Global Goals Yearbook 2023 makes SDG impact measurable

No poverty, no hunger, peace: In 2015, the United Nations adopted the 17 Sustainable Development Goals, which were supposed to make the world a better place by 2030. Now it is half-time. The results are sobering. In the remaining time, measures must be more targeted and more effective. On the occasion of COP28 in Dubai, the Global Goals Yearbook is focusing on the aspect of impact.

No poverty, no hunger, peace: In 2015, the United Nations adopted the 17 Sustainable Development Goals, which were supposed to make the world a better place by 2030. Now it is half-time. The results are sobering. In the remaining time, measures must be more targeted and more effective. On the occasion of COP28 in Dubai, the Global Goals Yearbook is focusing on the aspect of impact.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

METHODOLOGY<br />

Investor’s view<br />

Investors who are committed to addressing<br />

social and environmental issues must<br />

recognize that <strong>impact</strong> management cannot<br />

operate in isolation from financial<br />

management. The major obstacle is the<br />

lack of interoperability between financial<br />

and <strong>impact</strong> management methodologies<br />

– an obstacle that poses a significant<br />

challenge to investment fund specialists.<br />

These experts have their own unique<br />

terminologies, frameworks, and datasets<br />

that exist independently of one another.<br />

Successfully incorporating <strong>impact</strong>ful<br />

investments into decision-making processes<br />

requires investors to ask four fundamental<br />

questions:<br />

Investors who limit their approach to<br />

<strong>impact</strong> or financial considerations are<br />

missing out on potential gains. However,<br />

those seeking a more holistic investment<br />

strategy face the challenge of creating<br />

a customized plan that integrates social<br />

and environmental factors. The process<br />

begins with an <strong>impact</strong> analysis during<br />

pre-investment screening using both<br />

negative (excluding companies engaging<br />

in harmful practices) and positive<br />

screenings (including only those meeting<br />

minimum standards for positive<br />

<strong>impact</strong>). Once investments pass these<br />

tests, most investors make decisions<br />

based solely on financial performance.<br />

Unfortunately, few investors actively<br />

optimize both profit and societal benefits<br />

simultaneously beyond initial screening<br />

stages. This is where consulting firms<br />

like Impact Frontiers come into play by<br />

working alongside investors to develop<br />

new methods for integrating sustainable<br />

management strategies with traditional<br />

finance approaches while sharing best<br />

practices across industries.<br />

As Hannah Schiff from Nuveen says<br />

about Impact Frontiers: “Our clients<br />

expect us to deliver results through<br />

sound fiduciary duty as well as meaningful<br />

social change.” Therefore it is<br />

crucial to explore innovative solutions<br />

that balance economic growth without<br />

sacrificing the commitment to sustainability<br />

goals.<br />

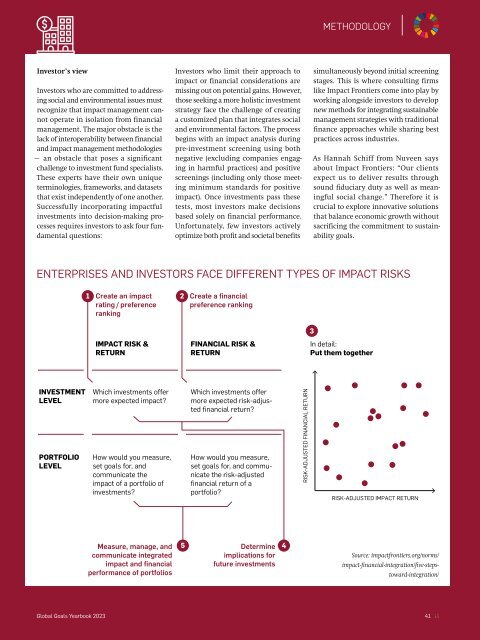

ENTERPRISES AND INVESTORS FACE DIFFERENT TYPES OF IMPACT RISKS<br />

1 Create an <strong>impact</strong> 2 Create a financial<br />

rating / preference preference ranking<br />

ranking<br />

IMPACT RISK &<br />

RETURN<br />

FINANCIAL RISK &<br />

RETURN<br />

3<br />

In detail:<br />

Put them together<br />

INVESTMENT<br />

LEVEL<br />

PORTFOLIO<br />

LEVEL<br />

Which investments offer<br />

more expected <strong>impact</strong>?<br />

How would you measure,<br />

set goals for, and<br />

communicate the<br />

<strong>impact</strong> of a portfolio of<br />

investments?<br />

Which investments offer<br />

more expected risk-adjusted<br />

financial return?<br />

How would you measure,<br />

set goals for, and communicate<br />

the risk-adjusted<br />

financial return of a<br />

portfolio?<br />

RISK-ADJUSTED FINANCIAL RETURN<br />

RISK-ADJUSTED IMPACT RETURN<br />

Measure, manage, and<br />

communicate integrated<br />

<strong>impact</strong> and financial<br />

performance of portfolios<br />

5<br />

Determine<br />

implications for<br />

future investments<br />

4<br />

Source: <strong>impact</strong>frontiers.org/norms/<br />

<strong>impact</strong>-financial-integration/five-stepstoward-integration/<br />

<strong>Global</strong> <strong>Goals</strong> <strong>Yearbook</strong> <strong>2023</strong><br />

41