Contents - Tanzania Revenue Authority

Contents - Tanzania Revenue Authority

Contents - Tanzania Revenue Authority

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

At the end of each tax period add the figures on each heading<br />

and insert them on your VAT returns.<br />

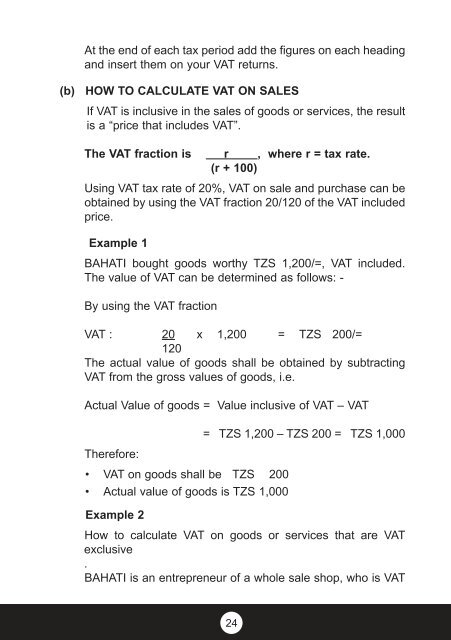

(b) HOW TO CALCULATE VAT ON SALES<br />

If VAT is inclusive in the sales of goods or services, the result<br />

is a “price that includes VAT”.<br />

The VAT fraction is r , where r = tax rate.<br />

(r + 100)<br />

Using VAT tax rate of 20%, VAT on sale and purchase can be<br />

obtained by using the VAT fraction 20/120 of the VAT included<br />

price.<br />

Example 1<br />

BAHATI bought goods worthy TZS 1,200/=, VAT included.<br />

The value of VAT can be determined as follows: -<br />

By using the VAT fraction<br />

VAT : 20 x 1,200 = TZS 200/=<br />

120<br />

The actual value of goods shall be obtained by subtracting<br />

VAT from the gross values of goods, i.e.<br />

Actual Value of goods = Value inclusive of VAT – VAT<br />

= TZS 1,200 – TZS 200 = TZS 1,000<br />

Therefore:<br />

• VAT on goods shall be TZS 200<br />

• Actual value of goods is TZS 1,000<br />

Example 2<br />

How to calculate VAT on goods or services that are VAT<br />

exclusive<br />

.<br />

BAHATI is an entrepreneur of a whole sale shop, who is VAT<br />

24