Financial Information Act Return - BC Hydro

Financial Information Act Return - BC Hydro

Financial Information Act Return - BC Hydro

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

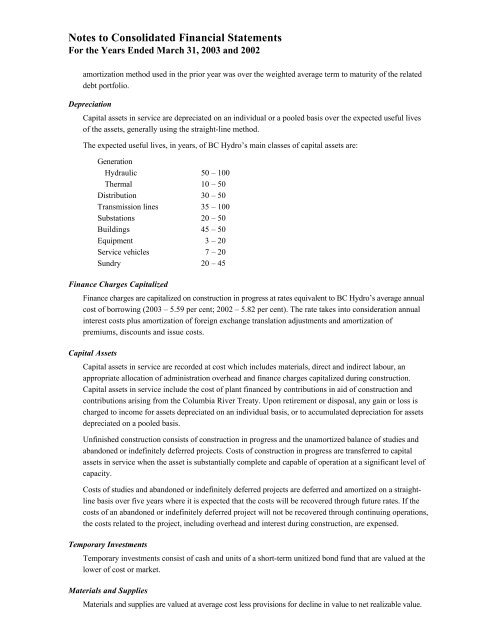

Notes to Consolidated <strong>Financial</strong> Statements<br />

For the Years Ended March 31, 2003 and 2002<br />

amortization method used in the prior year was over the weighted average term to maturity of the related<br />

debt portfolio.<br />

Depreciation<br />

Capital assets in service are depreciated on an individual or a pooled basis over the expected useful lives<br />

of the assets, generally using the straight-line method.<br />

The expected useful lives, in years, of <strong>BC</strong> <strong>Hydro</strong>’s main classes of capital assets are:<br />

Generation<br />

Hydraulic 50 – 100<br />

Thermal 10 – 50<br />

Distribution 30 – 50<br />

Transmission lines 35 – 100<br />

Substations 20 – 50<br />

Buildings 45 – 50<br />

Equipment 3 – 20<br />

Service vehicles 7 – 20<br />

Sundry 20 – 45<br />

Finance Charges Capitalized<br />

Finance charges are capitalized on construction in progress at rates equivalent to <strong>BC</strong> <strong>Hydro</strong>’s average annual<br />

cost of borrowing (2003 – 5.59 per cent; 2002 – 5.82 per cent). The rate takes into consideration annual<br />

interest costs plus amortization of foreign exchange translation adjustments and amortization of<br />

premiums, discounts and issue costs.<br />

Capital Assets<br />

Capital assets in service are recorded at cost which includes materials, direct and indirect labour, an<br />

appropriate allocation of administration overhead and finance charges capitalized during construction.<br />

Capital assets in service include the cost of plant financed by contributions in aid of construction and<br />

contributions arising from the Columbia River Treaty. Upon retirement or disposal, any gain or loss is<br />

charged to income for assets depreciated on an individual basis, or to accumulated depreciation for assets<br />

depreciated on a pooled basis.<br />

Unfinished construction consists of construction in progress and the unamortized balance of studies and<br />

abandoned or indefinitely deferred projects. Costs of construction in progress are transferred to capital<br />

assets in service when the asset is substantially complete and capable of operation at a significant level of<br />

capacity.<br />

Costs of studies and abandoned or indefinitely deferred projects are deferred and amortized on a straightline<br />

basis over five years where it is expected that the costs will be recovered through future rates. If the<br />

costs of an abandoned or indefinitely deferred project will not be recovered through continuing operations,<br />

the costs related to the project, including overhead and interest during construction, are expensed.<br />

Temporary Investments<br />

Temporary investments consist of cash and units of a short-term unitized bond fund that are valued at the<br />

lower of cost or market.<br />

Materials and Supplies<br />

Materials and supplies are valued at average cost less provisions for decline in value to net realizable value.