Financial Information Act Return - BC Hydro

Financial Information Act Return - BC Hydro

Financial Information Act Return - BC Hydro

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

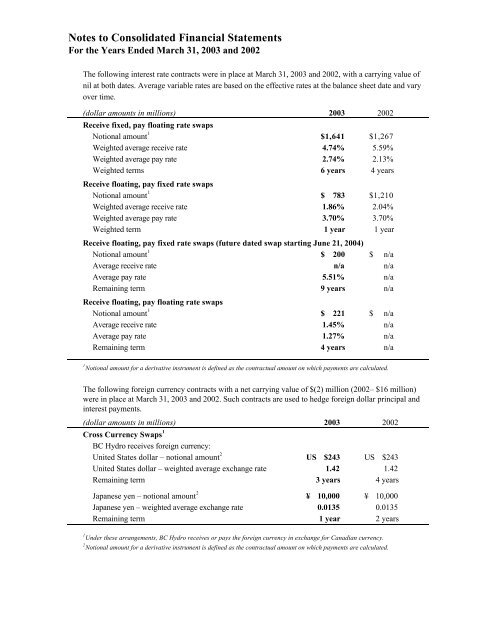

Notes to Consolidated <strong>Financial</strong> Statements<br />

For the Years Ended March 31, 2003 and 2002<br />

The following interest rate contracts were in place at March 31, 2003 and 2002, with a carrying value of<br />

nil at both dates. Average variable rates are based on the effective rates at the balance sheet date and vary<br />

over time.<br />

(dollar amounts in millions) 2003 2002<br />

Receive fixed, pay floating rate swaps<br />

Notional amount 1 $1,641 $1,267<br />

Weighted average receive rate 4.74% 5.59%<br />

Weighted average pay rate 2.74% 2.13%<br />

Weighted terms 6 years 4 years<br />

Receive floating, pay fixed rate swaps<br />

Notional amount 1 $ 783 $1,210<br />

Weighted average receive rate 1.86% 2.04%<br />

Weighted average pay rate 3.70% 3.70%<br />

Weighted term 1 year 1 year<br />

Receive floating, pay fixed rate swaps (future dated swap starting June 21, 2004)<br />

Notional amount 1 $ 200 $ n/a<br />

Average receive rate n/a n/a<br />

Average pay rate 5.51% n/a<br />

Remaining term 9 years n/a<br />

Receive floating, pay floating rate swaps<br />

Notional amount 1 $ 221 $ n/a<br />

Average receive rate 1.45% n/a<br />

Average pay rate 1.27% n/a<br />

Remaining term 4 years n/a<br />

1 Notional amount for a derivative instrument is defined as the contractual amount on which payments are calculated.<br />

The following foreign currency contracts with a net carrying value of $(2) million (2002– $16 million)<br />

were in place at March 31, 2003 and 2002. Such contracts are used to hedge foreign dollar principal and<br />

interest payments.<br />

(dollar amounts in millions) 2003 2002<br />

Cross Currency Swaps 1<br />

<strong>BC</strong> <strong>Hydro</strong> receives foreign currency:<br />

United States dollar – notional amount 2<br />

US $243 US $243<br />

United States dollar – weighted average exchange rate 1.42 1.42<br />

Remaining term 3 years 4 years<br />

Japanese yen – notional amount 2<br />

¥ 10,000 ¥ 10,000<br />

Japanese yen – weighted average exchange rate 0.0135 0.0135<br />

Remaining term 1 year 2 years<br />

1 Under these arrangements, <strong>BC</strong> <strong>Hydro</strong> receives or pays the foreign currency in exchange for Canadian currency.<br />

2 Notional amount for a derivative instrument is defined as the contractual amount on which payments are calculated.