Anthem Blue Cross Blue Shield PPO Plan - Teamworks at Home ...

Anthem Blue Cross Blue Shield PPO Plan - Teamworks at Home ...

Anthem Blue Cross Blue Shield PPO Plan - Teamworks at Home ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

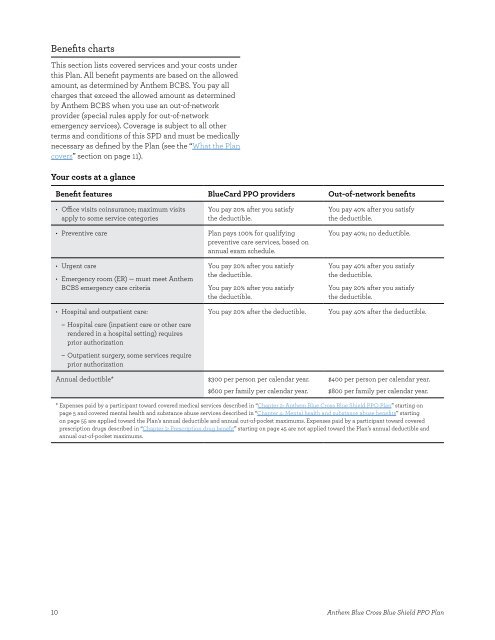

Benefts charts<br />

This section lists covered services and your costs under<br />

this <strong>Plan</strong>� All beneft payments are based on the allowed<br />

amount, as determined by <strong>Anthem</strong> BCBS� You pay all<br />

charges th<strong>at</strong> exceed the allowed amount as determined<br />

by <strong>Anthem</strong> BCBS when you use an out-of-network<br />

provider (special rules apply for out-of-network<br />

emergency services)� Coverage is subject to all other<br />

terms and conditions of this SPD and must be medically<br />

necessary as defned by the <strong>Plan</strong> (see the “Wh<strong>at</strong> the <strong>Plan</strong><br />

covers” section on page 11)�<br />

Your costs <strong>at</strong> a glance<br />

Beneft fe<strong>at</strong>ures <strong>Blue</strong>Card <strong>PPO</strong> providers Out-of-network benefts<br />

• Ofce visits coinsurance; maximum visits<br />

apply to some service c<strong>at</strong>egories<br />

You pay 20% after you s<strong>at</strong>isfy<br />

the deductible�<br />

• Preventive care <strong>Plan</strong> pays 100% for qualifying<br />

preventive care services, based on<br />

annual exam schedule�<br />

• Urgent care<br />

• Emergency room (ER) — must meet <strong>Anthem</strong><br />

BCBS emergency care criteria<br />

• Hospital and outp<strong>at</strong>ient care:<br />

– Hospital care (inp<strong>at</strong>ient care or other care<br />

rendered in a hospital setting) requires<br />

prior authoriz<strong>at</strong>ion<br />

– Outp<strong>at</strong>ient surgery, some services require<br />

prior authoriz<strong>at</strong>ion<br />

You pay 20% after you s<strong>at</strong>isfy<br />

the deductible�<br />

You pay 20% after you s<strong>at</strong>isfy<br />

the deductible�<br />

Annual deductible* $300 per person per calendar year�<br />

$600 per family per calendar year�<br />

10<br />

You pay 40% after you s<strong>at</strong>isfy<br />

the deductible�<br />

You pay 40%; no deductible�<br />

You pay 40% after you s<strong>at</strong>isfy<br />

the deductible�<br />

You pay 20% after you s<strong>at</strong>isfy<br />

the deductible�<br />

You pay 20% after the deductible� You pay 40% after the deductible�<br />

$400 per person per calendar year�<br />

$800 per family per calendar year�<br />

* Expenses paid by a participant toward covered medical services described in “Chapter 2: <strong>Anthem</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> <strong>Shield</strong> <strong>PPO</strong> <strong>Plan</strong>” starting on<br />

page 5 and covered mental health and substance abuse services described in “Chapter 4: Mental health and substance abuse benefts” starting<br />

on page 55 are applied toward the <strong>Plan</strong>’s annual deductible and annual out-of-pocket maximums� Expenses paid by a participant toward covered<br />

prescription drugs described in “Chapter 3: Prescription drug beneft” starting on page 45 are not applied toward the <strong>Plan</strong>’s annual deductible and<br />

annual out-of-pocket maximums�<br />

<strong>Anthem</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> <strong>Shield</strong> <strong>PPO</strong> <strong>Plan</strong>