2018 Startup GUIDE - 10th Edition

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COVER STORIES 43<br />

SVC Ltd. for Risk Capital for SMEs<br />

Investing in Swiss Entrepreneurship<br />

The presenting partner of the <strong>2018</strong> Swiss <strong>Startup</strong> Days, founded<br />

in collaboration with the Swiss Venture Club as a wholly owned<br />

subsidiary of Credit Suisse (Switzerland) Ltd., provides venture<br />

capital to small and medium-sized enterprises as well as young<br />

entrepreneurs and start-up companies.<br />

For this purpose, SVC Ltd. for Risk Capital for SMEs (SVC Ltd.) is<br />

providing a total of CHF 130 million in private capital – with CHF<br />

30 million earmarked for fintech companies. Furthermore, it also<br />

supports its investments with advice and expertise from a comprehensive<br />

network of partners.<br />

LONG-TERM INVESTMENTS<br />

SVC Ltd. facilitates the development of SMEs in various stages<br />

of their life cycle in a quick and straightforward manner. In doing<br />

so, it also seeks to make a contribution to competitive advantage<br />

in Switzerland. In terms of its investments, SVC Ltd.’s main<br />

focus is on long-term financial impact. This also applies to SVC<br />

Ltd. itself: Set-up as an evergreen structure, the profits generated<br />

from investments in line with the respective sector’s standard<br />

conditions are not required to be distributed back to Credit Suisse,<br />

but can immediately be plowed back into the investment cycle<br />

and thus once more become available as financial resources<br />

for Swiss SMEs.<br />

Now in its eighth year of operation, given its investment focus<br />

both on established SMEs and early-stage investments within<br />

medtech, automation/robotics, and fintech, SVC Ltd. is able to<br />

achieve positive returns on its investments and thus continue to<br />

grow its investment capital. Due to the status of the investment<br />

portfolio, SVC Ltd. made some successful divestments both in<br />

2017 and the first half of <strong>2018</strong>, and was able to make a positive<br />

contribution to its perpetual investment model.<br />

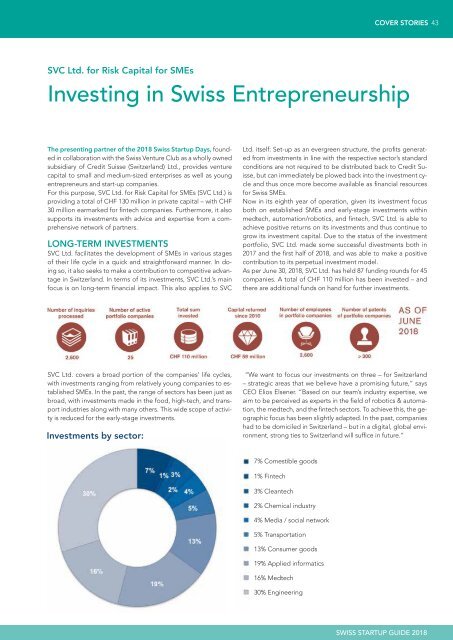

As per June 30, <strong>2018</strong>, SVC Ltd. has held 87 funding rounds for 45<br />

companies. A total of CHF 110 million has been invested – and<br />

there are additional funds on hand for further investments.<br />

SVC Ltd. covers a broad portion of the companies’ life cycles,<br />

with investments ranging from relatively young companies to established<br />

SMEs. In the past, the range of sectors has been just as<br />

broad, with investments made in the food, high-tech, and transport<br />

industries along with many others. This wide scope of activity<br />

is reduced for the early-stage investments.<br />

Investments by sector:<br />

“We want to focus our investments on three – for Switzerland<br />

– strategic areas that we believe have a promising future,” says<br />

CEO Elios Elsener. “Based on our team’s industry expertise, we<br />

aim to be perceived as experts in the field of robotics & automation,<br />

the medtech, and the fintech sectors. To achieve this, the geographic<br />

focus has been slightly adapted. In the past, companies<br />

had to be domiciled in Switzerland – but in a digital, global environment,<br />

strong ties to Switzerland will suffice in future.”<br />

7% Comestible goods<br />

1% Fintech<br />

3% Cleantech<br />

2% Chemical industry<br />

4% Media / social network<br />

5% Transportation<br />

13% Consumer goods<br />

19% Applied informatics<br />

16% Medtech<br />

30% Engineering<br />

SWISS STARTUP <strong>GUIDE</strong> <strong>2018</strong>