Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PROFESSIONAL MAGAZINE FOR MANUFACTURERS OF KITCHENS, CABINET, OFFICE AND SEATING FURNITURE AND FOR INTERIOR FITTERS AND DESIGNERS · WWW.MATERIAL-TECHNIK.DE · 30835<br />

The magazine for furniture production and related fields<br />

<strong>special</strong> <strong>01</strong>|19<br />

Quality Inside

Round-the-clock<br />

promotion!<br />

On the 2020 trade fair wall<br />

calendar from material+technik<br />

möbel your company is 24 hours<br />

a day and 365 days a year in the focus<br />

of your clients!<br />

The calendar is an optimal planning tool<br />

as important worldwide furniture and<br />

supplier shows are shown with dates and<br />

day sequences so that possible overlapping<br />

of the fair dates can be easily seen.<br />

9,500 copies are printed, 8,500 of<br />

them will be inserted in the 07|2<strong>01</strong>9 issue<br />

of material+technik möbel.<br />

Be part of this fantastic promotion<br />

tool and book your ad on<br />

the wall calendar 2020 by<br />

November 22, 2<strong>01</strong>9!<br />

For more information about placement options for ads, please contact:<br />

Birgit Kunze, phone: +49 (0) 911 95578-84, e-mail: kunze@ritthammer-verlag.de

Quality Inside<br />

Scoring points with the right<br />

products in Europe<br />

Richard Barth, Editor-in-chief.<br />

Photo: Richter<br />

Globalisation and digitialization have led to a widening<br />

of global trade flows. Today, furniture and<br />

other furnishings are sold even in the remotest<br />

regions of the world. In order to operate successfully<br />

in the target markets, the furniture<br />

manufacturer must not only be able to offer a<br />

competitive product, but also be well informed<br />

about the sales market.<br />

Based on more than 40 years of experience in<br />

the furniture industry, the German supplier magazine<br />

material+technik möbel publishes the<br />

<strong>special</strong> “Quality Inside – made in Europe” every<br />

year. The trade magazine is a useful export guide<br />

for producers of furnishings in all regions of the<br />

world, providing a key to Western European<br />

markets.<br />

On the following pages, “Quality Inside – made<br />

in Europe” provides up-to-the-minute and indepth<br />

information about the furnishing market in<br />

Europe. Data and forecasts on the economic development<br />

are published in English and the<br />

latest material and colour trends in the furnishing<br />

segment are shown. In addition, machine<br />

technologies for small and large companies are<br />

presented that enable automated and efficient<br />

production of home and upholstered furniture.<br />

In combination with high-quality surfaces and<br />

fittings from Western Europe, furnishings can<br />

be produced that meet the growing demands of<br />

European consumers for quality and indivi duality.<br />

Supplied products “made in Europe” are internationally<br />

regarded as products of first choice,<br />

as European manufacturers reproduce woods,<br />

stones and metals in a highly authentic manner<br />

and equip fittings with sophisticated functions.<br />

In May, the more than 74,000 international visitors<br />

to the German supplier fair interzum, which<br />

is regarded as the world’s leading trade fair in<br />

this field and only takes place every two years,<br />

were able to see for themselves. With their qualitative<br />

features, the supplier products make a<br />

decisive contribution to enhancing the value of<br />

furnishings and offer consumers added value<br />

that can be used to trigger purchasing impulses.<br />

Content<br />

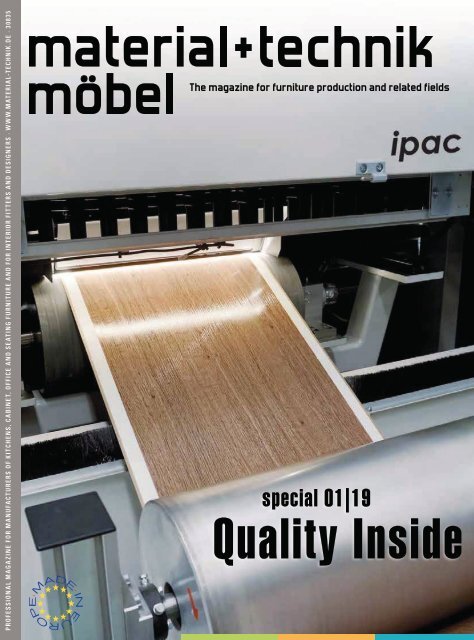

Title: With the Inline Colour Measurement<br />

System (ICMS) from IPAC an inline tool is<br />

available for the first time, which allows an<br />

objective evaluation of multi-coloured surfaces<br />

and which is used since some months<br />

in the production of digitally printed plastic<br />

edge bandings. <br />

Photo: Ipac<br />

Editorial 3<br />

External factors unsettle the European economy 4–7<br />

Germany and Italy remain main production countries 8–9<br />

Individualisation through material mix 10–12<br />

Competence in adhesives and coatings 13<br />

Authentic surfaces and “invisible” fittings 14–16<br />

Customized drawers 17<br />

New, durable wrapping foil qualities 17<br />

Surface <strong>special</strong>ists are repositioning themselves 18–19<br />

Technologies for businesses both big and small 20–21<br />

First inline colour measurement in operation 22–23<br />

Automation and high-tech materials for the upholstered furniture industry 24–25<br />

European fair calendar 26<br />

MoOD becomes Decosit once more 26<br />

Proposte with a new date 26<br />

Partners to the furniture industry 27<br />

Index of advertisers 27<br />

Imprint 27<br />

material+technik möbel – <strong>special</strong> <strong>01</strong>|19 3

Quality Inside<br />

External factors<br />

unsettle the<br />

European economy<br />

Over summer, the tide has turned in Europe. After an encouraging<br />

economic development in the previous year, the first<br />

months of 2<strong>01</strong>9 saw the first storm clouds gathering. Meanwhile,<br />

external factors overshadow further growth in the<br />

European Union and visibly dampen the mood in industry.<br />

When the European Union (EU)<br />

was founded in 1961, there were<br />

only six countries involved. Since<br />

Croatia joined in 2<strong>01</strong>3, a total of 28<br />

states now belong to this economic<br />

community, however only 19<br />

have the Euro as their official currency.<br />

The Euro is used each day by<br />

around 341 million people and is<br />

thus the second most frequently<br />

used currency in the world. EU<br />

member states such as the United<br />

Kingdom and Denmark have retained<br />

their own currency, however.<br />

The remaining seven countries<br />

will take on the Euro as soon as the<br />

required prerequisites are fulfilled.<br />

4 material+technik möbel – <strong>special</strong> <strong>01</strong>|19<br />

External factors<br />

The most important driver of<br />

growth in the European Union (EU)<br />

in 2<strong>01</strong>9 is domestic demand and<br />

here in particular, private household<br />

consumption. However, for<br />

some time, the mood has been<br />

characterised by uncertainty. On<br />

top of the unclear situation in the<br />

United Kingdom, where the idea of<br />

Brexit (the withdrawal of the state<br />

from the EU) is still being fought<br />

over, there was also a governmental<br />

crisis in Italy in August. There,<br />

the Prime Minister resigned in the<br />

middle of August so that there will<br />

either be a new government<br />

formed or new elections in autumn<br />

at the latest. At the editorial deadline,<br />

it looked like a new government<br />

could form. However, based<br />

on the unclear political situation,<br />

economic experts expect purchasing<br />

restraint by consumers and<br />

negative effects on private consumption.<br />

The Ifo-Institut (Germany) also see<br />

this occurring in the event of a hard<br />

Brexit, meaning without a trade<br />

agreement. According to a study by<br />

the economic research institute,<br />

this would result in the level of<br />

prosperity falling, to the greatest<br />

extent in Ireland by 8.16 per cent.<br />

For the United Kingdom, the institute<br />

calculated a reduction of 2.76<br />

per cent. The real earnings in Germany<br />

would fall by 0.72 per cent<br />

and in France by 0.52 per cent. In<br />

the smaller EU states, the reductions<br />

would be between 0.35 and<br />

1.64 per cent. The institute views<br />

the effects on the rest of the world<br />

as rather low.<br />

The uncertainty over the political<br />

development in the United Kingdom<br />

and in Italy could also influence<br />

the economic development in<br />

the whole of Europe. The trade dispute<br />

between the USA and China<br />

as well as between the USA and<br />

the EU is also causing headaches<br />

for companies in western Europe.<br />

They fear that America’s punitive<br />

tariffs and the Chinese countermeasures<br />

will make exports into<br />

this country more difficult over the<br />

next while.<br />

For the reasons mentioned above,<br />

over recent months, the leading<br />

economic institutes have scaled<br />

back their forecasts of economic<br />

development in the European Union<br />

over the last few months. In<br />

Germany, a significant slowing<br />

down of the economic development<br />

was recorded in the middle of<br />

the year, meaning that in summer,<br />

the economic forecasts were adjusted<br />

downwards for a second<br />

time.<br />

In their summer forecast for 2<strong>01</strong>9<br />

across the whole EU (28 states),<br />

the European Commission only ex-

Quality Inside<br />

Various negative factors<br />

overshadow the economic<br />

development of the EU.<br />

Photo: Fotolia.com/<br />

ViennaFrame<br />

pected a growth of 1.4 per cent, in<br />

the Eurozone (19 member states<br />

with the Euro as their official currency)<br />

even only as much as 1.2 per<br />

cent. For 2020, the expectations<br />

had even lowered when compared<br />

to earlier forecasts and are only 1.4<br />

per cent for the Eurozone and 1.6<br />

per cent for the whole European<br />

Union. The low oil prices and the<br />

weaker economic prospects mean<br />

that the experts are also predicting<br />

lower inflation which should be at<br />

1.3 per cent in the Eurozone in 2<strong>01</strong>9<br />

and 2020, and at 1.5 to 1.6 per cent<br />

in the whole EU.<br />

Positive development in<br />

housing construction<br />

The development of housing construction<br />

plays an important role for<br />

the furniture sector. Moving into a<br />

new flat or home usually goes<br />

hand-in-hand with the purchase of<br />

new furniture. The connection between<br />

housing construction and<br />

the purchase of furniture is e<strong>special</strong>ly<br />

high in the kitchen area, as,<br />

unlike living furniture, the previous<br />

kitchen furnishings usually do not<br />

fit into the new space.<br />

In the whole of the EU, housing<br />

construction has experienced a<br />

very positive development over recent<br />

years. The European research<br />

and consulting network Euroconstruct<br />

expects the number of completed<br />

homes to increase by one<br />

quarter to 1.77 million units in the<br />

period between 2<strong>01</strong>7 and 2020. In<br />

2<strong>01</strong>9, the growth should amount to<br />

3.3 per cent and a new record high<br />

should be achieved with 1.774 million<br />

completions. 1.773 million<br />

units are forecast for 2020. At the<br />

same time, Euroconstruct notes<br />

significant differences in the<br />

growth dynamics in individual<br />

countries, which relate to statespecific<br />

support measures. Since<br />

1974, Euroconstruct has regularly<br />

been observing and analysing the<br />

Of the 28 member<br />

states of the EU,<br />

19 belong to the<br />

so-called Eurozone and<br />

use the Euro as their<br />

official currency.<br />

Photo: Fotolia.com/<br />

petri<br />

construction sector development<br />

in 15 western European countries<br />

and four eastern European countries.<br />

In the following, we will present<br />

the economic development and<br />

forecasts of leading economic institutes<br />

for selected member<br />

states and regions in western Europe.<br />

The individual states contribute<br />

to a greater or lesser extent<br />

to the economic performance<br />

of the European Union,<br />

based on their size, population<br />

and economic potential. With a<br />

proportion of over 21 per cent,<br />

Germany is the country with the<br />

greatest economic performance<br />

in the community, followed by<br />

the United Kingdom, France, Italy<br />

and Spain.<br />

Germany: In Germany, the biggest<br />

economic power in the EU, the dynamics<br />

in the economy have<br />

slowed down in summer 2<strong>01</strong>9. In<br />

the second quarter, the gross domestic<br />

product (GDP) even dropped<br />

slightly compared to the previous<br />

year. Compared to the same period<br />

of the previous year, the GDP has<br />

stagnated in the first six months.<br />

Accordingly, the leading economic<br />

institutes have lowered their forecasts<br />

once more. At the beginning<br />

of the year, they had already scaled<br />

back their forecasts from 1.8 per<br />

cent to 1 per cent.<br />

The IfW Kiel (Institute for the World<br />

Economy) expects a GDP growth<br />

of 0.6 per cent for 2<strong>01</strong>9. The federal<br />

government expects 0.5 per cent.<br />

In 2<strong>01</strong>8, the German economy<br />

grew by 1.5 per cent. The forecasts<br />

for 2020 are more optimistic,<br />

where the economic experts of the<br />

IfW expect a growth of 1.6 per cent.<br />

The IMF (International Monetary<br />

Fund) even forecast 1.7 per cent<br />

growth. The economic experts give<br />

the reason for this as the increasing<br />

private consumption in Germany<br />

and the continuing low unemployment<br />

rate of 3 per cent. The moderate<br />

increase in consumer prices<br />

should also have a positive effect.<br />

These are supposed to have increased<br />

by only 1.4 and 1.5 per cent<br />

in 2<strong>01</strong>9. In 2<strong>01</strong>8, they increased by<br />

1.9 per cent.<br />

Over the course of the year, however,<br />

there emerged a reduction in<br />

readiness to invest in new homes.<br />

According to statements from the<br />

statistics authority Destatis, the<br />

material+technik möbel – <strong>special</strong> <strong>01</strong>|19 5

Quality Inside<br />

Photo: European Parliament<br />

number of building approvals in<br />

Germany in the first half of 2<strong>01</strong>9<br />

dropped by 2.3 per cent compared<br />

to the period in the previous year.<br />

The construction of only 164,600<br />

homes was approved. Building approvals<br />

for two-family dwellings<br />

(-4.7%) and multiple-family dwellings<br />

(-3.2%) were affected above<br />

all. The number of building approvals<br />

for single-family dwellings remained<br />

close to the number for the<br />

previous year, according to the German<br />

statistics authority. Based on<br />

the reduction in approvals, experts<br />

predict a further reduction in housing<br />

construction activities. In the<br />

overall year 2<strong>01</strong>8, the construction<br />

of 347,000 homes was approved,<br />

which was a slight reduction of 0.3<br />

per cent compared to 2<strong>01</strong>7. At the<br />

same time, a total of 285,914<br />

homes were completed in the reporting<br />

year, which is a slight increase<br />

of 0.4 per cent compared to<br />

the previous year. In 2<strong>01</strong>8, the construction<br />

of homes in multiple-family<br />

dwellings increased (+9.2%),<br />

while the completion of homes in<br />

single-family dwellings decreased<br />

by 3.7 per cent.<br />

France: As the third most important<br />

national economy in the European<br />

Union, France was able to increase<br />

its GDP in 2<strong>01</strong>8 by 1.7 per<br />

cent, and the experts are predicting<br />

6 material+technik möbel – <strong>special</strong> <strong>01</strong>|19<br />

a further growth of 1.4 per cent for<br />

2<strong>01</strong>9. The forecasts for economic<br />

growth in 2020 are just as high. The<br />

positive economic development<br />

will also further reduce the unemployment<br />

rate, which was still at<br />

9.1 per cent in 2<strong>01</strong>8. A reduction to<br />

8.3 per cent is predicted by 2020. A<br />

reduction in consumer prices of 2.1<br />

per cent in 2<strong>01</strong>8 to 1.4 per cent in<br />

2020 could also encourage French<br />

consumption. In France, housing<br />

construction is also continuing to<br />

develop positively. According to<br />

statements from Euroconstruct,<br />

the number of completions in 2<strong>01</strong>8<br />

rose to 400,000 homes, an increase<br />

of almost 7 per cent. In 2<strong>01</strong>9<br />

it is expected to become 417,000<br />

before the number of completions<br />

is then supposed to decline to<br />

408,000 in 2020.<br />

Benelux (Belgium, the Netherlands):<br />

In both Benelux states, the<br />

economic dynamics are slowing.<br />

Above all, this can be seen in the<br />

Netherlands, where the GDP<br />

should only increase by 1.8 per cent<br />

this year and in the coming year. In<br />

2<strong>01</strong>8, the growth amounted to 2.6<br />

per cent. In Belgium, IfW Kiel expects<br />

a stable economic development.<br />

After 1.4 per cent growth in<br />

2<strong>01</strong>8, the current and following<br />

years are expected to see a growth<br />

of 1.4 and 1.3 per cent respectively.<br />

The consumer prices are expected<br />

to grow by 1.8 per cent, while in the<br />

Netherlands, they are expected to<br />

grow by 2.3 per cent in 2<strong>01</strong>9. In<br />

2020, the upward trend of prices<br />

will supposedly reduce to around<br />

1.8 per cent. A consistent or slightly<br />

declining rate of unemployment<br />

may encourage private consumption.<br />

The Euroconstruct experts view<br />

the housing construction activity as<br />

positive in the Netherlands. Here,<br />

the construction of 68,000 homes<br />

in 2<strong>01</strong>9 and 74,000 homes in 2020<br />

is expected. This would be a clear<br />

increase compared to 2<strong>01</strong>6, when<br />

the number of completed homes<br />

was just under 55,000. With Euroconstruct<br />

anticipating a decline in<br />

completions to just under 48,000<br />

units, the forecasts for Belgium are<br />

just the contrary. However, in 2<strong>01</strong>9,<br />

a significantly higher number of<br />

homes is expected to be built than<br />

in the previous years. In contrast to<br />

2<strong>01</strong>6, the number of completions is<br />

9.5 per cent higher.<br />

United Kingdom: The United Kingdom<br />

contribute around 15.1 per<br />

cent to the economic performance<br />

in the EU and are thus the second<br />

greatest economic power in the<br />

Union. Officially, the United Kingdom<br />

want to withdraw from the EU<br />

on 31 October after several postponements,<br />

and thus carry out the<br />

long-planned Brexit. At the editorial<br />

deadline, it was unclear whether<br />

there would be no deal, or whether<br />

the state would enter into a trade<br />

agreement with the European Union.<br />

In any case, experts anticipate<br />

economic consequences for the<br />

United Kingdom, but also for the<br />

European states. At the same time,<br />

the state is split by the discussion<br />

as, for example, the majority of<br />

Scots are in favour of remaining in<br />

the EU and are now demanding<br />

their country’s independence.<br />

Problematic here is the situation for<br />

Ireland, which will remain in the<br />

EU, while the northern part of the<br />

island is part of the United Kingdom<br />

and will therefore leave the EU. An<br />

external border of the EU would<br />

therefore run across the island and<br />

thus make border controls necessary,<br />

which would lead to unrest<br />

among the population. This problem<br />

will supposedly be solved by a<br />

“backstop” arrangement, which<br />

would permit unrestricted trade on<br />

the island of Ireland. The arrangement<br />

intends for the United Kingdom<br />

to remain in the customs union<br />

with the EU until a permanent<br />

solution is found for Northern Ireland,<br />

which makes border controls<br />

unnecessary. However, the Prime<br />

Minister, Boris Johnson, who was

Quality Inside<br />

newly appointed in June, rejects<br />

such a backstop arrangement and<br />

wants to remove the agreement<br />

from the exit deal. He fears that the<br />

United Kingdom will remain tied to<br />

the EU for a long period of time if<br />

both parties cannot reach an agreement.<br />

On the other hand, the representatives<br />

of the European Union<br />

want the arrangement to avoid the<br />

possibility of goods flowing into the<br />

EU in an uncontrolled manner. Economic<br />

experts believe that if the<br />

state leaves without an agreement<br />

(“no-deal Brexit”), this would lead<br />

to reduced investments by companies,<br />

falling exports due to increased<br />

trade barriers and a loss of<br />

value of the British currency. According<br />

to experts, the gross domestic<br />

product is to drop by around<br />

2 per cent by 2020. Up until now,<br />

they had believed the British economy<br />

could grow by 1.8 and 1.5 per<br />

cent respectively in 2<strong>01</strong>9 and also<br />

2020. As before, the housing construction<br />

figures are going upwards.<br />

After the number of completions<br />

from 2<strong>01</strong>8 lightly increased<br />

to around 177,000 homes, the Euroconstruct<br />

network expect a further<br />

increase for 2<strong>01</strong>9 by 11 per cent to<br />

182,000 newly constructed homes.<br />

In 2020 it is supposed to be as<br />

many as 188,000 units.<br />

Italy: Not merely due to the new<br />

governmental crisis, the country is<br />

the problem child in the European<br />

Union. It is the fourth largest economic<br />

nation in the EU, and at the<br />

The withdrawal of the United<br />

Kingdom agreed for the end of<br />

October is unsettling the<br />

European economy.<br />

Photo: Fotolia.com/ tanaonte<br />

same time, the country with the<br />

highest debt. In terms of absolute<br />

figures, no country in the EU is<br />

more in debt than Italy. Greece only<br />

has greater debt than Italy in terms<br />

of the rate. The prospects are also<br />

not very bright. Over the year so far,<br />

there have only been small indications<br />

of the economy reviving. For<br />

2<strong>01</strong>9, the IMF and the EU Commission<br />

expect a growth of a mere 0.1<br />

per cent. The situation may only improve<br />

in 2020, meaning that the<br />

forecasts here predict an economic<br />

growth of 0.6 per cent. The level of<br />

unemployment here remains one<br />

of the highest in Europe and persists<br />

at 10.1 per cent. The consumer<br />

prices should further drop and increase<br />

by only 0.8 per cent in 2020<br />

after an increase of 1.3 per cent.<br />

Low-level growth is also seen in<br />

housing construction. In 2<strong>01</strong>8, the<br />

number of completed homes only<br />

grew by 3 per cent to around<br />

83,000 units. For 2<strong>01</strong>9, experts also<br />

anticipate only a low increase to<br />

just under 85,000 completions. In<br />

2020, this should be just under<br />

87,000 homes.<br />

Scandinavia (Denmark, Sweden,<br />

Norway, Finland): In the four<br />

northern countries, the economic<br />

development is rather varied. As<br />

EU member states, Denmark,<br />

Sweden and Finland contribute 6<br />

per cent to the economic performance<br />

of the community. While in<br />

Finland, after a growth of 2.1 per<br />

cent in 2<strong>01</strong>8, the economy is only<br />

supposed to increase by 1.3 or 1.2<br />

per cent, the IfW Kiel is anticipating<br />

Denmark having a greater increase<br />

in economic performance in 2<strong>01</strong>9<br />

than in 2<strong>01</strong>8. After 1.2 per cent, the<br />

GDP is to increase by 2 per cent in<br />

the current year. In 2020, the forecast<br />

is 1.5 per cent. In Sweden, almost<br />

the same level of GDP growth<br />

is expected, meaning that for this<br />

year and next year, a 2.3 and 2.1 per<br />

cent increase are forecast. In Norway,<br />

which is not a member of the<br />

EU, 2<strong>01</strong>9 is expected to be a record<br />

year. According to the forecast, the<br />

GDP should increase by between 2<br />

and 2.6 per cent. The experts are<br />

also optimistic for 2020, where the<br />

forecasts range from 2.5 to 3 per<br />

cent. In 2<strong>01</strong>8, the country was able<br />

to expand its economic performance<br />

by 1.4 per cent.<br />

The development of housing construction<br />

is also broken down.<br />

While experts in Denmark in particular<br />

expect a clear increase to<br />

25,500 in this year and 27,000 next<br />

year, the three other countries are<br />

expected to suffer a decline in completions.<br />

After 40,000 more homes<br />

were built in Finland in 2<strong>01</strong>8, the<br />

number of anticipated homes by<br />

2020 will drop to 31,000.<br />

In Norway, the number of home<br />

completions between 2<strong>01</strong>6 and<br />

2<strong>01</strong>8 increased by almost 27 per<br />

cent to 37,300 units, however this<br />

number is supposed to drop to<br />

33,000 homes by 2020. In Sweden,<br />

things look similar. Here, the number<br />

of newly built living units increased<br />

from 2<strong>01</strong>6 to 2<strong>01</strong>8 by almost<br />

40 per cent to just under<br />

75,000. Here, only 73,700 in 2<strong>01</strong>9<br />

and in the following year, just under<br />

70,000 homes are predicted to be<br />

completed.<br />

Austria: After a GDP growth of 2.7<br />

per cent, Austria is expected to<br />

have significantly weaker economic<br />

dynamics over this year and next<br />

year. The growth should amount to<br />

just 1.3 per cent in 2<strong>01</strong>9 and 1 per<br />

cent in the following year. With an<br />

almost unchanged rate of unemployment<br />

between 4.6 and 4.9 per<br />

cent, the economic experts at the<br />

IfW Kiel anticipate a drop in consumer<br />

prices. While these only<br />

gained 2.1 per cent in 2<strong>01</strong>8, this<br />

year and next year there is a forecast<br />

increase of 1.4 and 1.3 per<br />

cent.<br />

In Austria in 2<strong>01</strong>9, the completion<br />

of around 53,000 homes is expected,<br />

which would be a growth of 1<br />

per cent compared to the previous<br />

year. However, the experts only expect<br />

an insignificant increase for<br />

2020 with 53,700 completed<br />

homes.<br />

Greece: The economic recovery of<br />

the country is making further progress.<br />

After the GDP grew in 2<strong>01</strong>8<br />

by 1.9 per cent, the IMF expects 2.4<br />

per cent in the current year. IfW Kiel<br />

is more restrained and expects only<br />

an increase of 1.3 and 2.0 per cent<br />

for this year and next year respectively.<br />

The economy shrunk continually<br />

over many years. The more<br />

positive economic development is<br />

reflected not least in the declining<br />

unemployment. In 2<strong>01</strong>7 it was at almost<br />

21 per cent, so in 2<strong>01</strong>9, a further<br />

reduction of the rate to 17.6 per<br />

cent is expected. In 2020, it is to<br />

amount to a mere 15.7 per cent.<br />

However, the economic recovery<br />

may cause the prices to increase,<br />

which means that consumer prices<br />

are anticipated to increase by up to<br />

1 per cent.<br />

The housing construction situation<br />

in Greece is also moving upwards<br />

again, although the number of<br />

building approvals remains under<br />

the numbers from before the global<br />

economic and financial crisis. After<br />

13,800 units in 2<strong>01</strong>7, the number of<br />

building approvals increased in<br />

2<strong>01</strong>8 to 15,200 homes. However,<br />

according to the Greek Office for<br />

Statistics, the figures for the first<br />

five months 2<strong>01</strong>9 were only insignificantly<br />

above those for the period<br />

in the previous year. Before the<br />

crisis, the number of building approvals<br />

was up to 80,000 homes<br />

per year.<br />

Spain: After the long economic crisis,<br />

the Spanish economy is on a<br />

course of recovery. After a GDP<br />

growth of 2.6 per cent in 2<strong>01</strong>8, the<br />

country is forecast to experience<br />

an increase of 2.4 per cent and 2<br />

per cent over the coming year and<br />

the year after. This will also lower<br />

the high rate of unemployment<br />

from 15.3 per cent in 2<strong>01</strong>8 to a forecast<br />

12.5 per cent in 2020. The<br />

moderate increase in consumer<br />

prices, which were at 1.7 per cent in<br />

2<strong>01</strong>8, and should be 1.2 and 1.4 per<br />

cent in 2<strong>01</strong>9 and 2020, may boost<br />

private consumption.<br />

The increasing number of building<br />

approvals indicates the sustainable<br />

economic recovery of the country.<br />

After the number of home completions<br />

climbed from 40,000 to<br />

around 70,000 units in the period<br />

2<strong>01</strong>6 to 2<strong>01</strong>8, Euroconstruct expects<br />

a further increase to 80,000<br />

in 2<strong>01</strong>9 and 90,000 homes in the<br />

year after. Richard Barth<br />

material+technik möbel – <strong>special</strong> <strong>01</strong>|19 7

Quality Inside<br />

Germany and Italy remain main<br />

production countries<br />

Germany and Italy are Western Europe’s largest furniture producing countries. Both countries account for<br />

around 9 percent of global production turnover and account for around 40 percent of furniture production<br />

in Europe. At the same time, the region accounted for 26 percent of global furniture production in 2<strong>01</strong>8.<br />

The market research institute CSIL<br />

(Italy) estimates global furniture<br />

production for 2<strong>01</strong>8 at around 460<br />

billion dollars (approx. 420 billion<br />

euros). Furniture manufacturers in<br />

Europe account for 26 percent of<br />

this figure. Around 54 percent are<br />

manufactured in the Asia-Pacific region,<br />

with China alone accounting<br />

for around 39 percent. CSIL estimates<br />

the share of America at 17<br />

percent and that of the Middle East<br />

and Africa at 3 percent.<br />

According to the European Furniture<br />

Industries Confederation<br />

(EFIC), there are almost 120,000<br />

furniture producers in Europe employing<br />

around one million people.<br />

EFIC puts the turnover of these<br />

companies at around 100 billion euros,<br />

with German producers, followed<br />

by Italian companies, making<br />

the largest contribution.<br />

Germany: weakening demand<br />

In Germany, the structure of the furniture<br />

industry has consolidated in<br />

recent years and the number of furniture<br />

factories with more than 50<br />

employees has fallen by 18 percent<br />

since 2005. The industry currently<br />

employs around 85,000 people.<br />

According to the Association of the<br />

German Furniture Industry (VDM),<br />

in 2<strong>01</strong>8 the German furniture industry<br />

was able to achieve a turnover<br />

of almost 18 billion euros and thus<br />

slightly exceed the previous year’s<br />

result by 0.6 percent. However,<br />

since sales had fallen slightly in the<br />

previous year, the result was the<br />

same as in 2<strong>01</strong>6. 32.4 percent of<br />

sales were generated from exports.<br />

The slight increase in turnover was<br />

due to the positive development in<br />

the kitchen and office segments.<br />

Both achieved sales of EUR 4.9 billion<br />

and EUR 2.2 billion, respectively,<br />

and thus contributed a total of 40<br />

percent to industry sales. With a<br />

share of 40 percent, however, the<br />

“other furniture” segment (living<br />

room, dining room and bedroom<br />

furniture, small pieces of furniture,<br />

non-upholstered seating furniture,<br />

furniture components, etc.) is the<br />

largest single segment, with sales<br />

of 7.1 billion euros in 2<strong>01</strong>8. The turnover<br />

of the manufacturers of shop<br />

and contract furniture amounted to<br />

2 billion euros, upholstered furniture<br />

achieved a turnover of 920 million<br />

euros and mattresses 780 million<br />

euros.<br />

While furniture exports increased<br />

by 2.2 percent to 10.9 billion euros,<br />

imports declined slightly by 0.7 percent.<br />

At 12.7 billion euros, however,<br />

they exceeded exports, resulting<br />

in a foreign trade deficit of 1.8<br />

billion euros. The purely arithmetical<br />

furniture consumption is 19.8<br />

billion euros. More than a quarter of<br />

all imported furniture came from<br />

Poland in 2<strong>01</strong>8.<br />

Minus expected in 2<strong>01</strong>9<br />

Following the positive development<br />

in 2<strong>01</strong>8, the German furniture<br />

industry did not make a successful<br />

start to the current year. According<br />

to information from the industry association<br />

VDM (Verband der<br />

deutschen Möbelindustrie), companies<br />

suffered a decline in sales of<br />

1.8 percent to 8.9 billion euros in<br />

the first half of 2<strong>01</strong>9. However, the<br />

individual product segments developed<br />

differently: kitchen furniture<br />

manufacturers increased by 1.4<br />

percent to around 2.5 billion euros,<br />

the office furniture industry even increased<br />

its sales by 1.6 percent to<br />

around 1.1 billion euros. Manufacturers<br />

of shop furniture and other<br />

contract furniture were 1.4 percent<br />

up on the previous year and<br />

achieved sales of around 910 million<br />

euros. Manufacturers of upholstered<br />

furniture registered a decline,<br />

with sales from January to<br />

June 2<strong>01</strong>9 falling by 3 per cent to<br />

around EUR 470 million. The sales<br />

trend for other furniture (residential<br />

furniture and furniture components)<br />

was also more negative than<br />

the industry average at minus 5.4<br />

percent to EUR 3.5 billion. Sales in<br />

the mattress industry also declined.<br />

Their turnover fell by 4.2 percent<br />

to around 390 million euros.<br />

Germany: Top 10 furniture supplying countries 2<strong>01</strong>8 (in billion euros/change 2<strong>01</strong>8/2<strong>01</strong>7 in %)<br />

Poland<br />

3.35 (+2,2 %)<br />

China<br />

Czech Republic<br />

1.69 (-4,8 %)<br />

1.90 (-1.6 %)<br />

Italy<br />

0.80 (±0 %)<br />

Hungary<br />

Romania<br />

Turkey<br />

France<br />

Austria<br />

0.46 (-6.2 %)<br />

0.36 (-7.1 %)<br />

0.33 (+0.9 %)<br />

0.31 (+6.8 %)<br />

0.27(-12.7 %)<br />

Netherlands<br />

0.26 (-4.0 %)<br />

8 material+technik möbel – <strong>special</strong> <strong>01</strong>|19<br />

Source: VDM

M_<strong>mt</strong>0318_Anz_Limbach_96x67.indd 1 05.<strong>01</strong>.18 09:42<br />

Quality Inside<br />

Turnover of the German furniture industry 2<strong>01</strong>2–2<strong>01</strong>9 (in billion euros)<br />

2<strong>01</strong>2<br />

2<strong>01</strong>3<br />

2<strong>01</strong>4<br />

2<strong>01</strong>5<br />

2<strong>01</strong>6<br />

2<strong>01</strong>7<br />

2<strong>01</strong>8<br />

2<strong>01</strong>9*<br />

*estimation <br />

Furniture production by geographical<br />

regions 2<strong>01</strong>8 (% in value)<br />

Asia and<br />

Pacific 54 %<br />

Source: CSIL<br />

Middle East and Africa 3 %<br />

North America 15 %<br />

South<br />

America 2%<br />

Europe (incl. Russia<br />

and Turkey) 26 %<br />

16.0<br />

16.4<br />

17.1<br />

17.4<br />

18.0<br />

17.8<br />

18.0<br />

17.6<br />

Source: VDM<br />

around 130,000 people. As the statistics<br />

also include smaller companies<br />

with fewer than 50 employees,<br />

the statistical data cannot be<br />

compared with the German data.<br />

The turnover of the furniture manufacturers<br />

is estimated by the industry<br />

association Federlegno-Arredo<br />

at 16.4 billion euros for 2<strong>01</strong>8, which<br />

corresponds to an increase of 2 per<br />

cent compared to the previous year.<br />

Furniture manufacturers thus accounted<br />

for 38.5 per cent of the total<br />

turnover of the wood and furniture<br />

industry, which is estimated at<br />

42.6 billion euros for 2<strong>01</strong>8. If other<br />

furnishing sectors such as bathroom<br />

furnishings (-0.5%), office furnishings<br />

(1%) and lighting (+0.2%)<br />

are added to the pure furniture turnover,<br />

this results in a turnover of<br />

27.4 billion euros, which was 1.9 per<br />

cent higher than the previous year’s<br />

figure. In terms of exports, however,<br />

the industry was only able to increase<br />

by 0.9 per cent.<br />

According to Federlegno-Arredo,<br />

domestic demand for furniture<br />

grew by 1.8 per cent in the year under<br />

review, not least due to a government<br />

subsidy programme. Introduced<br />

in 2<strong>01</strong>3, this “Bonus Mobili”<br />

program grants tax breaks to all<br />

those who purchase new furniture<br />

or larger, energy-efficient built-in<br />

electrical appliances as part of renovation<br />

and maintenance work on<br />

their property. The tax savings<br />

amount to 50 per cent up to a total<br />

amount of 10,000 euros and thus a<br />

maximum of 5,000 euros. Divided<br />

over ten years, a maximum deduction<br />

of 500 euros per year can be<br />

claimed. However, imports also<br />

benefited from the furniture bonus,<br />

with growth estimated at 5 per<br />

cent.<br />

The Italian market research institute<br />

CSIL expects the Italian furniture<br />

industry to continue its positive<br />

development, as the extension<br />

of the “Bonus Mobili” to the current<br />

year has once again created<br />

sales incentives. While exports are<br />

expected to increase by 1.6 per<br />

cent, market researchers are forecasting<br />

domestic demand to grow<br />

by 1 per cent. The increase in production<br />

turnover is expected to be<br />

equally high. CSIL also sees the further<br />

development of the market as<br />

positive. Since exports are expected<br />

to increase by 3 per cent over<br />

the next two years, furniture production<br />

could increase by 2 per<br />

cent.<br />

Richard Barth<br />

The negative industry result in the<br />

first half of 2<strong>01</strong>9 was not least attributable<br />

to the decline in domestic<br />

demand, which could not be offset<br />

by the positive export results.<br />

The German furniture industry generates<br />

only one third of its sales<br />

abroad. In the reporting period, exports<br />

increased by 2.4 per cent to<br />

5.7 billion euros. Imports were also<br />

affected by the negative development<br />

on the domestic market.<br />

These fell by 0.7 per cent to 6.7 billion<br />

euros. Accordingly, the foreign<br />

trade deficit fell by 17 per cent to<br />

around 1 billion euros. As the VDM<br />

further informs, more than 55 per<br />

cent of the value is attributable to<br />

the three most important supplier<br />

countries Poland, China and the<br />

Czech Republic. Due to the weak<br />

business development in the first<br />

half of the year and the negative<br />

signs for the second half of 2<strong>01</strong>9,<br />

VDM anticipates a decline in industry<br />

sales of 1.5 to 2 per cent for<br />

2<strong>01</strong>9 as a whole.<br />

Italy: on course for recovery<br />

Italy is the second largest furniture<br />

producer in Europe and one of the<br />

largest furniture exporters. In 2<strong>01</strong>8<br />

the Italian companies sold 51 per<br />

cent of their production abroad. The<br />

production of furniture is handled<br />

by 18,600 companies employing<br />

Advertisement<br />

material+technik möbel – <strong>special</strong> <strong>01</strong>|19 9

Quality Inside<br />

Individualisation<br />

through material mix<br />

The furnishing trends in Western Europe can be seen every year at the two<br />

major furniture fairs, imm cologne in Cologne and Salone del Mobile in<br />

Milan. With more than 3,000 exhibitors, both events offer visitors an overview<br />

of new shapes, colours and materials. The increasingly individual furnishing<br />

wishes of consumers have led to a variety of materials in which wood no<br />

longer plays the main role.<br />

fair and will therefore not be taking<br />

part again until 2020 (20.–26. April<br />

2020) were not on board.<br />

The imm cologne, which takes<br />

place in the odd-numbered years<br />

together with the kitchen trade fair<br />

LivingKitchen in Cologne (Germany),<br />

offers an initial insight into the<br />

new furnishing trends every year.<br />

Molteni (Italy) also wants to<br />

make rooms transparent with<br />

glass cabinets. Photo: Molteni<br />

At both fairs (14.1.–20.1.19), 1,355<br />

furniture and kitchen manufacturers<br />

from 50 countries presented<br />

their new models. Among the exhibitors<br />

were around 370 German<br />

suppliers, whose products offered<br />

an insight into the current taste of<br />

German furnishing. Visitor interest<br />

proved to be just as international as<br />

the range on offer at the fair: Both<br />

10 material+technik möbel – <strong>special</strong> <strong>01</strong>|19<br />

events – including around 50,000<br />

end consumers – attracted more<br />

than 150,000 visitors. With a share<br />

of 52 per cent, the share of foreign<br />

visitors was higher than in previous<br />

years.<br />

At the same time, the range on offer<br />

at the furniture fair in Cologne<br />

gave a foretaste of the furnishing<br />

trends that were to be seen a few<br />

months later at the Salone del Mobile<br />

in Milan (Italy). Numerous imm<br />

cologne material trends were confirmed<br />

at the Italian furniture show.<br />

New colour and material trends<br />

were also set at the Salone. With<br />

over 2,400 exhibitors, the Milan<br />

event (9.4. to 14.4.2<strong>01</strong>9) set off a<br />

firework display of innovative products<br />

for the home, the office and<br />

the bathroom. Around 1,300 suppliers<br />

gathered in the residential furniture<br />

sector.<br />

This year the event attracted<br />

386,236 visitors from 181 countries,<br />

including around 100,000 end<br />

consumers. The manufacturers of<br />

kitchens who only exhibit every<br />

two years at the Eurocucina trade<br />

In the “Vivi” concept by Doimo<br />

(Italy), the pattern of the<br />

wallpaper can be found on the<br />

furniture and table fronts.<br />

Photo: Doimo<br />

Deep matt surfaces<br />

For this reason, visitor interest at<br />

the Cologne event was increasingly<br />

devoted to the kitchen range, which<br />

was characterised by diversity and<br />

numerous new presentations. In<br />

addition to real wood, lacquered<br />

fronts could be seen in the kitchen<br />

area, which did not appear in high<br />

gloss but with a deep matt surface.<br />

With their velvety soft feel, they resembled<br />

the laminate surfaces exhibited<br />

with an anti-fingerprint effect.<br />

Metallic surfaces in various<br />

shades were also on display. For<br />

kitchens and living furniture, thick<br />

veneers were also used, which<br />

were embossed and thus had an<br />

authentic old wood character. Compared<br />

to previous years, however,<br />

the wood surfaces were less rustic<br />

and more elegant. Oak dominated<br />

the solid wood programmes in the<br />

living area, followed by beech,<br />

which mostly appeared as ash pine<br />

or beech heartwood. More frequently<br />

than in previous years, oak<br />

was shown in the white oiled version.<br />

Among the wood reproductions,<br />

oak was also ahead of walnut. The<br />

rusticity of the previous years also<br />

seemed to be somewhat reduced<br />

here, so that more elegant and<br />

above all lighter oak decors could

Advertisement<br />

be seen. Occasionally, replicas of<br />

ash and larch were shown. In addition<br />

to the authentic appearance<br />

of the decors, there was a<br />

corresponding haptic, because<br />

melamine surfaces as well as<br />

some finish foils were provided<br />

with a tactile surface structure.<br />

In many cases only accents were<br />

set with wood and wood replicas,<br />

while other material replicas such<br />

as cement or concrete as well as<br />

stone or marble were given greater<br />

focus. Ceramics and slate were<br />

also used as materials as well as<br />

replicas.<br />

Black and almost black surfaces<br />

were eye-catching in the colours.<br />

At the same time, light, pastel<br />

blue and green shades as well as<br />

various shades of grey were also<br />

to be found in the trade fair image.<br />

Glass creates<br />

transparent spaces<br />

The strong presence of open<br />

shelves in the kitchen and glass<br />

showcases in the living room was<br />

also a striking feature of the range<br />

on offer at the trade fair. Visitors to<br />

Marble is one of the trendy<br />

materials for Olivieri (Italy) as a<br />

replica on the glass fronts of<br />

the wardrobe. Photo: Olivieri<br />

the glass showcases usually<br />

found a metal frame structure in<br />

which the sides were also made<br />

of glass and thus provided increased<br />

transparency in the<br />

room. Transparency also proved<br />

to be an important trend at the Salone<br />

del Mobile in Milan (Italy), as<br />

almost every exhibitor had exhibited<br />

wardrobes and, in some cases,<br />

home furniture with a metal<br />

structure completely clad in glass.<br />

A large part of the exhibited furniture<br />

was also not equipped with<br />

the usual cup hinges, but had<br />

hinges that were almost flush<br />

with the wall. Both in Cologne and<br />

in Milan, built-in sliding doors<br />

(pocket doors) were also on dis-<br />

There were also other material<br />

impressions to be seen on the<br />

fronts, such as ceramic in<br />

marble look at Schüller<br />

(Germany). Photo: Schüller<br />

As individual as you.<br />

Customisable design – a matter of importance for more<br />

and more furniture buyers. But how can marketable,<br />

customised options be produced cost effectively?<br />

To this end, Hettich has for a long time been offering<br />

platform concepts and solutions that fascinate. Discover<br />

how easy it is to make customisable furniture design the<br />

standard. In your production too.<br />

Let Hettich fascinate you.

Quality Inside<br />

The oval chest of drawers B&B<br />

Italia (Italy) is made of tineo<br />

veneer. Photo: B&B Italia<br />

hunter green to a mustard shade.<br />

In the mid-price segment, however,<br />

grey tones dominated the trade<br />

fair image, while beige, brown and<br />

mud tones were the dominant<br />

colours in the high-price segment.<br />

Marble “on top”<br />

For numerous furnishing products,<br />

the exhibitors also played with the<br />

The kitchen of Dada (Italy) has<br />

fronts in Black Palm Wood.<br />

Photo: Dada<br />

play, which can be used to conceal<br />

utility areas in the kitchen, for example,<br />

or a workplace in the kitchen<br />

area. Since the living spaces in<br />

the houses are now more open and<br />

the boundaries between kitchen<br />

and living space become fluid, areas<br />

of the kitchen can be concealed<br />

in this way.<br />

Organic shapes<br />

At the Salone del Mobile, the new<br />

box furniture was presented in thin<br />

material thicknesses and often in a<br />

minimalist style, while the upholstered<br />

furniture was often lavishly<br />

upholstered and with organic lines.<br />

The opposite was formed by expansive,<br />

linear upholstery programmes<br />

with low seat depths.<br />

While dark wood colours dominated<br />

the high-value segment, the<br />

Metal on the front: Kettnaker<br />

(Germany) and Zeyko (Germany).<br />

Photos: Kettnaker, Zeyko<br />

range in the mid-price segment<br />

was lighter. In the upper price segment,<br />

oak and eucalyptus veneer,<br />

often thermally treated or stained<br />

black, continued to play the main<br />

role. This year, however, furniture in<br />

light oak was added for the first<br />

time. Walnut had also gained<br />

ground. Elm was a widespread<br />

wood species, e<strong>special</strong>ly in the replicas.<br />

Some programmes were<br />

shown in ash veneer, which was<br />

then often varnished in open-pore<br />

colour. Exotic woods and veneers<br />

Lema (Italy) showed furniture made of heat-treated oak on filigree<br />

bronze-colored metal feet. <br />

Photo: Lema<br />

were occasionally used: Tineo<br />

wood veneer was to be found at<br />

B&B Italia (Italy), Porro (Italy) presented<br />

Pale-Moon wood (a strongly<br />

drawn ebony from Southeast<br />

Asia), MisuraEmme (Italy) showed<br />

furniture made of high-gloss ebony<br />

and Dada (Italy) made of black palm<br />

wood.<br />

Green proved to be the trend colour<br />

for this year’s salon, as this colour<br />

was exhibited both in the living area<br />

and in upholstered furniture. The<br />

palette ranged from pastel green to<br />

materials to give their models an individual<br />

look. The main role was<br />

played by marble and various reproductions<br />

of the material. While the<br />

original stone was often colour-intensive<br />

or with contrasting veins,<br />

the replicas were based on classic<br />

Cararra marble. Richard Barth<br />

At Ballerina (Germany), work<br />

areas in the kitchen can be<br />

concealed with pocket doors.<br />

Photo: Ballerina<br />

12 material+technik möbel – <strong>special</strong> <strong>01</strong>|19

Quality Inside<br />

The adhesives <strong>special</strong>ist Kleiberit<br />

(Germany) has developed new adhesive<br />

solutions in micro-emission<br />

quality for various areas of application,<br />

which can score points in<br />

terms of user benefits and can be<br />

identified by the ME (=Micro-Emission)<br />

label. According to the manufacturer,<br />

these products are characterized<br />

by the highest bonding<br />

properties, combined with safe and<br />

simple handling, as well as environmental<br />

friendliness and no obligation<br />

to label.<br />

Wide range of applications<br />

The PUR hot-melt adhesive “Kleiberit<br />

702.5.03 ME” is used for the<br />

sheathing of wood-based material<br />

and PVC profiles in the interior. Very<br />

high initial strength, enormous heat<br />

resistance of up to +140 °C (depending<br />

on substrate) and cold resistance<br />

down to -40 °C characterize<br />

this product.<br />

For edge bonding, the company<br />

has added the two PUR hot melt<br />

adhesives “KLEIBERIT 707.9.03<br />

ME” and “KLEIBERIT 707.9.38<br />

ME” to its product range.<br />

When laminating flat workpieces<br />

with foils, veneers or papers on<br />

laminating machines, Kleiberit also<br />

“HotCoating” technology can<br />

also be used to finish products<br />

for outdoor use.<br />

Competence in<br />

adhesives and coatings<br />

The adhesives <strong>special</strong>ist Kleiberit has developed a comprehensive portfolio<br />

of environmentally friendly PUR adhesives and with these products it hits<br />

the nerve of time. For years, the company has also been successful with its<br />

“HotCoating” technology, with which surfaces are finished worldwide.<br />

relies on the use of reactive PUR<br />

hot-melt adhesives in ME quality<br />

and offers a whole range of new<br />

hot-melt adhesives such as “KLEI-<br />

BERIT 706.2.03 ME” or “KLEIBER-<br />

IT 706.2.43 ME”.<br />

New fields of application<br />

With more than 60 plants using the<br />

company’s “HotCoating” technology<br />

installed worldwide, Kleiberit<br />

has been an important partner to<br />

the wood-based panel industry for<br />

surface finishing for years. The<br />

company continuously develops<br />

the process further and opens up<br />

new fields of application.<br />

At Ligna 2<strong>01</strong>9, for example, a system<br />

for finishing digitally printed<br />

roll material using the “HotCoating”<br />

process was presented, which<br />

was taken over by a customer directly<br />

after the trade fair. It can be<br />

used to coat webs up to 1.50 m<br />

wide, which opens up completely<br />

new possibilities for the user in the<br />

high-quality coating of elements<br />

such as doors. The technology can<br />

also be used to produce both highgloss<br />

and supermatt finishes,<br />

which are then provided with textured<br />

embossing in a further process.<br />

The advantage of this “imprint”<br />

technology is that the flexible<br />

The new Micro Emission PUR<br />

adhesives score points, among<br />

other things, in the surface<br />

lamination of various panel<br />

materials. Photos: Kleiberit<br />

“HotCoating” functional layer does<br />

not break out, as is the case with<br />

classic coatings. It is also possible<br />

to use “HotCoating” technology to<br />

finish products for the outdoor<br />

sector.<br />

ba<br />

Recently, roll material can also<br />

be coated using the HotCoating<br />

process, which opens up<br />

completely new possibilities for<br />

the user in the high-quality<br />

coating of elements.<br />

material+technik möbel – <strong>special</strong> <strong>01</strong>|19 13

Salice presented<br />

his pocket door<br />

system “Exedra”<br />

with assisted<br />

opening action<br />

and damped<br />

closing movement.<br />

Photo: Salice<br />

Authentic surfaces<br />

and “invisible” fittings<br />

Decorative surfaces and functional fittings that inspire users visually and haptically and offer them comfort<br />

were the focus of this year’s interzum in Cologne. As the world’s leading trade fair for supplier materials for<br />

the furnishing industry, it lived up to its reputation in May and attracted visitors from all over the world.<br />

To mark the 60 th anniversary of the<br />

supplier show, interzum (21.5.–<br />

24.5.2<strong>01</strong>9) featured the largest<br />

product range in years: 1,805 exhibitors<br />

had gathered on an area of<br />

around 190,000 sqm to present<br />

their new developments in surfaces,<br />

wood-based materials, decorative<br />

and functional fittings, light and<br />

upholstery materials to more than<br />

74,000 international visitors. This<br />

was more exhibitors and visitors<br />

than at the previous interzum in<br />

2<strong>01</strong>7. According to the trade fair<br />

management, 55,000 foreign visitors<br />

alone took the opportunity to<br />

get an overview of the latest supplier<br />

products at the world’s leading<br />

trade fair held every two years.<br />

In the even years, Koelnmesse, as<br />

the organiser of interzum in the<br />

German city of Bad Salzuflen, organises<br />

a smaller supplier product<br />

show under the name ZOW, which<br />

concentrates more on the regional<br />

furniture industry and focuses<br />

more on exchanging ideas with users<br />

than on presenting new products.<br />

It will take place from 4 to 6<br />

February 2020.<br />

Leading suppliers on board<br />

At interzum in Cologne, the leading<br />

exhibitors of wood-based products,<br />

surface products and fittings competed<br />

in all product segments. The<br />

manufacturers of recessed furniture<br />

luminaires were also represented.<br />

The upholstered furniture<br />

industry also had a wide range of<br />

products on offer, including foams,<br />

adhesives, upholstery materials<br />

and relax fittings in several exhibition<br />

halls.<br />

The products were often presented<br />

in a homely atmosphere or as ideas<br />

for tomorrow’s living scenarios. In<br />

addition to the practical application<br />

ideas and solutions at the trade fair,<br />

hardware manufacturer Hettich<br />

(Germany) presented sophisticated<br />

application possibilities for its<br />

products, thus providing customers<br />

with a wealth of inspiration on<br />

their journey home. In addition to<br />

the huge range on offer at the fair,<br />

this year’s interzum was also<br />

packed with a wealth of themed exhibitions<br />

on new technologies and<br />

disruptive materials. The aim was<br />

to give visitors a glimpse of new<br />

manufacturing technologies and<br />

materials that furniture manufacturers<br />

might change in the future.<br />

The supporting programme was<br />

supplemented by <strong>special</strong>ist lectures<br />

on current industry topics and<br />

product innovations, which provided<br />

further information at the four<br />

so-called Piazzas and familiarised<br />

visitors to the fair with future topics<br />

relevant to the industry.<br />

14 material+technik möbel – <strong>special</strong> <strong>01</strong>|19<br />

Flap fittings such as the “ViZard<br />

by ambigence” from Hettich are<br />

hidden in the side wall.<br />

Photo: Hettich<br />

Living today and tomorrow<br />

Not only at the Piazzas but also at<br />

the exhibitors’ stands, visitors<br />

were made aware of the expected

Quality Inside<br />

Coked or burnt woods such as<br />

“Carbonized Wood” from<br />

Impress were among the new<br />

decors. Photo: Impress<br />

changes and challenges that will result<br />

from the ageing of society, urbanisation<br />

and, as a result, the scarcity<br />

of affordable housing in the cities.<br />

The hardware manufacturers<br />

Blum (Austria), Hettich and Häfele<br />

(both Germany) came up with suggestions<br />

and solutions on how to<br />

live comfortably in confined spaces<br />

and how sophisticated functional<br />

fittings can ensure the multifunctionality<br />

of furniture and rooms.<br />

As the boundaries between kitchen<br />

and living space are becoming<br />

blurred, end consumers are looking<br />

for furnishing solutions that allow<br />

them to hide the working areas of<br />

the kitchen. This is where pocket<br />

doors such as those seen at Blum<br />

(Austria), Salice (Italy) or Hawa<br />

(Switzerland) come in. When open,<br />

Blum’s single or double doors are<br />

concealed in their own narrow corpus.<br />

To close, the door is only slightly<br />

pressed and thus gently ejected<br />

from the pocket. Even when opening,<br />

the door only needs to be<br />

pressed slightly and it moves to the<br />

side and can be pushed into the<br />

narrow body element by pressing<br />

lightly.<br />

Other functional fittings also disappear<br />

from the observer’s view: Two<br />

years ago, door hinges were integrated<br />

into the carcase and made<br />

their debut at interzum. This year<br />

they were followed by flap fittings<br />

for kitchen wall units. Integrated into<br />

the side corpus, hardly visible,<br />

they provide an optically seamless<br />

interior for the cabinets and at the<br />

same time do not take up any storage<br />

space. Even with the new, slim<br />

drawer systems, the technology is<br />

hidden in such a way that no cover<br />

caps or other technical details can<br />

interfere with the flawless interior<br />

of the drawer.<br />

More differentiation<br />

In addition, supplier products such<br />

as drawer systems are designed to<br />

be modular so that they allow users<br />

to differentiate prices within their<br />

product range or from competitors<br />

without having to stock large quantities.<br />

At the same time, storage is<br />

reduced because many components<br />

for the drawers are identical.<br />

The aim of the manufacturers is to<br />

enable their users from the furniture<br />

industry to individualise the<br />

process chain at the end. In addition,<br />

there are further tricks, such<br />

as a high degree of pre-assembly of<br />

complicated hardware systems<br />

and the simplest possible on-site<br />

assembly, which reduce effort and<br />

costs. This also applies to the electrification<br />

of movement functions:<br />

Salice (Italy) presented an innovative<br />

motorization solution for its<br />

various sliding door systems, which<br />

“Smartfoil Nature” is a finish<br />

foil with anti-fingerprint effect<br />

and matt soft-touch surface.<br />

Photo: Schattdecor<br />

only has to be docked onto the<br />

guide rail and can therefore be retrofitted.<br />

PVC instead of paper<br />

Visitors to the fair experienced a<br />

small revolution in surface products:<br />

instead of printing on decor<br />

paper as before, almost all decor<br />

printers presented additional thermoplastic<br />

materials such as PVC<br />

and PP as substrates for their replicas<br />

of wood or other natural materials.<br />

The new base materials can<br />

score points with product properties<br />

that cannot be achieved with<br />

decor paper, such as the combination<br />

of moisture resistance with<br />

<strong>special</strong> surface effects. In addition<br />

to the ever more authentic reproductions<br />

of natural materials such<br />

as wood, stones or fabrics, the haptics<br />

and the functional properties of<br />

the surfaces were given an important<br />

role. More and more furniture<br />

surfaces are being equipped with<br />

anti-fingerprint properties. In addi-<br />

Blum’s “Merivobox” gives<br />

manufacturers the possibility to<br />

offer their customers a diverse<br />

pull-out range based on one box<br />

system.<br />

Photo: Blum<br />

material+technik möbel – <strong>special</strong> <strong>01</strong>|19 15

tion, there are synchronous haptic<br />

structures that make it almost impossible<br />

to distinguish replicas<br />

from the original wooden or stone<br />

models.<br />

Wood, marble and metal<br />

For the designs, the decor printers<br />

focused on material diversity and<br />

not only on wood reproductions. In<br />

addition to marble and various<br />

stone reproductions, metal decors<br />

were shown, in which the spectrum<br />

of impressions ranged from<br />

oxidised steel to aluminium optics<br />

and finished surfaces.<br />

With the woods, the companies<br />

set different accents, either remaining<br />

true to the rusticity of the<br />

oak and thus to the vintage look, or<br />

relying on exotic woods. Hybrid decors,<br />

in which different materials<br />

were combined, such as concrete<br />

and fabric look or floral wallpaper<br />

patterns with lime surfaces, were<br />

also on display.<br />

The wood colours did not show a<br />

uniform picture. While one decor<br />

printer was dominated by light<br />

tones, other stands were dominated<br />

by medium to darker colours.<br />

Several suppliers showed decors<br />

inspired by burnt or charred wood,<br />

such as the old Japanese technique<br />

Shou Sugi Ban. Alternative materials<br />

to wood, such as metals and<br />

16 material+technik möbel – <strong>special</strong> <strong>01</strong>|19<br />

The new “ST 20 Metal Brushed”<br />

surface at Egger looks like<br />

genuine brushed aluminium.<br />

Photo: Egger<br />

stones in particular, also served as<br />

models and were artificially “aged”.<br />

In addition to carbonized woods,<br />

the designs included oxidized steel<br />

and brushed or flamed metals. Other<br />

suppliers had chosen textile fabrics<br />

or worn carpets as models. In<br />

particular, the replicas of old wood<br />

or weathered woods were made<br />

using all the latest technology.<br />

Cracks, knotholes and traces of use<br />

and processing were reproduced<br />

plastically in such a way that, in<br />

combination with the corresponding<br />

haptics, they produced an authentic<br />

effect on laminates, melamine<br />

surfaces and also on finish<br />

foils. The manufacturers of thermoplastic<br />

furniture foils also followed<br />

this trend and equipped their materials<br />

with appropriate embossing.<br />

For example, the “Metalspin” embossing<br />

could be seen at<br />

Hornschuch (Germany). This is an<br />

iridescent polished structure that<br />

gives metallized plain colours the<br />

character of a used metal surface<br />

With tight radii, the new edges<br />

from MKT prevent white<br />

breakage. Photo: Barth<br />

With “Rocks” Interprint made its<br />

contribution to the marble trend.<br />

Photo: Interprint<br />

through “circular” traces of use. In<br />

line with the current metal trend,<br />

the new “ST 20 Metal Brushed”<br />

surface, which looks like brushed<br />

genuine aluminium, was on display<br />

at Egger (Austria). The “ST 75 Mineral<br />

Satin” texture, which gives decors<br />

a matt and velvety feel, was<br />

presented e<strong>special</strong>ly for worktops.<br />

Pfleiderer (Germany) presented<br />

the laminated panel “XTreme plus”.<br />

Fingerprints do not remain and<br />

even stubborn traces of grease can<br />

be easily removed. With its high<br />

abrasion and scratch resistance, it<br />

is even suitable for heavily used interior<br />

and contract furnishings.<br />

The wood-based panel industry also<br />

used interzum to introduce new<br />

wood-based panels. The “Be.Yond”<br />

chipboard made its debut at Swiss<br />

Krono (Switzerland). According to<br />

the company, it is the most environmentally<br />

friendly furniture board of<br />

its kind on the market. It is manufactured<br />

with a binder system on a<br />

“DuraBind” biobasis from the<br />

Canadian company EcoSynthetix<br />

and has an emission level that<br />

matches that of trees.<br />

Metamerism-free edges<br />

The manufacturers of edge bandings<br />

were also able to come up<br />

with innovations. An important topic<br />

was the freedom from metamerism.<br />

Exhibitors such as MKT (Germany)<br />

and Kröning (Germany) will<br />

be presenting edge bandings that<br />

perfectly match the colour of the<br />

furniture surface under different<br />

light sources. So far, it has been<br />

possible for furniture fronts, edges<br />

and profiles to be identical in colour<br />

in daylight, but different in colour<br />

under a different light source such<br />

as LED or neon light. MKT also presented<br />

PP edge bandings for panels<br />

with tight radii where no white<br />

breakage is visible. Richard Barth<br />

The “Be.Yond” chipboard from<br />

Swiss Krono is regarded as the<br />

most environmentally friendly<br />

furniture board on the market.<br />

Photo: Swiss Krono

Quality Inside<br />

Customized drawers<br />

The individualisation<br />

megatrend: Hettich presents<br />

its innovative platform<br />

“AvanTech YOU” as the latest<br />

stand-out product in the field<br />

of drawer systems. This<br />

enables furniture manufacturers<br />

to react economically<br />

to individual customer<br />

wishes. Photos: Hettich<br />

With “AvanTech YOU” Hettich (Germany)<br />

presents a new platform and<br />

its latest stand-out product in the<br />

field of drawer systems. This platform<br />

allows drawers to be designed<br />

in a unique manner and, according<br />

to the company, wins customers<br />

over with its exceptionally slim, purist<br />

design, without any visible screw<br />

heads or cover caps.<br />

In doing so, the platform provides<br />

the company with the opportunity<br />

to get ahead of the competition – to<br />

provide unique furniture design<br />

across a range of price segments<br />

and to react to customer specifications<br />

in a targeted manner. It enables<br />

manufacturers to offer a wide<br />

range of goods while also enjoying<br />

the benefits of lean, flexible manufacturing<br />

processes and low production<br />

and storage costs.<br />

On fairs, Hettich uses the motto<br />

“Fascin[action]” to display a range<br />

of product solutions which are<br />

based on the individual wishes of<br />

the customer: to feel style, enjoy<br />

comfort and win storage.<br />

Using creative design ideas, the fitting<br />

solutions company is aiming to<br />

provide a clear demonstration of<br />

how living spaces can be connected<br />

in a functional and elegant manner.<br />

For example, how you can enjoy<br />

a closet with a panorama effect.<br />

Or how you can make office work<br />

even more comfortable thanks to<br />

convertible furniture concepts. leo<br />

New, durable wrapping foil qualities<br />

“DFF 200” and “DFF 145”, these are the new<br />

foils with which Kröning (Germany) turns to<br />

manufacturers of room doors and baseboards.<br />

“Outstanding overstretching and carrier lamination<br />

with the additional possibility of overpainting”<br />

– argues , the <strong>special</strong>ist for surfaces of the<br />

furniture industry. Foils weights of 145 or 200<br />

grams per square meter, minimum quantity of<br />

one roll with 500 sqm, different white shades<br />

are available from stock. These are further arguments<br />

from the team. For those interested, the<br />

company provides an information folder with<br />

technical details and original samples. Kröning<br />

products are according to company information<br />