Page 353 and 354: wall street survivor • investing

- Page 355 and 356: wall street survivor • investing

- Page 357 and 358:

wall street survivor • investing

- Page 359 and 360:

wall street survivor • investing

- Page 361 and 362:

wall street survivor • investing

- Page 363 and 364:

wall street survivor •• investi

- Page 365 and 366:

wall street survivor • investing

- Page 367 and 368:

wall street survivor • investing

- Page 369 and 370:

wall street survivor • investing

- Page 371 and 372:

wall street survivor • investing

- Page 373 and 374:

wall street survivor • investing

- Page 375 and 376:

wall street survivor • investing

- Page 377 and 378:

wall street survivor • investing

- Page 379 and 380:

wall street survivor • investing

- Page 381 and 382:

wall street survivor • investing

- Page 383 and 384:

wall street survivor •• investi

- Page 385 and 386:

wall street survivor • investing

- Page 387 and 388:

wall street survivor • investing

- Page 389 and 390:

wall street survivor • investing

- Page 391 and 392:

wall street survivor • investing

- Page 393 and 394:

wall street survivor • investing

- Page 395 and 396:

wall street survivor • investing

- Page 397 and 398:

wall street survivor • investing

- Page 399 and 400:

wall street survivor • investing

- Page 401 and 402:

wall street survivor • investing

- Page 403 and 404:

wall street survivor • investing

- Page 405 and 406:

wall street survivor • investing

- Page 407 and 408:

wall street survivor • investing

- Page 409 and 410:

wall street survivor • investing

- Page 411 and 412:

wall street survivor • investing

- Page 413 and 414:

wall street survivor • investing

- Page 415 and 416:

wall street survivor • investing

- Page 417 and 418:

wall street survivor • investing

- Page 419 and 420:

wall street survivor • investing

- Page 421 and 422:

wall street survivor • investing

- Page 423 and 424:

wall street survivor • investing

- Page 425 and 426:

wall street survivor • investing

- Page 427 and 428:

wall street survivor • investing

- Page 429 and 430:

wall street survivor • investing

- Page 431 and 432:

wall street survivor • investing

- Page 433 and 434:

wall street survivor • investing

- Page 435 and 436:

wall street survivor • investing

- Page 437 and 438:

wall street survivor • investing

- Page 439 and 440:

wall street survivor • investing

- Page 441 and 442:

wall street survivor • investing

- Page 443 and 444:

wall street survivor • investing

- Page 445 and 446:

wall street survivor • investing

- Page 447 and 448:

wall street survivor • investing

- Page 449 and 450:

Wall Street Survivor 3500 de Maison

- Page 451 and 452:

Attachment C Analysis of Stock Mark

- Page 453 and 454:

TableofContents I.Acknowledgements

- Page 455 and 456:

I.Acknowledgements Iwouldliketoth

- Page 457 and 458:

III.ListofFigures Figure1:AppleInc.

- Page 459 and 460:

IV.ListofTables Table1:AAPLTransact

- Page 461 and 462:

1.Introduction 1.1Goals The main go

- Page 463 and 464:

suffered severe losses due to the e

- Page 465 and 466:

Because of its relative unpredictab

- Page 467 and 468:

2.4MutualFunds Mutual Funds are an

- Page 469 and 470:

3.2SwingTrading SwingTradingisthes

- Page 471 and 472:

een a leading maker of consumer ele

- Page 473 and 474:

4.2.3RaytheonCompany(NYSE:RTN) Ray

- Page 475 and 476:

Figure4:GoogleInc.(NASDAQ:GOOG)Year

- Page 477 and 478:

products have driven NVIDIA’s suc

- Page 479 and 480:

Figure8:AdvancedMicroDevices,Inc.(N

- Page 481 and 482:

soldmy100sharesofApplestocklateFrid

- Page 483 and 484:

Table3:GOOGTransactions(June17Jun

- Page 485 and 486:

Table4:INTC,NVDA,ERTS,YHOO,AMDTrans

- Page 487 and 488:

anetlossof$325.50beforewatchingthei

- Page 489 and 490:

Table8:AAPL,GOOG,MSFTTransactions(J

- Page 491 and 492:

Table10:NOVL,AAPLTransactions(July1

- Page 493 and 494:

4.4Simulation2:DayTrading 4.4.1Week

- Page 495 and 496:

Figure24:FordMotorCo.(NYSE:F)PriceC

- Page 497 and 498:

4.4.2Week2:June29-July3 , 2009 The

- Page 499 and 500:

myself to back out of any investmen

- Page 501 and 502:

share.Mypredictionofalate‐Fridayr

- Page 503 and 504:

Table21:INTC,GOOGTransactions(July1

- Page 505 and 506:

infelltothepointwhereIwouldloosemor

- Page 507 and 508:

events that caused the value of the

- Page 509 and 510:

8. 100 Best Companies to Work For 2

- Page 511 and 512:

06/23/09 F sell $5.59 8000 $44,710.

- Page 513 and 514:

07/09/09 MSFT sell $22.54 950 $21,4

- Page 515 and 516:

Advocacy Foundation Publishers Page

- Page 517 and 518:

Issue Title Quarterly Vol. I 2015 T

- Page 519 and 520:

Issue Title Quarterly Vol. V 2019 O

- Page 521 and 522:

LI Nonprofit Confidentiality In The

- Page 523 and 524:

Vol. XVIII 2032 Public Policy LXXVI

- Page 525 and 526:

Legal Missions International Page 2

- Page 527 and 528:

Vol. V 2019 XVII Russia Q-1 2019 XV

- Page 529 and 530:

The e-Advocate Newsletter Genesis o

- Page 531 and 532:

Extras The Nonprofit Advisors Group

- Page 533 and 534:

www.TheAdvocacyFoundation.org Page