How Do Corporate Venture Capitalists Create Value for ...

How Do Corporate Venture Capitalists Create Value for ...

How Do Corporate Venture Capitalists Create Value for ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

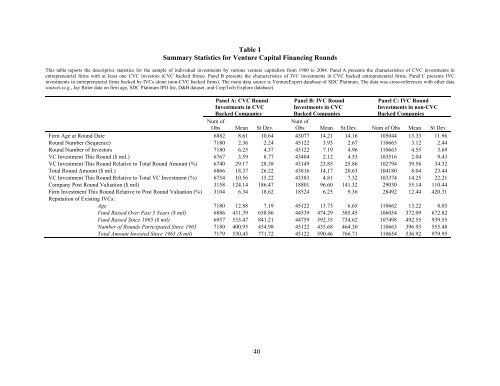

Table 1<br />

Summary Statistics <strong>for</strong> <strong>Venture</strong> Capital Financing Rounds<br />

This table reports the descriptive statistics <strong>for</strong> the sample of individual investments by various venture capitalists from 1980 to 2004. Panel A presents the characteristics of CVC investments in<br />

entrepreneurial firms with at least one CVC investors (CVC backed firms). Panel B presents the characteristics of IVC investments in CVC backed entrepreneurial firms. Panel C presents IVC<br />

investments in entrepreneurial firms backed by IVCs alone (non-CVC backed firms). The main data source is <strong>Venture</strong>Expert database of SDC Platinum. The data was cross-references with other data<br />

sources (e.g., Jay Ritter data on firm age, SDC Platinum IPO list, D&B dataset, and CorpTech Explore database).<br />

Panel A: CVC Round<br />

Investments in CVC<br />

Backed Companies<br />

Num of<br />

Obs Mean St Dev.<br />

40<br />

Panel B: IVC Round<br />

Investments in CVC<br />

Backed Companies<br />

Panel C: IVC Round<br />

Investments in non-CVC<br />

Backed Companies<br />

Num of<br />

Obs Mean St Dev. Num of Obs Mean St Dev.<br />

Firm Age at Round Date 6882 8.61 10.64 43077 14.21 14.16 105044 13.33 11.96<br />

Round Number (Sequence) 7180 2.36 2.24 45122 3.93 2.67 110663 3.12 2.44<br />

Round Number of Investors 7180 6.25 4.37 45122 7.19 4.96 110663 4.55 3.69<br />

VC Investment This Round ($ mil.) 6767 3.59 8.77 43404 2.12 4.53 103516 2.04 9.43<br />

VC Investment This Round Relative to Total Round Amount (%) 6740 29.17 28.38 43149 23.85 25.86 102794 39.56 34.32<br />

Total Round Amount ($ mil.) 6866 18.37 26.22 43816 14.17 20.63 104180 8.04 23.44<br />

VC Investment This Round Relative to Total VC Investment (%) 6754 10.56 15.22 43383 4.81 7.32 103374 14.25 22.21<br />

Company Post Round Valuation ($ mil) 3158 124.14 186.47 18801 96.60 141.32 29030 55.14 110.44<br />

Firm Investment This Round Relative to Post Round Valuation (%) 3104 6.34 18.62 18524 6.25 9.36 28492 12.44 420.31<br />

Reputation of Existing IVCs:<br />

Age 7180 12.88 7.19 45122 13.73 6.65 110662 13.22 8.03<br />

Fund Raised Over Past 5 Years ($ mil) 6886 431.39 658.86 44539 474.29 585.45 106054 372.09 672.82<br />

Fund Raised Since 1965 ($ mil) 6957 533.47 841.21 44759 592.35 734.62 107498 492.55 939.55<br />

Number of Rounds Participated Since 1965 7180 400.95 454.98 45122 435.68 464.30 110663 396.93 555.48<br />

Total Amount Invested Since 1965 ($ mil) 7179 530.45 771.72 45122 590.46 766.71 110654 536.92 979.95