National Hardwood Magazine - January 2021

In this issue of National Hardwood Magazine, get to know the team at Hardwood Floors of Hillsboro, see predictions for the 2021 Wood Products Industry, and check out the graduating class of the NHLA Inspector Training School.

In this issue of National Hardwood Magazine, get to know the team at Hardwood Floors of Hillsboro, see predictions for the 2021 Wood Products Industry, and check out the graduating class of the NHLA Inspector Training School.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

If History is an Indicator, the <strong>Hardwood</strong><br />

Market Will Rise to Meet the Demand<br />

By Sue Putnam<br />

<strong>Hardwood</strong> Market Report Editor David Caldwell recently<br />

presented the <strong>Hardwood</strong> Market Update during a complimentary<br />

webinar hosted by the <strong>Hardwood</strong> Manufacturers<br />

Association. To follow are excerpts of Caldwell’s presentation.<br />

How 2020 Began...<br />

2020 started out with such great promise. On <strong>January</strong><br />

15th, China rolled back tariffs on U.S. produced <strong>Hardwood</strong><br />

lumber. <strong>Hardwood</strong> lumber sales to China increased in <strong>January</strong><br />

to the highest monthly level since May of 2019.<br />

Domestic business was clipping along at a nice pace too,<br />

led by the longest housing boom since the U.S. Census began<br />

tracking housing data.<br />

And, industrial markets were performing well.<br />

In <strong>January</strong>, Eastern U.S. sawmill production recorded the<br />

highest level of output since October of 2019 and remains<br />

the monthly highest rate this year.<br />

COVID-19 changed all of that. As we know, the virus<br />

started in China, and that country’s economy was hit first<br />

and hit hard.<br />

In February and March<br />

of 2020, exports to China<br />

fell to the lowest pace<br />

since December of 2011.<br />

In fact, all countries have<br />

experienced a downturn<br />

in economic activity from<br />

the pandemic.<br />

The result of 2020’s<br />

turbulence has been dramatic.<br />

GDP hit an all-time<br />

low in the second quarter<br />

of 2020 at -31.4%.<br />

The <strong>Hardwood</strong> industry<br />

has not been spared.<br />

David Caldwell<br />

Through the first half of the year, industrial markets fell<br />

1.1BBF; exports were off 159MMBF, and domestic grade<br />

lumber usage tumbled 723MMBF. Total consumption is<br />

down almost 2.0BBF in 2020 from 2019.<br />

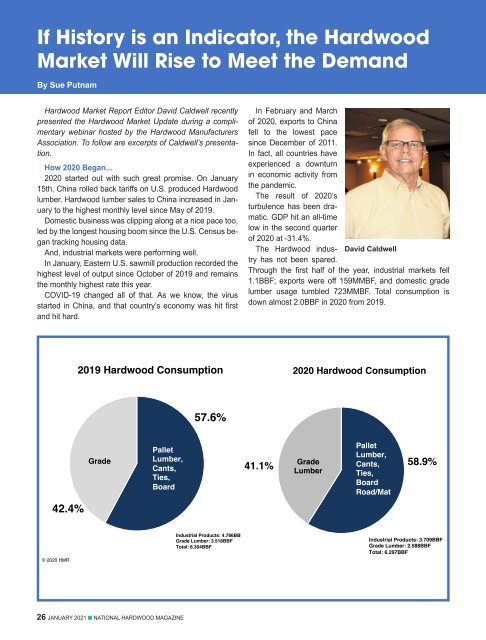

The main takeaway here is that industrial product consumption<br />

grew as a percentage of the total in 2020: 57.6%<br />

in 2019 to 58.9% in 2020, which means grade lumber consumption<br />

declined as a percentage of total consumption<br />

from 42.4% in 2019 to 41.1% in 2020.<br />

Production follows demand. In the first quarter of 2020,<br />

Billion Board Feet<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

<strong>Hardwood</strong> Lumber Consumption by the US Furniture Industry<br />

© 2020 HMR<br />

sawmill output held up well, but as demand for lumber fell,<br />

so did production, to the tune of 35%. We are on pace to<br />

produce 1.8BBF less <strong>Hardwood</strong> material in 2020 than the<br />

previous year. That is 2020 in a nutshell.<br />

But, even more concerning is the <strong>Hardwood</strong> industry is<br />

experiencing a longer-term trend in contracting demand<br />

and production. •••<br />

In this time series, consumption peaked<br />

in 1997 at 3.0 billion board feet (BBF).<br />

The 2020 annualized mid-year estimate<br />

is .331 BBF. That is a loss of 2.669 BBF<br />

of domestic grade lumber usage.<br />

1.0<br />

2019 <strong>Hardwood</strong> Consumption<br />

2020 <strong>Hardwood</strong> Consumption<br />

0.5<br />

*Mid-year estimate<br />

57.6%<br />

0.0<br />

1991 1997 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 *2020<br />

42.4%<br />

© 2020 HMR<br />

Grade<br />

Pallet<br />

Lumber,<br />

Cants,<br />

Ties,<br />

Board<br />

Industrial Products: 4.786BBF<br />

Grade Lumber: 3.518BBF<br />

Total: 8.304BBF<br />

41.1%<br />

Grade<br />

Lumber<br />

Pallet<br />

Lumber,<br />

Cants,<br />

Ties,<br />

Board<br />

Road/Mat<br />

58.9%<br />

Industrial Products: 3.709BBF<br />

Grade Lumber: 2.588BBF<br />

Total: 6.297BBF<br />

Long -Term Adjustments to the U.S. Furniture Industry<br />

The U.S. furniture industry is the most notable example of<br />

the longer-term contraction of grade <strong>Hardwood</strong> lumber usage.<br />

It is estimated that 70% of furniture manufacturing has<br />

moved out of the U.S.<br />

In 1999, the U.S. furniture industry used 3.0BBF of <strong>Hardwood</strong><br />

lumber. In 2020, consumption was 331MMBF. That is<br />

a loss of almost 2.7BBF of grade lumber consumption.<br />

Lumber prices have been affected from offshoring fur-<br />

niture manufacturing. Green 4/4 No. 1 Common Red Oak<br />

prices were fairly steady between 1992 and 2001, following<br />

U.S. housing market trends. As demand from the U.S. furniture<br />

industry decreased, lumber manufacturers were more<br />

reliant on foreign business or non-traditional markets, such<br />

as the solid wood flooring industry as outlets for 4/4 No. 1<br />

Common Red Oak. The rapid rate of price change makes<br />

it difficult for primary and secondary manufacturers, as well<br />

as yards to plan for the future.<br />

Please turn the page<br />

26 JANUARY <strong>2021</strong> n NATIONAL HARDWOOD MAGAZINE JANUARY <strong>2021</strong> n NATIONAL HARDWOOD MAGAZINE 27