Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

VOX Research-based policy analysis and commentary from leading economists<br />

46<br />

with financial crises, in other words, much more severe than those employed in<br />

stress tests this year both in the US and Europe.<br />

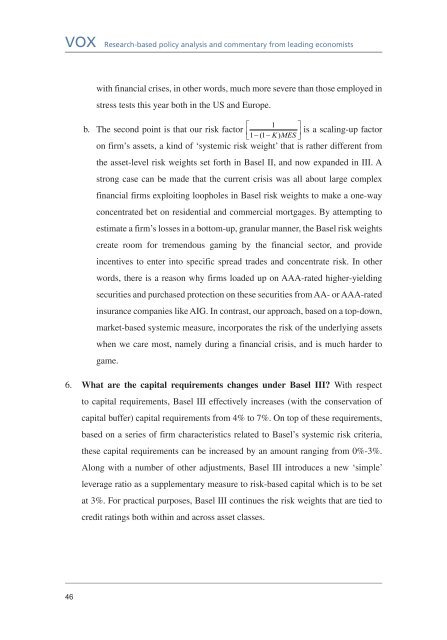

⎡ 1 ⎤<br />

b. The second point is that our risk factor ⎢<br />

1 − (1 − K) MES<br />

⎥ is a scaling-up factor<br />

⎣ ⎦<br />

on firm’s assets, a kind of ‘systemic risk weight’ that is rather different from<br />

the asset-level risk weights set forth in Basel II, and now expanded in III. A<br />

strong case can be made that the current crisis was all about large complex<br />

financial firms exploiting loopholes in Basel risk weights to make a one-way<br />

concentrated bet on residential and commercial mortgages. By attempting to<br />

estimate a firm’s losses in a bottom-up, granular manner, the Basel risk weights<br />

create room for tremendous gaming <strong>by</strong> the financial sector, and provide<br />

incentives to enter into specific spread trades and concentrate risk. In other<br />

words, there is a reason why firms loaded up on AAA-rated higher-yielding<br />

securities and purchased protection on these securities from AA- or AAA-rated<br />

insurance companies like AIG. In contrast, our approach, based on a top-down,<br />

market-based systemic measure, incorporates the risk of the underlying assets<br />

when we care most, namely during a financial crisis, and is much harder to<br />

game.<br />

6. What are the capital requirements changes under Basel III? With respect<br />

to capital requirements, Basel III effectively increases (with the conservation of<br />

capital buffer) capital requirements from 4% to 7%. On top of these requirements,<br />

based on a series of firm characteristics related to Basel’s systemic risk criteria,<br />

these capital requirements can be increased <strong>by</strong> an amount ranging from 0%-3%.<br />

Along with a number of other adjustments, Basel III introduces a new ‘simple’<br />

leverage ratio as a supplementary measure to risk-based capital which is to be set<br />

at 3%. For practical purposes, Basel III continues the risk weights that are tied to<br />

credit ratings both within and across asset classes.