Financial Information Act Return - BC Hydro

Financial Information Act Return - BC Hydro

Financial Information Act Return - BC Hydro

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

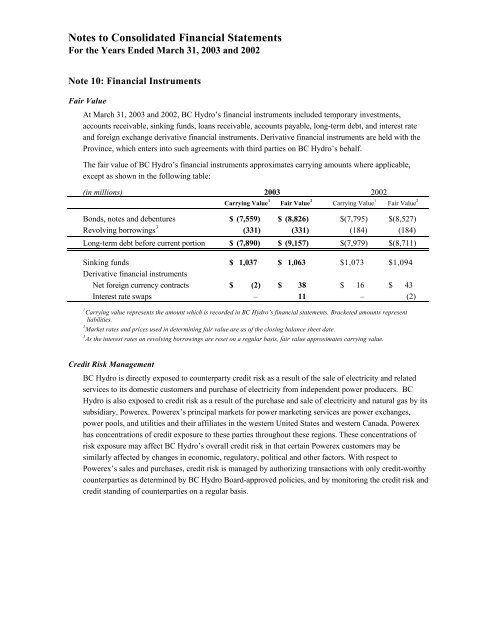

Notes to Consolidated <strong>Financial</strong> Statements<br />

For the Years Ended March 31, 2003 and 2002<br />

Note 10: <strong>Financial</strong> Instruments<br />

Fair Value<br />

At March 31, 2003 and 2002, <strong>BC</strong> <strong>Hydro</strong>’s financial instruments included temporary investments,<br />

accounts receivable, sinking funds, loans receivable, accounts payable, long-term debt, and interest rate<br />

and foreign exchange derivative financial instruments. Derivative financial instruments are held with the<br />

Province, which enters into such agreements with third parties on <strong>BC</strong> <strong>Hydro</strong>’s behalf.<br />

The fair value of <strong>BC</strong> <strong>Hydro</strong>’s financial instruments approximates carrying amounts where applicable,<br />

except as shown in the following table:<br />

(in millions) 2003 2002<br />

Carrying Value 1<br />

Fair Value 2<br />

Carrying Value 1<br />

Fair Value 2<br />

Bonds, notes and debentures $ (7,559) $ (8,826) $(7,795) $(8,527)<br />

Revolving borrowings 3<br />

(331) (331) (184) (184)<br />

Long-term debt before current portion $ (7,890) $ (9,157) $(7,979) $(8,711)<br />

Sinking funds $ 1,037 $ 1,063 $1,073 $1,094<br />

Derivative financial instruments<br />

Net foreign currency contracts $ (2) $ 38 $ 16 $ 43<br />

Interest rate swaps – 11 – (2)<br />

1<br />

Carrying value represents the amount which is recorded in <strong>BC</strong> <strong>Hydro</strong>’s financial statements. Bracketed amounts represent<br />

liabilities.<br />

2<br />

Market rates and prices used in determining fair value are as of the closing balance sheet date.<br />

3 As the interest rates on revolving borrowings are reset on a regular basis, fair value approximates carrying value.<br />

Credit Risk Management<br />

<strong>BC</strong> <strong>Hydro</strong> is directly exposed to counterparty credit risk as a result of the sale of electricity and related<br />

services to its domestic customers and purchase of electricity from independent power producers. <strong>BC</strong><br />

<strong>Hydro</strong> is also exposed to credit risk as a result of the purchase and sale of electricity and natural gas by its<br />

subsidiary, Powerex. Powerex’s principal markets for power marketing services are power exchanges,<br />

power pools, and utilities and their affiliates in the western United States and western Canada. Powerex<br />

has concentrations of credit exposure to these parties throughout these regions. These concentrations of<br />

risk exposure may affect <strong>BC</strong> <strong>Hydro</strong>’s overall credit risk in that certain Powerex customers may be<br />

similarly affected by changes in economic, regulatory, political and other factors. With respect to<br />

Powerex’s sales and purchases, credit risk is managed by authorizing transactions with only credit-worthy<br />

counterparties as determined by <strong>BC</strong> <strong>Hydro</strong> Board-approved policies, and by monitoring the credit risk and<br />

credit standing of counterparties on a regular basis.