Asian Sky Quarterly 2023 Q1

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EUROPE PROFILE: HELICOPTER<br />

The helicopter fleet in Europe recorded a net addition of 39 helicopters<br />

during the 12-month period from <strong>Q1</strong> 2022 to <strong>Q1</strong> <strong>2023</strong>, reaching a total of<br />

4,115 in operation and a growth rate close to 1.0%. Over the latest threeyear<br />

period, the fleet increased by 3.3%. The top five countries by fleet<br />

size held a market share of 67%, with France leading the national fleet<br />

count at 637 helicopters, overtaking the UK's largest fleet in Q2 2022.<br />

The UK's fleet shrank by 9% over the latest three-year period, totalling 607<br />

helicopters in operation during <strong>Q1</strong> <strong>2023</strong>. Italy maintained the third largest<br />

helicopter fleet with 561 in operation, having surpassed Germany's fleet<br />

in <strong>Q1</strong> 2022. Germany and Spain completed the top five countries with<br />

528 and 439 helicopters, respectively.<br />

Following the spike in demand associated with the reopening of the<br />

world economy in 2021, the helicopter market has likewise moderated,<br />

experiencing a slower growth rate by <strong>Q1</strong> <strong>2023</strong>. The helicopter fleet in<br />

Europe grew by 1.9% over a 12-month period during <strong>Q1</strong> 2022, which<br />

has since slowed down to just under 1% during <strong>Q1</strong> <strong>2023</strong> over the same<br />

period. Moreover, the pre-owned market for sale has seen a year-onyear<br />

reduction of 18.8% since <strong>Q1</strong> 2022, while the latest quarter in <strong>2023</strong><br />

recorded a 44.2% decrease in the number of transactions compared to<br />

the sales figures achieved during <strong>Q1</strong> 2022.<br />

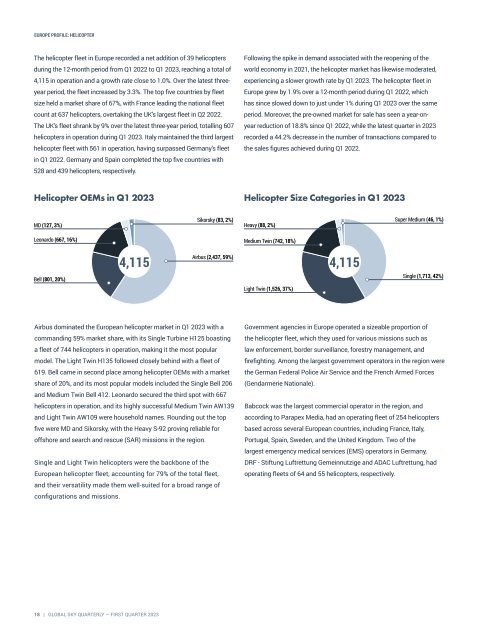

Helicopter OEMs in <strong>Q1</strong> <strong>2023</strong><br />

Helicopter Size Categories in <strong>Q1</strong> <strong>2023</strong><br />

MD (127, 3%)<br />

Sikorsky (83, 2%)<br />

Heavy (88, 2%)<br />

Super Medium (46, 1%)<br />

Leonardo (667, 16%)<br />

Medium Twin (742, 18%)<br />

Bell (801, 20%)<br />

4,115<br />

Airbus (2,437, 59%)<br />

4,115<br />

Single (1,713, 42%)<br />

Light Twin (1,526, 37%)<br />

Airbus dominated the European helicopter market in <strong>Q1</strong> <strong>2023</strong> with a<br />

commanding 59% market share, with its Single Turbine H125 boasting<br />

a fleet of 744 helicopters in operation, making it the most popular<br />

model. The Light Twin H135 followed closely behind with a fleet of<br />

619. Bell came in second place among helicopter OEMs with a market<br />

share of 20%, and its most popular models included the Single Bell 206<br />

and Medium Twin Bell 412. Leonardo secured the third spot with 667<br />

helicopters in operation, and its highly successful Medium Twin AW139<br />

and Light Twin AW109 were household names. Rounding out the top<br />

five were MD and Sikorsky, with the Heavy S-92 proving reliable for<br />

offshore and search and rescue (SAR) missions in the region.<br />

Single and Light Twin helicopters were the backbone of the<br />

European helicopter fleet, accounting for 79% of the total fleet,<br />

and their versatility made them well-suited for a broad range of<br />

configurations and missions.<br />

Government agencies in Europe operated a sizeable proportion of<br />

the helicopter fleet, which they used for various missions such as<br />

law enforcement, border surveillance, forestry management, and<br />

firefighting. Among the largest government operators in the region were<br />

the German Federal Police Air Service and the French Armed Forces<br />

(Gendarmerie Nationale).<br />

Babcock was the largest commercial operator in the region, and<br />

according to Parapex Media, had an operating fleet of 254 helicopters<br />

based across several European countries, including France, Italy,<br />

Portugal, Spain, Sweden, and the United Kingdom. Two of the<br />

largest emergency medical services (EMS) operators in Germany,<br />

DRF - Stiftung Luftrettung Gemeinnutzige and ADAC Luftrettung, had<br />

operating fleets of 64 and 55 helicopters, respectively.<br />

18 | GLOBAL SKY QUARTERLY — FIRST QUARTER <strong>2023</strong>