Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

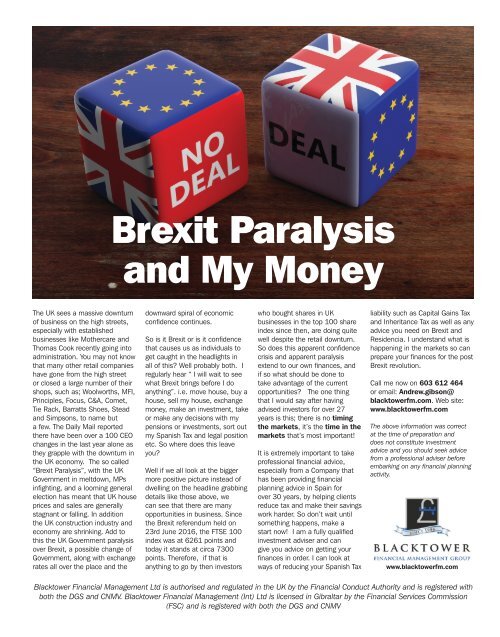

Brexit Paralysis<br />

and My Money<br />

The UK sees a massive downturn<br />

of business on the high streets,<br />

especially with established<br />

businesses like Mothercare and<br />

Thomas Cook recently going into<br />

administration. You may not know<br />

that many other retail companies<br />

have gone from the high street<br />

or closed a large number of their<br />

shops, such as; Woolworths, MFI,<br />

Principles, Focus, C&A, Comet,<br />

Tie Rack, Barratts Shoes, Stead<br />

and Simpsons, to name but<br />

a few. The Daily Mail reported<br />

there have been over a 100 CEO<br />

changes in the last year alone as<br />

they grapple with the downturn in<br />

the UK economy. The so called<br />

“Brexit Paralysis”, with the UK<br />

Government in meltdown, MPs<br />

infighting, and a looming general<br />

election has meant that UK house<br />

prices and sales are generally<br />

stagnant or falling. In addition<br />

the UK construction industry and<br />

economy are shrinking. Add to<br />

this the UK Government paralysis<br />

over Brexit, a possible change of<br />

Government, along with exchange<br />

rates all over the place and the<br />

downward spiral of economic<br />

confidence continues.<br />

So is it Brexit or is it confidence<br />

that causes us as individuals to<br />

get caught in the headlights in<br />

all of this? Well probably both. I<br />

regularly hear “ I will wait to see<br />

what Brexit brings before I do<br />

anything”. i.e. move house, buy a<br />

house, sell my house, exchange<br />

money, make an investment, take<br />

or make any decisions with my<br />

pensions or investments, sort out<br />

my Spanish Tax and legal position<br />

etc. So where does this leave<br />

you?<br />

Well if we all look at the bigger<br />

more positive picture instead of<br />

dwelling on the headline grabbing<br />

details like those above, we<br />

can see that there are many<br />

opportunities in business. Since<br />

the Brexit referendum held on<br />

23rd June 2016, the FTSE 100<br />

index was at 6261 points and<br />

today it stands at circa 7300<br />

points. Therefore, if that is<br />

anything to go by then investors<br />

who bought shares in UK<br />

businesses in the top 100 share<br />

index since then, are doing quite<br />

well despite the retail downturn.<br />

So does this apparent confidence<br />

crisis and apparent paralysis<br />

extend to our own finances, and<br />

if so what should be done to<br />

take advantage of the current<br />

opportunities? The one thing<br />

that I would say after having<br />

advised investors for over 27<br />

years is this; there is no timing<br />

the markets, it’s the time in the<br />

markets that’s most important!<br />

It is extremely important to take<br />

professional financial advice,<br />

especially from a Company that<br />

has been providing financial<br />

planning advice in Spain for<br />

over 30 years, by helping clients<br />

reduce tax and make their savings<br />

work harder. So don’t wait until<br />

something happens, make a<br />

start now! I am a fully qualified<br />

investment adviser and can<br />

give you advice on getting your<br />

finances in order. I can look at<br />

ways of reducing your Spanish Tax<br />

liability such as Capital Gains Tax<br />

and Inheritance Tax as well as any<br />

advice you need on Brexit and<br />

Residencia. I understand what is<br />

happening in the markets so can<br />

prepare your finances for the post<br />

Brexit revolution.<br />

Call me now on 603 612 464<br />

or email: Andrew.gibson@<br />

blacktowerfm.com. Web site:<br />

www.blacktowerfm.com<br />

The above information was correct<br />

at the time of preparation and<br />

does not constitute investment<br />

advice and you should seek advice<br />

from a professional adviser before<br />

embarking on any financial planning<br />

activity.<br />

www.blacktowerfm.com<br />

Blacktower Financial Management Ltd is authorised and regulated in the UK by the Financial Conduct Authority and is registered with<br />

both the DGS and CNMV. Blacktower Financial Management (Int) Ltd is licensed in Gibraltar by the Financial Services Commission<br />

(FSC) and is registered with both the DGS and CNMV