Jeweller - September 2021

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

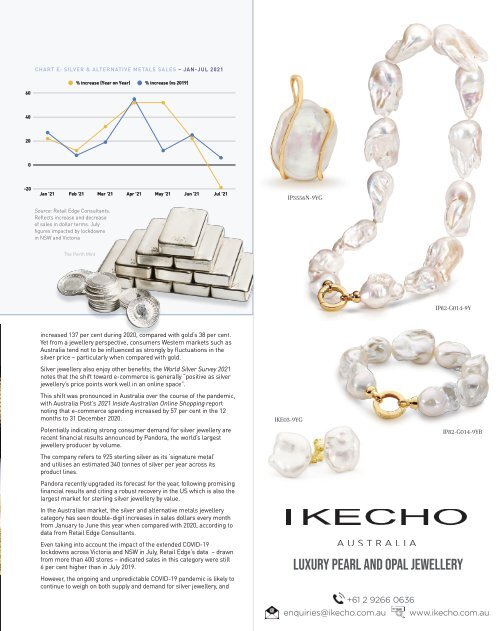

CHART E: SILVER & ALTERNATIVE METALS SALES – JAN-JUL <strong>2021</strong><br />

% increase (Year on Year) % increase (vs 2019)<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

Jan '21 Feb '21 Mar '21 Apr '21 May '21 Jun '21 Jul '21<br />

Source: Retail Edge Consultants.<br />

Reflects increase and decrease<br />

of sales in dollar terms. July<br />

figures impacted by lockdowns<br />

in NSW and Victoria<br />

IP3556N-9YG<br />

The Perth Mint<br />

IP82-G014-9Y<br />

increased 137 per cent during 2020, compared with gold’s 38 per cent.<br />

Yet from a jewellery perspective, consumers Western markets such as<br />

Australia tend not to be influenced as strongly by fluctuations in the<br />

silver price – particularly when compared with gold.<br />

Silver jewellery also enjoy other benefits; the World Silver Survey <strong>2021</strong><br />

notes that the shift toward e-commerce is generally “positive as silver<br />

jewellery’s price points work well in an online space”.<br />

This shift was pronounced in Australia over the course of the pandemic,<br />

with Australia Post’s <strong>2021</strong> Inside Australian Online Shopping report<br />

noting that e-commerce spending increased by 57 per cent in the 12<br />

months to 31 December 2020.<br />

Potentially indicating strong consumer demand for silver jewellery are<br />

recent financial results announced by Pandora, the world’s largest<br />

jewellery producer by volume.<br />

The company refers to 925 sterling silver as its ‘signature metal’<br />

and utilises an estimated 340 tonnes of silver per year across its<br />

product lines.<br />

Pandora recently upgraded its forecast for the year, following promising<br />

financial results and citing a robust recovery in the US which is also the<br />

largest market for sterling silver jewellery by value.<br />

In the Australian market, the silver and alternative metals jewellery<br />

category has seen double-digit increases in sales dollars every month<br />

from January to June this year when compared with 2020, according to<br />

data from Retail Edge Consultants.<br />

Even taking into account the impact of the extended COVID-19<br />

lockdowns across Victoria and NSW in July, Retail Edge’s data – drawn<br />

from more than 400 stores – indicated sales in this category were still<br />

6 per cent higher than in July 2019.<br />

However, the ongoing and unpredictable COVID-19 pandemic is likely to<br />

continue to weigh on both supply and demand for silver jewellery, and<br />

IKE03-9YG<br />

IP82-G014-9YB<br />

LUXURY pearl AND opal JEWELLERY<br />

+61 2 9266 0636<br />

enquiries@ikecho.com.au www.ikecho.com.au