Staatsolie Annual Report 2017

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> <strong>2017</strong> 29<br />

<strong>Report</strong> on the Audit of the Consolidated Financial Statements<br />

(Continued)<br />

Key audit matters<br />

(Continued)<br />

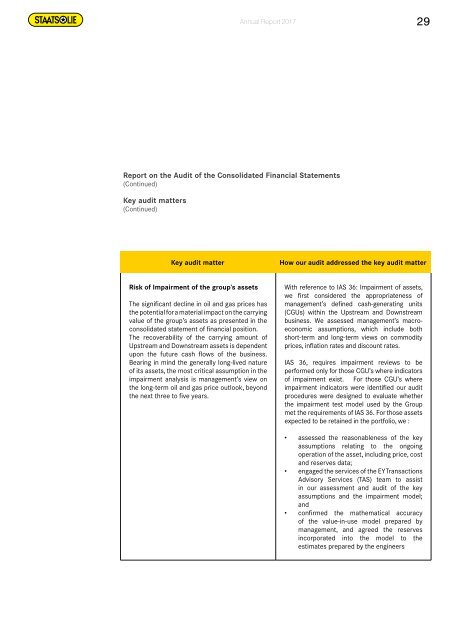

Key audit matter<br />

How our audit addressed the key audit matter<br />

Risk of Impairment of the group’s assets<br />

The significant decline in oil and gas prices has<br />

the potential for a material impact on the carrying<br />

value of the group’s assets as presented in the<br />

consolidated statement of financial position.<br />

The recoverability of the carrying amount of<br />

Upstream and Downstream assets is dependent<br />

upon the future cash flows of the business.<br />

Bearing in mind the generally long-lived nature<br />

of its assets, the most critical assumption in the<br />

impairment analysis is management’s view on<br />

the long-term oil and gas price outlook, beyond<br />

the next three to five years.<br />

With reference to IAS 36: Impairment of assets,<br />

we first considered the appropriateness of<br />

management’s defined cash-generating units<br />

(CGUs) within the Upstream and Downstream<br />

business. We assessed management’s macroeconomic<br />

assumptions, which include both<br />

short-term and long-term views on commodity<br />

prices, inflation rates and discount rates.<br />

IAS 36, requires impairment reviews to be<br />

performed only for those CGU’s where indicators<br />

of impairment exist. For those CGU’s where<br />

impairment indicators were identified our audit<br />

procedures were designed to evaluate whether<br />

the impairment test model used by the Group<br />

met the requirements of IAS 36. For those assets<br />

expected to be retained in the portfolio, we :<br />

• assessed the reasonableness of the key<br />

assumptions relating to the ongoing<br />

operation of the asset, including price, cost<br />

and reserves data;<br />

• engaged the services of the EY Transactions<br />

Advisory Services (TAS) team to assist<br />

in our assessment and audit of the key<br />

assumptions and the impairment model;<br />

and<br />

• confirmed the mathematical accuracy<br />

of the value-in-use model prepared by<br />

management, and agreed the reserves<br />

incorporated into the model to the<br />

estimates prepared by the engineers