Hong Kong's International Financial Centre: Retrospect and Prospect

Hong Kong's International Financial Centre: Retrospect and Prospect

Hong Kong's International Financial Centre: Retrospect and Prospect

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

______________________________________________________________________________<br />

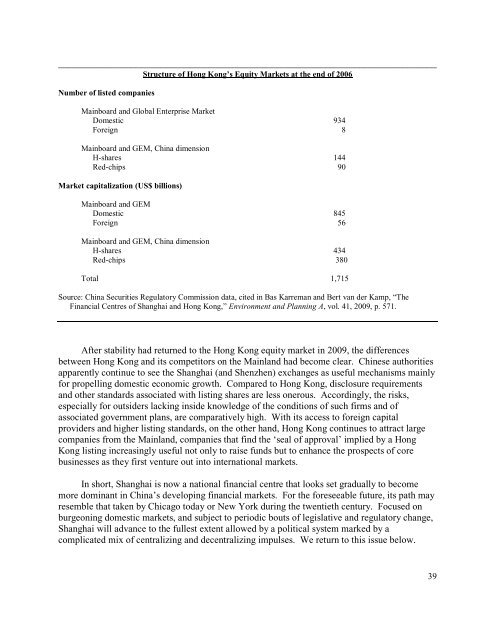

Structure of <strong>Hong</strong> Kong’s Equity Markets at the end of 2006<br />

Number of listed companies<br />

Mainboard <strong>and</strong> Global Enterprise Market<br />

Domestic 934<br />

Foreign 8<br />

Mainboard <strong>and</strong> GEM, China dimension<br />

H-shares 144<br />

Red-chips 90<br />

Market capitalization (US$ billions)<br />

Mainboard <strong>and</strong> GEM<br />

Domestic 845<br />

Foreign 56<br />

Mainboard <strong>and</strong> GEM, China dimension<br />

H-shares 434<br />

Red-chips 380<br />

Total 1,715<br />

Source: China Securities Regulatory Commission data, cited in Bas Karreman <strong>and</strong> Bert van der Kamp, “The<br />

<strong>Financial</strong> <strong>Centre</strong>s of Shanghai <strong>and</strong> <strong>Hong</strong> Kong,” Environment <strong>and</strong> Planning A, vol. 41, 2009, p. 571.<br />

After stability had returned to the <strong>Hong</strong> Kong equity market in 2009, the differences<br />

between <strong>Hong</strong> Kong <strong>and</strong> its competitors on the Mainl<strong>and</strong> had become clear. Chinese authorities<br />

apparently continue to see the Shanghai (<strong>and</strong> Shenzhen) exchanges as useful mechanisms mainly<br />

for propelling domestic economic growth. Compared to <strong>Hong</strong> Kong, disclosure requirements<br />

<strong>and</strong> other st<strong>and</strong>ards associated with listing shares are less onerous. Accordingly, the risks,<br />

especially for outsiders lacking inside knowledge of the conditions of such firms <strong>and</strong> of<br />

associated government plans, are comparatively high. With its access to foreign capital<br />

providers <strong>and</strong> higher listing st<strong>and</strong>ards, on the other h<strong>and</strong>, <strong>Hong</strong> Kong continues to attract large<br />

companies from the Mainl<strong>and</strong>, companies that find the ‘seal of approval’ implied by a <strong>Hong</strong><br />

Kong listing increasingly useful not only to raise funds but to enhance the prospects of core<br />

businesses as they first venture out into international markets.<br />

In short, Shanghai is now a national financial centre that looks set gradually to become<br />

more dominant in China’s developing financial markets. For the foreseeable future, its path may<br />

resemble that taken by Chicago today or New York during the twentieth century. Focused on<br />

burgeoning domestic markets, <strong>and</strong> subject to periodic bouts of legislative <strong>and</strong> regulatory change,<br />

Shanghai will advance to the fullest extent allowed by a political system marked by a<br />

complicated mix of centralizing <strong>and</strong> decentralizing impulses. We return to this issue below.<br />

39