Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

38<br />

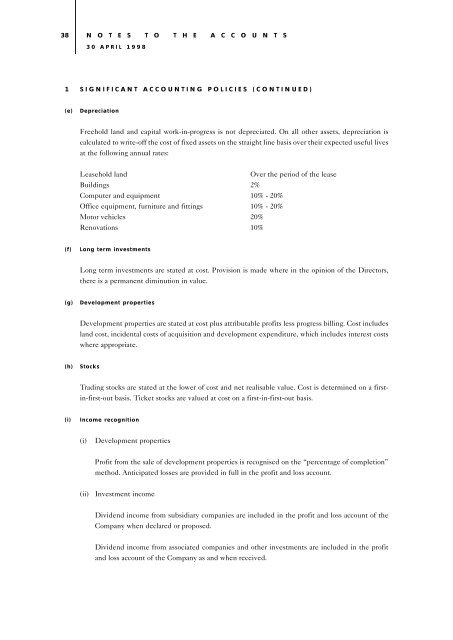

1 SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)<br />

(e) Depreciation<br />

Freehold land and capital work-in-progress is not depreciated. On all other assets, depreciation is<br />

calculated to write-off the cost of fixed assets on the straight line basis over their expected useful lives<br />

at the following annual rates:<br />

Leasehold land Over the period of the lease<br />

Buildings 2%<br />

Computer and equipment 10% - 20%<br />

Office equipment, furniture and fittings 10% - 20%<br />

Motor vehicles 20%<br />

Renovations 10%<br />

(f) Long term investments<br />

Long term investments are stated at cost. Provision is made where in the opinion of the Directors,<br />

there is a permanent diminution in value.<br />

(g) Development properties<br />

Development properties are stated at cost plus attributable profits less progress billing. Cost includes<br />

land cost, incidental costs of acquisition and development expenditure, which includes interest costs<br />

where appropriate.<br />

(h) Stocks<br />

N O T E S T O T H E A C C O U N T S<br />

30 APRIL 1998<br />

Trading stocks are stated at the lower of cost and net realisable value. Cost is determined on a firstin-first-out<br />

basis. Ticket stocks are valued at cost on a first-in-first-out basis.<br />

(i) Income recognition<br />

(i) Development properties<br />

Profit from the sale of development properties is recognised on the “percentage of completion”<br />

method. Anticipated losses are provided in full in the profit and loss account.<br />

(ii) Investment income<br />

Dividend income from subsidiary companies are included in the profit and loss account of the<br />

Company when declared or proposed.<br />

Dividend income from associated companies and other investments are included in the profit<br />

and loss account of the Company as and when received.