Asian Sky Quarterly 2023 Q1

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MOOD & INTENTIONS: QUARTERLY SURVEY<br />

QUARTERLY SURVEY<br />

The survey results reflect the views of respondents worldwide on the status of the business aviation market.<br />

1. A total of 88% respondents had an optimistic outlook on the<br />

economy moving forward, with an equal share of respondents<br />

asserting that the latest economic environment was either at<br />

the lowest point or recovering past its lowest point.<br />

2. Considering the recent replenishment of pre-owned market<br />

inventory, 43% of respondents regarded it as a buyer’s market,<br />

while those who viewed it as a seller’s market decreased by<br />

around 20 percentage points over the past quarter.<br />

3. Large jets were the preferred choice of aircraft among those<br />

seeking an aircraft in the market, while price remained the<br />

predominant factor behind purchasing decisions.<br />

4. Over 70% of respondents expressed their intention to charter<br />

aircraft within the next three months.<br />

RESPONDENT BREAKDOWN<br />

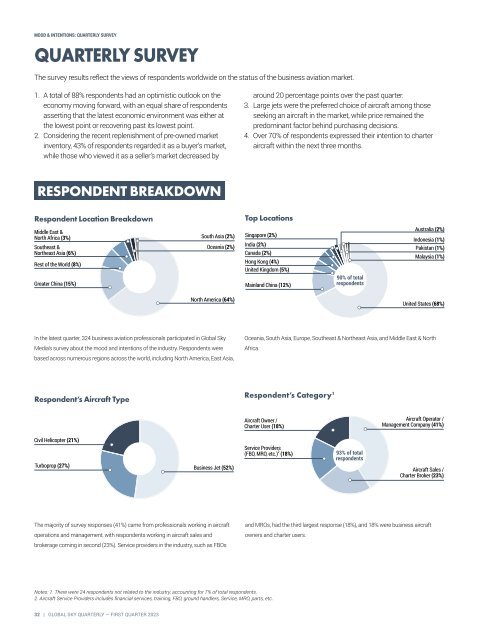

Respondent Location Breakdown<br />

Top Locations<br />

Middle East &<br />

North Africa (3%)<br />

Southeast &<br />

Northeast Asia (6%)<br />

Rest of the World (8%)<br />

Greater China (15%)<br />

South Asia (2%)<br />

Oceania (2%)<br />

Singapore (2%)<br />

India (2%)<br />

Canada (2%)<br />

Hong Kong (4%)<br />

United Kingdom (5%)<br />

Mainland China (12%)<br />

90% of total<br />

respondents<br />

Australia (2%)<br />

Indonesia (1%)<br />

Pakistan (1%)<br />

Malaysia (1%)<br />

North America (64%)<br />

United States (68%)<br />

In the latest quarter, 324 business aviation professionals participated in Global <strong>Sky</strong><br />

Media’s survey about the mood and intentions of the industry. Respondents were<br />

based across numerous regions across the world, including North America, East Asia,<br />

Oceania, South Asia, Europe, Southeast & Northeast Asia, and Middle East & North<br />

Africa.<br />

Respondent’s Aircraft Type<br />

Aircraft Owner /<br />

Charter User (18%)<br />

Aircraft Operator /<br />

Management Company (41%)<br />

Civil Helicopter (21%)<br />

Respondent’s Category 1 Aircraft Sales /<br />

Service Providers<br />

(FBO, MRO, etc.) 2 (18%)<br />

93% of total<br />

respondents<br />

Turboprop (27%) Business Jet (52%)<br />

Charter Broker (23%)<br />

The majority of survey responses (41%) came from professionals working in aircraft<br />

operations and management, with respondents working in aircraft sales and<br />

brokerage coming in second (23%). Service providers in the industry, such as FBOs<br />

and MROs, had the third largest response (18%), and 18% were business aircraft<br />

owners and charter users.<br />

Notes: 1. There were 24 respondents not related to the industry, accounting for 7% of total respondents.<br />

2. Aircraft Service Providers includes financial services, training, FBO, ground handlers, Service, MRO, parts, etc.<br />

32 | GLOBAL SKY QUARTERLY — FIRST QUARTER <strong>2023</strong>