Financial Information Act Return - BC Hydro

Financial Information Act Return - BC Hydro

Financial Information Act Return - BC Hydro

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

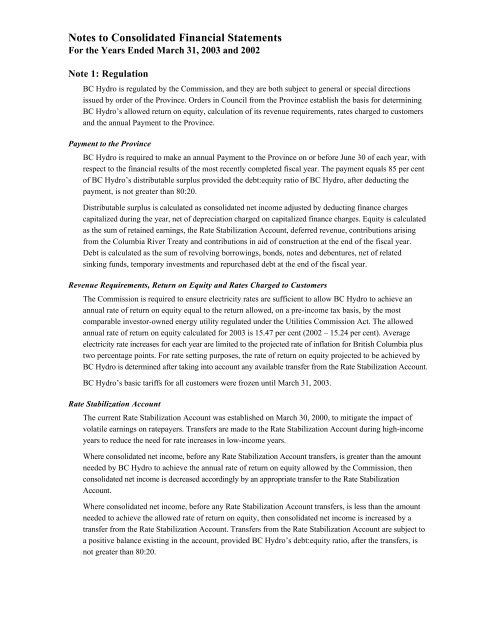

Notes to Consolidated <strong>Financial</strong> Statements<br />

For the Years Ended March 31, 2003 and 2002<br />

Note 1: Regulation<br />

<strong>BC</strong> <strong>Hydro</strong> is regulated by the Commission, and they are both subject to general or special directions<br />

issued by order of the Province. Orders in Council from the Province establish the basis for determining<br />

<strong>BC</strong> <strong>Hydro</strong>’s allowed return on equity, calculation of its revenue requirements, rates charged to customers<br />

and the annual Payment to the Province.<br />

Payment to the Province<br />

<strong>BC</strong> <strong>Hydro</strong> is required to make an annual Payment to the Province on or before June 30 of each year, with<br />

respect to the financial results of the most recently completed fiscal year. The payment equals 85 per cent<br />

of <strong>BC</strong> <strong>Hydro</strong>’s distributable surplus provided the debt:equity ratio of <strong>BC</strong> <strong>Hydro</strong>, after deducting the<br />

payment, is not greater than 80:20.<br />

Distributable surplus is calculated as consolidated net income adjusted by deducting finance charges<br />

capitalized during the year, net of depreciation charged on capitalized finance charges. Equity is calculated<br />

as the sum of retained earnings, the Rate Stabilization Account, deferred revenue, contributions arising<br />

from the Columbia River Treaty and contributions in aid of construction at the end of the fiscal year.<br />

Debt is calculated as the sum of revolving borrowings, bonds, notes and debentures, net of related<br />

sinking funds, temporary investments and repurchased debt at the end of the fiscal year.<br />

Revenue Requirements, <strong>Return</strong> on Equity and Rates Charged to Customers<br />

The Commission is required to ensure electricity rates are sufficient to allow <strong>BC</strong> <strong>Hydro</strong> to achieve an<br />

annual rate of return on equity equal to the return allowed, on a pre-income tax basis, by the most<br />

comparable investor-owned energy utility regulated under the Utilities Commission <strong>Act</strong>. The allowed<br />

annual rate of return on equity calculated for 2003 is 15.47 per cent (2002 – 15.24 per cent). Average<br />

electricity rate increases for each year are limited to the projected rate of inflation for British Columbia plus<br />

two percentage points. For rate setting purposes, the rate of return on equity projected to be achieved by<br />

<strong>BC</strong> <strong>Hydro</strong> is determined after taking into account any available transfer from the Rate Stabilization Account.<br />

<strong>BC</strong> <strong>Hydro</strong>’s basic tariffs for all customers were frozen until March 31, 2003.<br />

Rate Stabilization Account<br />

The current Rate Stabilization Account was established on March 30, 2000, to mitigate the impact of<br />

volatile earnings on ratepayers. Transfers are made to the Rate Stabilization Account during high-income<br />

years to reduce the need for rate increases in low-income years.<br />

Where consolidated net income, before any Rate Stabilization Account transfers, is greater than the amount<br />

needed by <strong>BC</strong> <strong>Hydro</strong> to achieve the annual rate of return on equity allowed by the Commission, then<br />

consolidated net income is decreased accordingly by an appropriate transfer to the Rate Stabilization<br />

Account.<br />

Where consolidated net income, before any Rate Stabilization Account transfers, is less than the amount<br />

needed to achieve the allowed rate of return on equity, then consolidated net income is increased by a<br />

transfer from the Rate Stabilization Account. Transfers from the Rate Stabilization Account are subject to<br />

a positive balance existing in the account, provided <strong>BC</strong> <strong>Hydro</strong>’s debt:equity ratio, after the transfers, is<br />

not greater than 80:20.