You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

VOX Research-based policy analysis and commentary from leading economists<br />

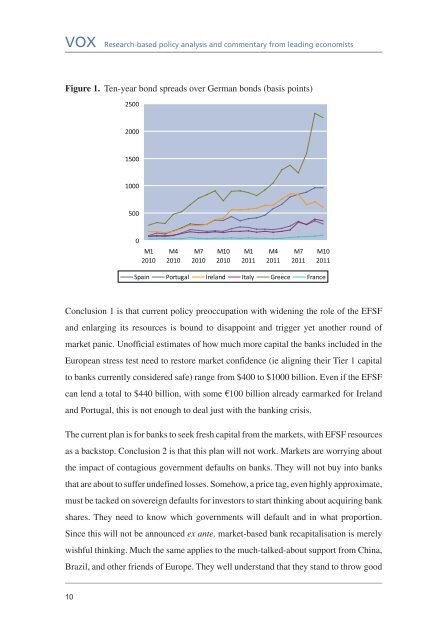

Figure 1. Ten-year bond spreads over German bonds (basis points)<br />

Conclusion 1 is that current policy preoccupation with widening the role of the EFSF<br />

and enlarging its resources is bound to disappoint and trigger yet another round of<br />

market panic. Unofficial estimates of how much more capital the banks included in the<br />

European stress test need to restore market confidence (ie aligning their Tier 1 capital<br />

to banks currently considered safe) range from $400 to $1000 billion. Even if the EFSF<br />

can lend a total to $440 billion, with some €100 billion already earmarked for Ireland<br />

and Portugal, this is not enough to deal just with the banking crisis.<br />

The current plan is for banks to seek fresh capital from the markets, with EFSF resources<br />

as a backstop. Conclusion 2 is that this plan will not work. Markets are worrying about<br />

the impact of contagious government defaults on banks. They will not buy into banks<br />

that are about to suffer undefined losses. Somehow, a price tag, even highly approximate,<br />

must be tacked on sovereign defaults for investors to start thinking about acquiring bank<br />

shares. They need to know which governments will default and in what proportion.<br />

Since this will not be announced ex ante, market-based bank recapitalisation is merely<br />

wishful thinking. Much the same applies to the much-talked-about support from China,<br />

Brazil, and other friends of Europe. They well understand that they stand to throw good<br />

10<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

M1<br />

2010<br />

M4<br />

2010<br />

M7<br />

2010<br />

M10<br />

2010<br />

M1<br />

2011<br />

M4<br />

2011<br />

M7<br />

2011<br />

M10<br />

2011<br />

Spain Portugal Ireland Italy Greece France