Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Continued from Page 10<br />

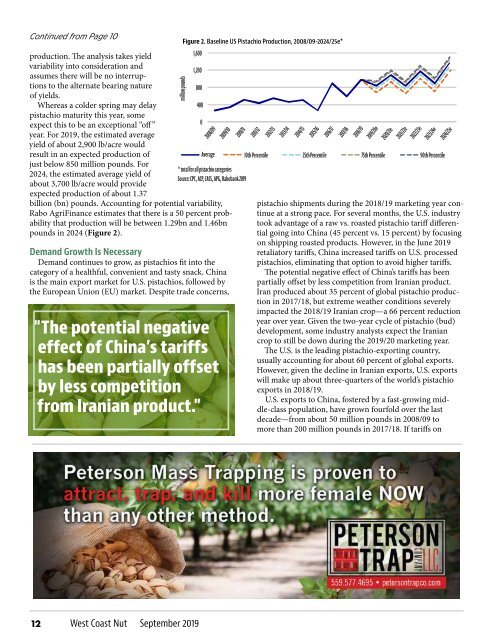

production. The analysis takes yield<br />

variability into consideration and<br />

assumes there will be no interruptions<br />

to the alternate bearing nature<br />

of yields.<br />

Whereas a colder spring may delay<br />

pistachio maturity this year, some<br />

expect this to be an exceptional “off ”<br />

year. For <strong>2019</strong>, the estimated average<br />

yield of about 2,900 lb/acre would<br />

result in an expected production of<br />

just below 850 million pounds. For<br />

2024, the estimated average yield of<br />

about 3,700 lb/acre would provide<br />

expected production of about 1.37<br />

billion (bn) pounds. Accounting for potential variability,<br />

Rabo AgriFinance estimates that there is a 50 percent probability<br />

that production will be between 1.29bn and 1.46bn<br />

pounds in 2024 (Figure 2).<br />

Demand Growth Is Necessary<br />

Demand continues to grow, as pistachios fit into the<br />

category of a healthful, convenient and tasty snack. China<br />

is the main export market for U.S. pistachios, followed by<br />

the European Union (EU) market. Despite trade concerns,<br />

million pounds<br />

1,600<br />

1,200<br />

800<br />

400<br />

0<br />

2008/09<br />

2009/10<br />

2010/11<br />

2011/12<br />

2012/13<br />

2013/14<br />

2014/15<br />

2015/16<br />

2016/17<br />

2017/18<br />

2018/19<br />

<strong>2019</strong>/20e<br />

2020/21e<br />

2021/22e<br />

2022/23e<br />

2023/24e<br />

Average 10th Percentile 25th Percentile 75th Percentile 90th Percentile<br />

* total for all pistachio categories<br />

Source: CPC, ACP, CASS, APG, Rabobank <strong>2019</strong><br />

"The potential negative<br />

effect of China’s tariffs<br />

has been partially offset<br />

by less competition<br />

from Iranian product."<br />

Figure 2. Baseline US Pistachio Production, 2008/09-2024/25e*<br />

pistachio shipments during the 2018/19 marketing year continue<br />

at a strong pace. For several months, the U.S. industry<br />

took advantage of a raw vs. roasted pistachio tariff differential<br />

going into China (45 percent vs. 15 percent) by focusing<br />

on shipping roasted products. However, in the June <strong>2019</strong><br />

retaliatory tariffs, China increased tariffs on U.S. processed<br />

pistachios, eliminating that option to avoid higher tariffs.<br />

The potential negative effect of China’s tariffs has been<br />

partially offset by less competition from Iranian product.<br />

Iran produced about 35 percent of global pistachio production<br />

in 2017/18, but extreme weather conditions severely<br />

impacted the 2018/19 Iranian crop—a 66 percent reduction<br />

year over year. Given the two-year cycle of pistachio (bud)<br />

development, some industry analysts expect the Iranian<br />

crop to still be down during the <strong>2019</strong>/20 marketing year.<br />

The U.S. is the leading pistachio-exporting country,<br />

usually accounting for about 60 percent of global exports.<br />

However, given the decline in Iranian exports, U.S. exports<br />

will make up about three-quarters of the world’s pistachio<br />

exports in 2018/19.<br />

U.S. exports to China, fostered by a fast-growing middle-class<br />

population, have grown fourfold over the last<br />

decade—from about 50 million pounds in 2008/09 to<br />

more than 200 million pounds in 2017/18. If tariffs on<br />

2024/25e<br />

12<br />

<strong>West</strong> <strong>Coast</strong> <strong>Nut</strong> <strong>September</strong> <strong>2019</strong>