Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

49<br />

N O T E S T O T H E A C C O U N T S<br />

30 APRIL 1998<br />

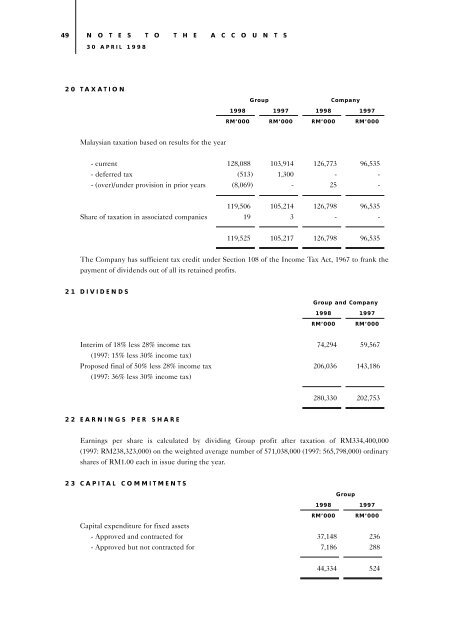

20 TAXATION<br />

Malaysian taxation based on results for the year<br />

Group Company<br />

1998 1997 1998 1997<br />

RM’000 RM’000 RM’000 RM’000<br />

- current 128,088 103,914 126,773 96,535<br />

- deferred tax (513) 1,300 - -<br />

- (over)/under provision in prior years (8,069) - 25 -<br />

119,506 105,214 126,798 96,535<br />

Share of taxation in associated companies 193 - -<br />

119,525 105,217 126,798 96,535<br />

The Company has sufficient tax credit under Section 108 of the Income Tax Act, 1967 to frank the<br />

payment of dividends out of all its retained profits.<br />

21 DIVIDENDS<br />

Group and Company<br />

1998 1997<br />

RM’000 RM’000<br />

Interim of 18% less 28% income tax<br />

(1997: 15% less 30% income tax)<br />

74,294 59,567<br />

Proposed final of 50% less 28% income tax<br />

(1997: 36% less 30% income tax)<br />

206,036 143,186<br />

22 EARNINGS PER SHARE<br />

280,330 202,753<br />

Earnings per share is calculated by dividing Group profit after taxation of RM334,400,000<br />

(1997: RM238,323,000) on the weighted average number of 571,038,000 (1997: 565,798,000) ordinary<br />

shares of RM1.00 each in issue during the year.<br />

23 CAPITAL COMMITMENTS<br />

Group<br />

1998 1997<br />

RM’000 RM’000<br />

Capital expenditure for fixed assets<br />

- Approved and contracted for 37,148 236<br />

- Approved but not contracted for 7,186 288<br />

44,334 524