Historic Omaha

An illustrated history of Omaha and the Douglas County area, paired with the histories of companies, families and organizations that make the region great.

An illustrated history of Omaha and the Douglas County area, paired with the histories of companies, families and organizations that make the region great.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

It was July 17, 1916, when President<br />

Woodrow Wilson appended his signature on a<br />

piece of legislation that would open the gates<br />

to an agricultural revolution. That document<br />

he signed would later become known as the<br />

Federal Farm Loan Act.<br />

Established at a time when credit for<br />

agriculture was difficult to come by in the<br />

existing banking community, the new<br />

legislation heralded the beginning of financial<br />

independence for farmers and ranchers and<br />

created what is known today as the Farm<br />

Credit System.<br />

Within that System, Farm Credit Services<br />

of America, known then as the Federal Land<br />

Bank of <strong>Omaha</strong>, was formed to provide<br />

farmers and ranchers long-term mortgage<br />

loans. Sixty thousand applications and<br />

inquiries awaited the company on its opening<br />

day, March 18, 1917. The first loan of $1,000<br />

was made for the purchase of 160 acres in Red<br />

Willow County. Five years later, over fifteen<br />

thousand loans totaling nearly $75 million<br />

had been made.<br />

In the decades to come, capital<br />

became essential to survive in rural<br />

America. By deferring and extending loan<br />

payments and with the help of federal<br />

funds, which were repaid in full in 1953,<br />

Farm Credit Services of America made it<br />

possible for thousands of hard-pressed<br />

farmers and ranchers to survive the Great<br />

Depression and prevail with better<br />

financial health. With newly available<br />

operating and equipment loans, financial<br />

freedom and prosperity took hold.<br />

By the 1950s, sophistication and<br />

modernization was fueling economic<br />

growth. Although the costs of farming<br />

continued to mount, borrowers began<br />

seeking larger loans for more land and<br />

new machinery. Farm Credit Services of<br />

America kept pace by making loans at a<br />

rate, which topped that of the troubled<br />

’30s. The company also expanded its<br />

services to include rural home mortgages<br />

and variable interest rate programs<br />

helping farmers and ranchers expand<br />

well into the ’70s.<br />

By the mid-1980s, rising inflation and<br />

collapsing farmland values forced<br />

American agriculture into a four year long<br />

recession. As a result, Farm Credit Services of<br />

America, along with commercial banks and<br />

producers, experienced severe financial stress.<br />

Through financial assistance, which was<br />

repaid in 1992, and changes in legislation, the<br />

company began its recovery in 1988 and set<br />

in motion a commitment to help distressed<br />

customers pull through the recession. The<br />

company returned to its strong financial<br />

health—a trend that continues today.<br />

The late 1990s sparked a chain of process<br />

enhancements, changed lending philosophies,<br />

new product introductions, a new market<br />

delivery structure, and technology<br />

improvements. Beginning the turn of the<br />

century, with assets exceeding $6.4 billion and<br />

serving nearly fifty thousand customers, Farm<br />

Credit Services of America has become one of<br />

the largest providers of credit and insurance<br />

services to farmers, ranchers, agribusinesses<br />

and rural residents in Nebraska, Iowa, South<br />

Dakota and Wyoming.<br />

FARM CREDIT<br />

SERVICES OF<br />

AMERICA<br />

✧<br />

Above: The corporate seal of the Federal<br />

Land Bank of <strong>Omaha</strong>, predecessor of today’s<br />

Farm Credit Services of America.<br />

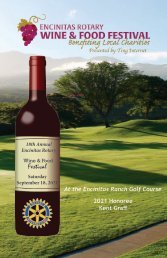

Below: Farm Credit Services of America<br />

headquarters in <strong>Omaha</strong> in the<br />

mid-twentieth century.<br />

THE MARKETPLACE<br />

163