Contents - Tanzania Revenue Authority

Contents - Tanzania Revenue Authority

Contents - Tanzania Revenue Authority

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

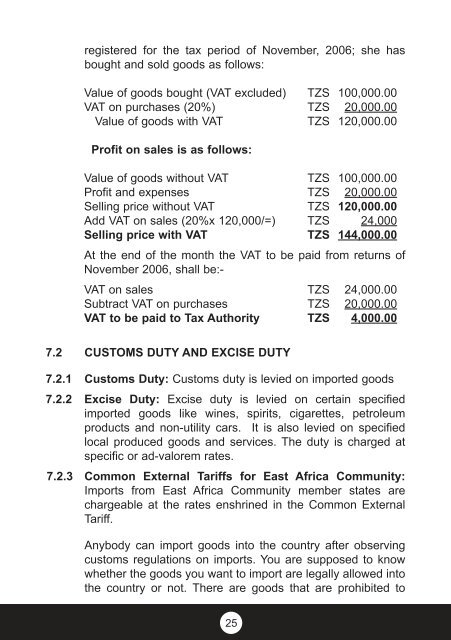

egistered for the tax period of November, 2006; she has<br />

bought and sold goods as follows:<br />

Value of goods bought (VAT excluded) TZS 100,000.00<br />

VAT on purchases (20%) TZS 20,000.00<br />

Value of goods with VAT TZS 120,000.00<br />

Profit on sales is as follows:<br />

Value of goods without VAT TZS 100,000.00<br />

Profit and expenses TZS 20,000.00<br />

Selling price without VAT TZS 120,000.00<br />

Add VAT on sales (20%x 120,000/=) TZS 24,000<br />

Selling price with VAT TZS 144,000.00<br />

At the end of the month the VAT to be paid from returns of<br />

November 2006, shall be:-<br />

VAT on sales TZS 24,000.00<br />

Subtract VAT on purchases TZS 20,000.00<br />

VAT to be paid to Tax <strong>Authority</strong> TZS 4,000.00<br />

7.2 CUSTOMS DUTY AND EXCISE DUTY<br />

7.2.1 Customs Duty: Customs duty is levied on imported goods<br />

7.2.2 Excise Duty: Excise duty is levied on certain specified<br />

imported goods like wines, spirits, cigarettes, petroleum<br />

products and non-utility cars. It is also levied on specified<br />

local produced goods and services. The duty is charged at<br />

specific or ad-valorem rates.<br />

7.2.3 Common External Tariffs for East Africa Community:<br />

Imports from East Africa Community member states are<br />

chargeable at the rates enshrined in the Common External<br />

Tariff.<br />

Anybody can import goods into the country after observing<br />

customs regulations on imports. You are supposed to know<br />

whether the goods you want to import are legally allowed into<br />

the country or not. There are goods that are prohibited to<br />

25