Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

18 SAY YOU SAW IT IN SUBURBAN October 19, 2021 - November 22, 2021<br />

MAINE<br />

Why did China even allow<br />

Evergrande to last this long?<br />

By Shuli Ren<br />

BLOOMBERG OPINION<br />

Many comparisons have been made<br />

lately between the collapse of Lehman<br />

Brothers Holdings Inc. and the<br />

apocalypse at China Evergrande<br />

Group, the world’s most indebted real<br />

estate developer. But they are nowhere<br />

close. Lehman was a top-tier<br />

investment bank that went from good<br />

to bad during the 2007 subprime<br />

mortgage crisis. On the other hand,<br />

Evergrande — a well-known presence<br />

in Hong Kong’s capital markets<br />

for years — has always been bad.<br />

For almost a decade, critics have<br />

been calling Evergrande out, questioning<br />

the asset quality of its unsold<br />

properties and asking if its auditors<br />

were asleep. All those warnings fell<br />

on deaf ears — and the developer-turned-conglomerate<br />

went on living<br />

out its nine lives. On Thursday,<br />

however, Beijing finally told local governments<br />

to prepare for Evergrande’s<br />

potential demise, the Wall Street<br />

Journal reported. The unanswered<br />

question is why the People’s Republic<br />

of China and its often merciless regulators<br />

allowed it to go on for so long.<br />

Evergrande’s liquidity crisis came<br />

about because all of its working capital<br />

is tied to its inventory, which is<br />

largely composed of $202 billion in<br />

unfinished housing projects. When<br />

unpaid suppliers and employees —<br />

who had also been asked to purchase<br />

wealth management products sold<br />

by the company — came knocking on<br />

its door, all Evergrande could offer<br />

in terms of repayment was unsold<br />

apartments, store fronts and empty<br />

parking lots. Some properties were<br />

offered to creditors at a discount<br />

of as much as 52 percent, giving a<br />

sense of their true market value. It<br />

should not be a surprise: There were<br />

warnings of “dead assets” from GMT<br />

Research five years ago.<br />

Perhaps investors chose to look on<br />

the bright side because the authorities<br />

were on Evergrande’s side. In<br />

2016, Hong Kong’s Securities and<br />

Futures Commission — which regulates<br />

the city’s financial markets —<br />

declared that U.S.-based short-seller<br />

Citron Research and its founder<br />

Andrew Left were culpable of market<br />

misconduct because of their<br />

negative assessment of Evergrande.<br />

“Left used sensationalist language<br />

in his report that Evergrande was<br />

insolvent and engaged in accounting<br />

fraud,” the commission said. Left responded,<br />

saying, “This court’s opinion<br />

simply stifles negative commentary.”<br />

Evergrande is among the most<br />

often shorted stocks on the Hong<br />

Kong bourse.<br />

Short sellers now may be feeling<br />

vindicated. But if anything, the Hong<br />

Kong SFC’s 2016 decision could have<br />

simply emboldened Evergrande.<br />

Founder Hui Ka Yan has relied on<br />

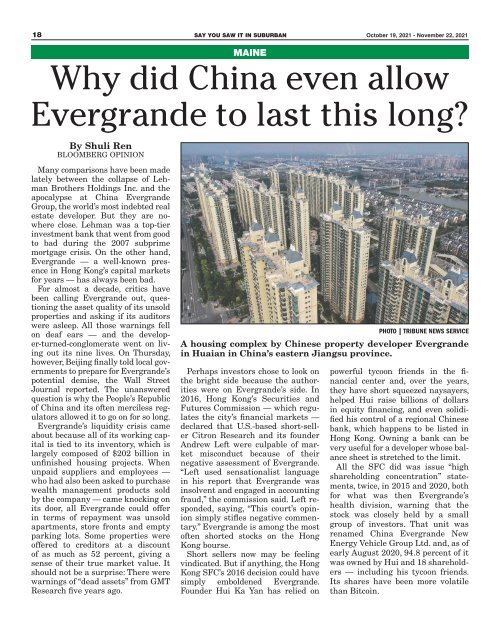

PHOTO | TRIBUNE NEWS SERVICE<br />

A housing complex by Chinese property developer Evergrande<br />

in Huaian in China’s eastern Jiangsu province.<br />

powerful tycoon friends in the financial<br />

center and, over the years,<br />

they have short squeezed naysayers,<br />

helped Hui raise billions of dollars<br />

in equity financing, and even solidified<br />

his control of a regional Chinese<br />

bank, which happens to be listed in<br />

Hong Kong. Owning a bank can be<br />

very useful for a developer whose balance<br />

sheet is stretched to the limit.<br />

All the SFC did was issue “high<br />

shareholding concentration” statements,<br />

twice, in 2015 and 2020, both<br />

for what was then Evergrande’s<br />

health division, warning that the<br />

stock was closely held by a small<br />

group of investors. That unit was<br />

renamed China Evergrande New<br />

Energy Vehicle Group Ltd. and, as of<br />

early August 2020, 94.8 percent of it<br />

was owned by Hui and 18 shareholders<br />

— including his tycoon friends.<br />

Its shares have been more volatile<br />

than Bitcoin.