XETRA Circular 072/05

XETRA Circular 072/05

XETRA Circular 072/05

- TAGS

- xetra

- circular

- www.xetra.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

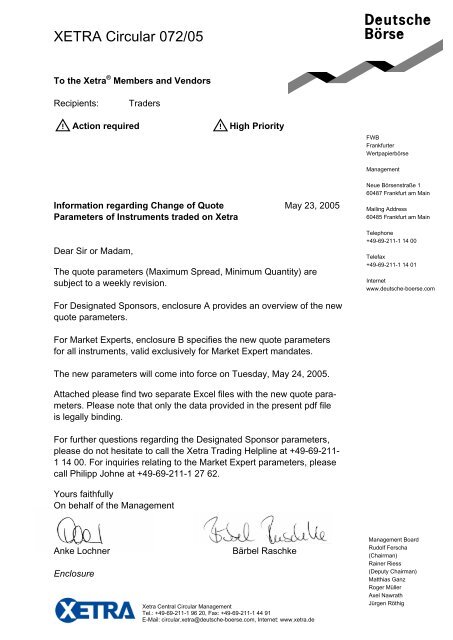

<strong>XETRA</strong> <strong>Circular</strong> <strong>072</strong>/<strong>05</strong><br />

To the Xetra ® Members and Vendors<br />

Recipients: Traders<br />

U Action required U High Priority<br />

Information regarding Change of Quote May 23, 20<strong>05</strong><br />

Parameters of Instruments traded on Xetra<br />

Dear Sir or Madam,<br />

The quote parameters (Maximum Spread, Minimum Quantity) are<br />

subject to a weekly revision.<br />

For Designated Sponsors, enclosure A provides an overview of the new<br />

quote parameters.<br />

For Market Experts, enclosure B specifies the new quote parameters<br />

for all instruments, valid exclusively for Market Expert mandates.<br />

The new parameters will come into force on Tuesday, May 24, 20<strong>05</strong>.<br />

Attached please find two separate Excel files with the new quote para-<br />

meters. Please note that only the data provided in the present pdf file<br />

is legally binding.<br />

For further questions regarding the Designated Sponsor parameters,<br />

please do not hesitate to call the Xetra Trading Helpline at +49-69-211-<br />

1 14 00. For inquiries relating to the Market Expert parameters, please<br />

call Philipp Johne at +49-69-211-1 27 62.<br />

Yours faithfully<br />

On behalf of the Management<br />

Anke Lochner Bärbel Raschke<br />

Enclosure<br />

Xetra Central <strong>Circular</strong> Management<br />

Tel.: +49-69-211-1 96 20, Fax: +49-69-211-1 44 91<br />

E-Mail: circular.xetra@deutsche-boerse.com, Internet: www.xetra.de<br />

FWB<br />

Frankfurter<br />

Wertpapierbörse<br />

Management<br />

Neue Börsenstraße 1<br />

60487 Frankfurt am Main<br />

Mailing Address<br />

60485 Frankfurt am Main<br />

Telephone<br />

+49-69-211-1 14 00<br />

Telefax<br />

+49-69-211-1 14 01<br />

Internet<br />

www.deutsche-boerse.com<br />

Management Board<br />

Rudolf Ferscha<br />

(Chairman)<br />

Rainer Riess<br />

(Deputy Chairman)<br />

Matthias Ganz<br />

Roger Müller<br />

Axel Nawrath<br />

Jürgen Röthig

Page 2 May 23, 20<strong>05</strong><br />

Enclosure A: Designated Sponsor Parameters<br />

Instrument<br />

Short<br />

Name ISIN WKN Liquidity<br />

Group Code<br />

Class Spread P Quantity<br />

AFR1 OT5 OTI ON TRACK INN.IS-,10 IL0010834682 924895 3 5 P 1000<br />

ASI1 EAR EBARA CORP.YN 50 JP3166000004 858656 4 10 P 1800<br />

ASI1 FJI FUJI PHOTO FILMYN 50 JP3814000000 854607 4 7 P 300<br />

ASI1 FUJ FUJITSU LTD.DZ DE0008632639 863263 4 10 P 1200<br />

ASI1 FUJ1 FUJITSU LTD JP3818000006 855182 4 10 P 1200<br />

ASI1 KUO KUBOTA CORP. YN 50 DZ DE0008619834 861983 4 10 P 1200<br />

ASI1 MIE MITSUBISHI EL. DZ DE0008621392 862139 4 10 P 1200<br />

ASI1 NIK1 NIKKO CORDI. JP3670000003 857085 4 10 P 1500<br />

ASI1 TEC TOSH.TEC CORP.YN50 DZ DE0008647504 864750 4 10 P 1500<br />

ASI2 KAJ KAJIMA CORP. JP3210200006 857003 4 10 P 1900<br />

ASI2 KPI1 KONICA MINOLTA HLDGS INC. JP3300600008 857929 4 0,56 A 800<br />

ASI2 KUO1 KUBOTA CORP.YN 50 JP32664000<strong>05</strong> 857751 4 10 P 1200<br />

ASI2 NKN NIKON CORP.YN 50 JP3657400002 853326 4 7 P 600<br />

ASI2 TECA TOSHIBA TEC CORP.YN 50 JP3594000006 857990 4 10 P 1400<br />

ASI2 WFD MITSUB.PHAR.YN 50 JP3155380003 858755 4 0,56 A 800<br />

ASI2 YFM SOMPO JAPANYN 50 JP3932400009 855983 4 0,56 A 700<br />

AST1 BEO BEKO HLDG AG AT0000908603 92<strong>05</strong>03 4 0,56 A 800<br />

FRA1 CGM CAP GEMINI INH.EO 8 FR0000125338 869858 4 7 P 200<br />

GER1 ACV AC-SERVICE AG NA O.N. DE00<strong>05</strong>110001 511000 3 0,4 A 1900<br />

GER1 AFX CARL-ZEISS MEDITEC AG DE00<strong>05</strong>313704 531370 2 4 P 1000<br />

GER1 AOF ATOSS SOFTWARE AG DE00<strong>05</strong>104400 510440 3 5 P 1100<br />

GER1 AVA AVA AG O.N. DE00<strong>05</strong>088504 508850 1 2,5 P 500<br />

GER1 BSS BETA SYST.SOFTW.AG O.N. DE00<strong>05</strong>224406 522440 3 5 P 800<br />

GER1 CEA CEAG AG DE0006201106 620110 3 0,4 A 1800<br />

GER1 CFA CONSTANTIN FILM AG O.N. DE00<strong>05</strong>800809 580080 3 5 P 1100<br />

GER1 ECK LUDW.BECK A.RATHAUSECK DE00<strong>05</strong>1999<strong>05</strong> 519990 3 0,4 A 1900<br />

GER1 EHX ESSANELLE HAIR GROUP O.N. DE0006610314 661031 3 0,4 A 1700<br />

GER1 EUZ ECKERT+ZIEGLER AG O.N. DE00<strong>05</strong>659700 565970 3 5 P 1000<br />

GER1 IXX INIT INNOVATION O.N. DE00<strong>05</strong>759807 575980 2 0,32 A 2000<br />

GER1 JTT JETTER AG O.N. DE00062640<strong>05</strong> 626400 3 5 P 1100<br />

GER1 LEI LEIFHEIT AG O.N. DE0006464506 646450 2 4 P 700<br />

GER1 LIA LINOS O.N. DE00<strong>05</strong>256507 525650 3 5 P 1100<br />

GER1 NEM NEMETSCHEK AG O.N. DE0006452907 645290 2 4 P 1000<br />

GER1 OGG CDV SOFTWARE O.N. DE00<strong>05</strong>488126 548812 2 4 P 1600<br />

GER1 OHB OHB TECHNOLOGY O.N. DE00<strong>05</strong>936124 593612 3 0,4 A 1400<br />

GER1 ONV ONVISTA O.N. DE00<strong>05</strong>461602 546160 3 0,4 A 1600<br />

GER1 PHO PHOENIX AG O.N. DE0006031008 603100 1 2,5 P 1000<br />

GER1 PSA2 PSI AG F.PR.U.SYS.O.N. DE0006968225 696822 3 10 P 2000<br />

GER1 PUI P U.I PER.U.INFO.AG O.N. DE0006913403 691340 2 4 P 1600<br />

GER1 PWO PROGRESS-WERK OBERK. O.N. DE0006968001 696800 3 5 P 400<br />

GER1 RBX ARBOMEDIA AG O.N. DE00<strong>05</strong>489306 548930 3 10 P 2000<br />

GER1 RSL1 R. STAHL AG O.N. DE00<strong>072</strong>57727 725772 2 4 P 1100<br />

GER1 RUK RUECKER AG O.N. DE00070411<strong>05</strong> 704110 3 0,4 A 1800<br />

GER1 RZS ROEDER ZELTSYS.U.SERVICE DE0007066003 706600 3 5 P 400<br />

GER1 SHW SHS AG O.N. DE00<strong>05</strong><strong>072</strong>409 5<strong>072</strong>40 2 0,32 A 2000<br />

GER1 SIS SILICON SENSOR INT. O.N. DE00<strong>072</strong>01907 720190 2 4 P 1200<br />

GER1 SRT3 SARTORIUS AG VZO O.N. DE0007165631 716563 3 5 P 700<br />

GER1 TPE PVA TEPLA AG O.N. DE0007461006 746100 3 0,4 A 1700<br />

GER1 ULC UNITED LABELS O.N. DE00<strong>05</strong>489561 548956 3 0,4 A 1600<br />

GER1 VRI VARETIS AG DE0006911902 691190 3 0,4 A 1500<br />

Max.<br />

A/<br />

Min.

Page 3 May 23, 20<strong>05</strong><br />

Instrument<br />

Short<br />

Name ISIN WKN Liquidity<br />

Group Code<br />

Class Spread P Quantity<br />

GER1 YSN SECUNET SECURITY AG O.N. DE00<strong>072</strong>76503 727650 3 0,4 A 1300<br />

GER2 BKM BK GRUNDBES.+BETEIL. DE00<strong>05</strong>250708 525070 3 5 P 900<br />

GER2 KPG KOLBENSCHMIDT PIERB.O.N. DE00070379<strong>05</strong> 703790 3 5 P 300<br />

GER2 MC9 MERCATURA COSM. AG DE0007552887 755288 2 0,32 A 2000<br />

GER2 MGN MOLOGEN AG DE0006637200 663720 2 0,32 A 2000<br />

GER2 MHH MEDISANA AG DE00<strong>05</strong>492540 549254 3 0,4 A 1600<br />

GER2 RWD ROHWEDDER AG O.N. DE0007<strong>05</strong>77<strong>05</strong> 7<strong>05</strong>770 3 0,4 A 1400<br />

GER2 SBS STRATEC BIOMED.SY.EO 1 DE00<strong>072</strong>89001 728900 3 5 P 500<br />

GER2 SFX SOLAR-FABRIK AG O.N. DE0006614712 661471 2 4 P 1400<br />

GER2 SMW SM WIRTSCHAFTSBERAT. DE00<strong>072</strong>38701 723870 3 0,4 A 2000<br />

GER2 SOO1 SOLON AG<br />

F.SOLARTECH.KONV<br />

DE0007471195 747119 2 4 P 500<br />

GER2 SWA SEKTK.SCHLOSS WACHEN-<br />

HEIM<br />

DE00<strong>072</strong>29007 722900 2 4 P 1500<br />

GER2 VAB VEM AKTIENBANK AG O.N. DE0007608309 760830 2 4 P 1000<br />

ITA1 FIAT FIAT ORD.EO 5 IT0001976403 860007 4 0,56 A 900<br />

ITA1 MDS MEDIASET S.P.A.EO 0,52 IT0001063210 901402 4 7 P 600<br />

LUX1 APM AD PEPPER MEDIAEO 0,10 NL0000238145 940883 3 0,4 A 2000<br />

LUX1 IFE1 IFCO SYSTEMS NVEO-,01 NL0000268456 157670 3 0,4 A 1300<br />

LUX1 KNP BUHRMANN NVEO 1,20 NL0000343135 851508 4 0,56 A 700<br />

MDX1 BZL BERU AG O.N. DE00<strong>05</strong><strong>072</strong>102 5<strong>072</strong>10 2 4 P 300<br />

MDX1 EAD EUROP.AERON.DEF.+SP. EADS NL0000235190 938914 1 2,5 P 900<br />

MDX1 IVG IVG IMMOBILIEN AG O.N. DE00062<strong>05</strong>701 62<strong>05</strong>70 1 2,5 P 1400<br />

MDX1 MDN MEDION AG O.N. DE00066<strong>05</strong>009 66<strong>05</strong>00 3 5 P 800<br />

MDX1 MPC MPC MUENCH.PET.CAP.O.N. DE00<strong>05</strong>187603 518760 1 2,5 P 500<br />

MDX1 RHM RHEINMETALL AG DE0007030009 703000 1 2,5 P 500<br />

MDX1 WIN WINCOR NIXDORF O.N. DE000A0CAYB2 A0CAYB 1 2,5 P 300<br />

NAM1 SAR SAUER-DANFOSS INC. DL-,01 US8041371076 880208 3 5 P 700<br />

NAM5 GHI GIB GLOB.INT.B. PFD REG.S USU3164K1089 A0B8TR 4 0,56 A 700<br />

NEWX IRK IRKUTSKENERGO ADR/50RL1 US4627141066 9<strong>05</strong>083 4 7 P 600<br />

SDX1 ARE AIG INTERNAT. REAL NA DE0006344211 634421 2 4 P 600<br />

SDX1 BYW6 BAYWA AG VINK.NA. O.N. DE00<strong>05</strong>194062 519406 3 5 P 800<br />

SDX1 CEV CENTROTEC SUSTAINABLE O.N DE00<strong>05</strong>407506 540750 2 4 P 700<br />

SDX1 CWC CEWE COLOR HOLDING O.N. DE00<strong>05</strong>403901 540390 3 5 P 400<br />

SDX1 FXX FLUXX.COM AG DE00<strong>05</strong>763502 576350 1 2,5 P 1900<br />

SDX1 KLK KLOECKNER-WERKE O.N. DE0006780000 678000 2 4 P 1300<br />

SDX1 LOE LOEWE AG O.N. DE0006494107 649410 2 4 P 1700<br />

SDX1 MVV MVV ENERGIE AG O.N. DE00<strong>072</strong>55903 725590 2 4 P 1000<br />

SDX1 SIX2 SIXT AG ST O.N. DE00<strong>072</strong>31326 723132 2 4 P 1000<br />

SDX1 SIX3 SIXT AG VZO O.N. DE00<strong>072</strong>31334 723133 2 4 P 1100<br />

SDX1 SKB KOENIG + BAUER AG ST O.N. DE0007193500 719350 2 4 P 800<br />

SDX1 VIA VIVACON AG O.N. DE0006048911 604891 1 2,5 P 1400<br />

SDX1 WAS H+R WASAG AG DE0007757007 775700 2 4 P 1300<br />

SDX1 ZPF ZAPF CREATION AG O.N. DE0007806002 780600 1 2,5 P 1900<br />

SKA1 NBZF NORDEA BANK FDREO 0,40 FI0009902530 931<strong>05</strong>5 4 0,56 A 700<br />

STX1 AEN AEGON NVEO-12 NL0000301760 858185 4 7 P 500<br />

STX1 BOY BCO BIL.VIZ.ARG.NOM.EO-49 ES0113211835 875773 4 7 P 400<br />

STX1 BTQ BT GROUP PLCLS 0.<strong>05</strong> GB0030913577 794796 4 10 P 1700<br />

STX1 SCR SCHWEIZ.RUECKV.N.SF 0,10 CH0012332372 852246 4 7 P 100<br />

STX1 TIM TELECOM ITALIA MOB.EO0,06 IT0001<strong>05</strong>2049 896356 4 10 P 1100<br />

STX1 TQI TELECOM ITALIAEO 0,55 IT0003497168 120470 4 10 P 1900<br />

SWI1 BERN BERNA BIOTECH NAM. SF 0,4 CH0014298019 884627 4 10 P 1000<br />

SWI1 CGI CIBA SPEZ.CH.HLDG NA SF 1 CH00<strong>05</strong>819724 9<strong>05</strong>373 4 7 P 200<br />

Max.<br />

A/<br />

Min.

Page 4 May 23, 20<strong>05</strong><br />

Instrument<br />

Short<br />

Name ISIN WKN Liquidity<br />

Group Code<br />

Class Spread P Quantity<br />

SWI1 ERO1 EROTIC MEDIA AG INH. SF 1 CH0016458363 121527 4 0,56 A 800<br />

SWI1 MTH BB MEDTECH INH.SF 2 CH0000428661 898194 3 5 P 400<br />

TDX1 BBZ BB BIOTECH INH.SF 1 CH0001441580 888509 3 5 P 300<br />

TDX1 IDS IDS SCHEER AG O.N. DE0006257009 625700 1 2,5 P 1400<br />

TDX1 RSI ROFIN SINAR TECHSDL-,01 US7750431022 902757 2 4 P 700<br />

TDX1 SOW SOFTWARE AG O.N. DE0003304002 330400 1 2,5 P 700<br />

TDX1 TLI TELES AG INFORM.TECHN. DE0007454902 745490 3 5 P 1100<br />

UKI1 TTP TRINTECH ADR 2/DL-,0027 US8966822004 622796 4 10 P 1500<br />

USS1 ALR ALTERA CORP. US0214411003 875650 4 7 P 300<br />

USS1 AP2 APPLIED MATERIALS INC. US0382221<strong>05</strong>1 865177 4 7 P 500<br />

USS1 ATD ALLEGHENY TECHNOL. DL-,01 US01741R1023 931083 4 7 P 300<br />

USS1 ATY ATI TECHS INC. CA0019411036 888576 4 7 P 500<br />

USS1 BCS BROCADE CMNCT.SYS DL-,001 US1116211087 922590 4 10 P 1600<br />

USS1 DEL DELTA AIR L.DL 1,5 US2473611083 850874 4 10 P 1900<br />

USS1 ERCA ERICSSON B SK 10 ADR/10 US2948216088 765913 4 7 P 200<br />

USS1 FXI FLEXTRONICSDL-,01 SG9999000020 890331 4 7 P 500<br />

USS1 GMC GENL MOTORSDL 1,666 US3704421<strong>05</strong>2 850000 4 7 P 200<br />

USS1 HWP HEWLETT-PACKARDDL-,01 US4282361033 851301 4 7 P 300<br />

USS1 NFS NORFOLK STHN CORP.DL 1 US6558441084 867028 4 7 P 200<br />

USS1 PEM PETSMART INC.DL-,0001 US7167681060 887162 4 7 P 200<br />

USS1 QLG QLOGIC CORP.DL-,001 US7472771010 890222 4 7 P 200<br />

USS1 RDO SIRIUS SATELLITEDL-,001 US82966U1034 904591 4 10 P 1200<br />

USS1 SAY SANMINA-SCIDL-,01 US8009071<strong>072</strong> 886288 4 10 P 1300<br />

USS1 STP STAPLES INC.DL-,0006 US8550301027 876951 4 7 P 300<br />

USS1 SYM SYMANTEC CORP.DL-,01 US8715031089 879358 4 7 P 300<br />

USS1 TLA TELLABS INC. US8796641004 867899 4 0,56 A 800<br />

USS1 VRT VERITAS SOFTWAREDL-01 US9234361098 888990 4 7 P 300<br />

Max.<br />

A/<br />

Min.

Page 5 May 23, 20<strong>05</strong><br />

Enclosure B: Market Expert Parameters<br />

US Stars<br />

Instrument ISIN WKN Mnemonic Volume Spread Home<br />

Spread Home<br />

Market closed Market open<br />

ATI Technologies Inc. CA0019411036 888576 ATY 900 5 3<br />

Garmin Ltd. KYG372601099 577963 GA1 300 5 3<br />

AES CORP. US00130H1<strong>05</strong>9 882177 AES 1000 5 3<br />

ALLEGHENY TECH US01741R1023 931083 ATD 600 5 3<br />

ALTERA CORP. US0214411003 875650 ALR 600 5 3<br />

AMER. PWR CONV. DL-,01 US0290661075 876553 APW 500 5 3<br />

APPLIED MATERIALS INC. US0382221<strong>05</strong>1 865177 AP2 900 5 3<br />

BEA SYSTEMS Inc. US0733251021 906523 BEA 1500 0,4 0,24<br />

BROCADE COMM. Inc. US1116211087 922590 BCS 3100 10 0,24<br />

CIENA CORP. US1717791016 9<strong>05</strong>348 CIE 5600 10 10<br />

CISCO SYSTEMS US17275R1023 878841 CIS 1300 5 2<br />

COGNIZANT TECH S. CORP US1924461023 915272 COZ 300 5 3<br />

COMCAST CORP SHARES US20030N1019 157484 CTP2 400 5 3<br />

COMPUWARE CORP. US2<strong>05</strong>6381096 885187 CWR 1900 0,4 0,24<br />

COSTCO WHOLESALE US22160K1<strong>05</strong>1 888351 CTO 300 5 3<br />

DELTA AIR L. US2473611083 850874 DEL 3800 10 0,24<br />

DOLLAR TREE STORES INC. US2567471063 894580 DT3 500 5 3<br />

EMC CORP. (MASS.) US2686481027 872526 EMP 900 5 3<br />

FORD MOTOR US3453708600 502391 FMC1 1300 0,4 0,24<br />

GENL EL. CO. US3696041033 851144 GEC 700 5 2<br />

GENL MOTORS US3704421<strong>05</strong>2 850000 GMC 800 5 2<br />

GENTEX CORP. DL-,06 US3719011096 868891 GTX 700 5 3<br />

HALLIBURTON CO. US4062161017 853986 HAL 400 5 3<br />

HEWLETT-PACKARD US4282361033 851301 HWP 1200 5 2<br />

Intersil Corporation US46069S1096 932546 IH9 700 5 3<br />

INTUIT US4612021034 886<strong>05</strong>3 ITU 300 5 3<br />

KLA-TENCOR CORP. US4824801009 865884 KLA 300 5 3<br />

Level 3 Communications, Inc. US52729N1000 912667 LVC 6300 10 10<br />

LIBERTY MEDIA INTERNATIONAL<br />

INC<br />

US5307191032 A0B5N3 LMI 400 5 3<br />

LUCENT TECHS US5494631071 899868 LUC 4400 10 10<br />

MERCURY Int. Corp. US5894<strong>05</strong>1094 890463 MRQ 300 5 3<br />

MOLEX INC. US6085541018 862269 MOX 500 5 3<br />

NORFOLK SOUTHERN CORP. US6558441084 867028 NFS 400 5 3<br />

NVIDIA CORP. US67066G1040 918422 NVD 500 5 3<br />

PETSMART INC. DL-,0001 US7167681060 887162 PEM 400 5 3<br />

PFIZER INC. SHARES DL -,<strong>05</strong> US7170811035 852009 PFE 900 5 2<br />

RF MICRO DEVICES INC. US7499411004 9<strong>072</strong>50 RFM 2800 10 0,24<br />

RADIOSHACK CORP. US7504381036 852618 TAN 500 5 3<br />

SANDISK CORP., DL-,01 US80004C1018 897826 SSK 500 5 3<br />

SANMINA CORP. US8009071<strong>072</strong> 886288 SAY 2800 10 0,24<br />

HENRY SCHEIN INC. DL-,01 US8064071025 897961 HS2 300 5 3<br />

SIRIUS SATELLITE RADIO INC US82966U1034 904591 RDO 2400 0,4 0,24<br />

SMURFIT-STONE CONT. US8327271016 917418 SFI 1200 5 3<br />

STAPLES INC. US8550301027 876951 STP 600 5 3<br />

SYMANTEC CORP. DL-,01 US8715031089 879358 SYM 600 5 3<br />

UNISYS CORP. US9092141087 85<strong>05</strong>46 USY 1900 0,4 0,24<br />

VERITAS SOFTWARE US9234361098 888990 VRT 600 5 3<br />

SCHLUMBERGER SVG AN8068571086 853390 SCL 200 5 3<br />

TYCO INTL LTD. BM9021241064 907902 TYI 500 5 3<br />

Marvell Technology Group, Inc BMG5876H1<strong>05</strong>1 930131 MVL 400 5 3

Page 6 May 23, 20<strong>05</strong><br />

Instrument ISIN WKN Mnemonic Volume Spread Home<br />

Spread Home<br />

Market closed Market open<br />

Research in Motion Limited CA7609751028 909607 RI1 200 5 3<br />

CHECK POINT SOFTW. Techn. IL0010824113 901638 CPW 600 5 3<br />

FLEXTRONICS Int. Ltd. SG9999000020 890331 FXI 1100 5 3<br />

AT + T CORP. US0019575<strong>05</strong>1 157112 ATT 700 5 3<br />

ABBOTT LABS US0028241000 850103 ABL 600 5 2<br />

ADOBE SYST. INC. US0<strong>072</strong>4F1012 871981 ADB 300 5 3<br />

ALCOA INC. US0138171014 850206 ALU 1000 5 2<br />

ALLSTATE CORP. US0200021014 886429 ALS 300 5 3<br />

ALTRIA GROUP INC. US02209S1033 200411 PHM7 400 5 2<br />

AMAZON.COM INC. US0231351067 906866 AMZ 400 5 3<br />

AMERICAN ELECTRIC POWER US0255371017 850222 AEP 400 5 3<br />

AMER. EXPRESS US0258161092 850226 AEC1 500 5 2<br />

American International Group Inc. US0268741073 859520 AIN 500 5 2<br />

AMGEN INC. US0311621009 867900 AMG 300 5 3<br />

ANHEUSER-BUSCH DL 1 US0352291035 865178 ABC 300 5 3<br />

APOLLO GROUP INC US0376041<strong>05</strong>1 898968 APO 200 5 3<br />

APPLE COMPUTER INC. US03783310<strong>05</strong> 865985 APC 400 5 3<br />

AUTODESK INC US<strong>05</strong>27691069 869964 AUD 400 5 3<br />

AVON PROD. US<strong>05</strong>43031027 853836 AVP 400 5 3<br />

BAKER HUGHES INC. US<strong>05</strong>72241075 872933 BHU 300 5 3<br />

BANK AMERICA US06<strong>05</strong><strong>05</strong>1046 858388 NCB 600 5 2<br />

BAXTER INTL US0718131099 853815 BTL 400 5 3<br />

BED BATH + BEYOND US0758961009 884304 BBY 400 5 3<br />

BELLSOUTH CORP. US0798601029 868403 BLS 1000 5 2<br />

BIOMET INC. US0906131000 868154 BOM 400 5 3<br />

BIOGEN IDEC INC. US09062X1037 789617 IDP 400 5 3<br />

BLACK + DECKER US0917971006 855120 BDC 200 5 3<br />

BOEING CO. US0970231<strong>05</strong>8 850471 BCO 500 5 2<br />

BRISTOL-MYERS SQUIBB US1101221083 85<strong>05</strong>01 BRM 600 5 3<br />

BROADCOM CORP. A US1113201073 913684 BDMA 400 5 3<br />

BURLINGTON NORTH. SANTA US12189T1043 897261 BNS 300 5 3<br />

CDW COMP. CENTERS DL-,01 US12512N1<strong>05</strong>4 812439 CDW 300 5 3<br />

C.H. ROBINSON WORLDWIDE US12541W1009 909939 CH1 300 5 3<br />

CIGNA CORP. US1255091092 866918 CGN 200 5 3<br />

CAMPBELL SOUP CO. US1344291091 85<strong>05</strong>61 CSC 500 5 3<br />

Carrer Education Corporation US1416651099 912062 CE1 400 5 3<br />

CATERPILLAR INC. US1491231015 85<strong>05</strong>98 CAT1 300 5 2<br />

CEPHALON INC. DL-,01 US1567081096 881752 CP9 300 5 3<br />

CHEVRONTEXACO CORP. SHARES US16676410<strong>05</strong> 852552 CHV 500 5 2<br />

CHIRON CORP. US1700401094 869640 CHC 400 5 3<br />

CINTAS CORP. US1729081<strong>05</strong>9 8802<strong>05</strong> CIT 400 5 3<br />

CITIGROUP INC. US1729671016 871904 TRV 600 5 2<br />

CITRIX SYSTEMS US1773761002 898407 CTX 600 5 3<br />

CLEAR CHANNEL COMMUN. INC. US1845021021 873046 CUN 500 5 3<br />

COCA-COLA CO. US1912161007 850663 CCC3 600 5 2<br />

COLGATE-PALMOLIVE US1941621039 850667 CPA 300 5 3<br />

COMPUTER SCIENCES US2<strong>05</strong>3631048 855862 CS9 300 5 3<br />

COMVERSE TECH. US2<strong>05</strong>8624022 885712 CMV 600 5 3<br />

DELL COMP. US24702R1014 121092 DLCA 700 5 2<br />

DENTSPLY INTERNATIONAL INC. US2490301<strong>072</strong> 884794 DY2 300 5 3<br />

DISNEY (WALT) CO. US2546871060 855686 WDP 1000 5 2<br />

DOW CHEM. US26<strong>05</strong>431038 850917 DCH1 300 5 3<br />

DU PONT NEMOURS US2635341090 852046 DUP 600 5 2<br />

EASTMAN KODAK US2774611097 850937 KOD 500 5 3

Page 7 May 23, 20<strong>05</strong><br />

Instrument ISIN WKN Mnemonic Volume Spread Home<br />

Spread Home<br />

Market closed Market open<br />

EBAY INC. US2786421030 916529 EBA 400 5 3<br />

ECHOSTAR COMMCTNS A US2787621091 896049 EOT 500 5 3<br />

EL PASO CORP. US28336L1098 915925 EPE 1300 0,4 0,24<br />

EL. ARTS INC. US2855121099 878372 ERT 300 5 3<br />

ENTERGY CORP. US29364G1031 889290 ETY 200 5 3<br />

ERICSSON B SK 2,50 ADR US2948216088 765913 ERCA 500 5 3<br />

EXELON CORP. US30161N1019 852011 PEO 300 5 3<br />

EXPEDITORS INTL WASH.DL01 US3021301094 875272 EW1 300 5 3<br />

EXPRESS SCRIPTS DL -,01 US3021821000 900130 ES5 200 5 3<br />

EXXON MOBIL CORP. US30231G1022 852549 XONA 500 5 2<br />

FASTENAL CO. DL-,01 US3119001044 887891 FAS 300 5 3<br />

FEDEX CORP. US31428X1063 912029 FDX 200 5 3<br />

FISERV INC. US3377381088 881793 FIV 300 5 3<br />

GENL DYNAMICS CORP. US3695501086 851143 GDX 200 5 3<br />

GENZYME CORP. US3729171047 871137 GEZ 200 5 3<br />

GILEAD SCIENCES DL-,001 US3755581036 885823 GIS 400 5 3<br />

GILLETTE CO. US3757661026 853194 GLL 300 5 3<br />

GOLDMAN SACHS GROUP INC.<br />

SHARES DL -,01<br />

US38141G1040 920332 GOS 200 5 3<br />

GOOGLE INC. US38259P5089 A0B7FY GGQ1 100 5 3<br />

HCA-HEALTH. US4041191093 883266 CUA 300 5 3<br />

HARRAH'S ENTMT US4136191073 878809 HAE 200 5 3<br />

HARTFORD FINL SVCS GRP US4165151048 898521 HFF 200 5 3<br />

HEINZ -H.J.- CO. US4230741039 851291 HJH 400 5 3<br />

HOME DEPOT INC. US4370761029 866953 HDI 700 5 2<br />

HONEYWELL INTL US4385161066 870153 ALD 700 5 2<br />

HUMAN GENOME Sc. US4449031081 889323 HGS 1200 5 3<br />

IAC Interactive Corp US44919P1021 A0B686 HNI 600 5 3<br />

ICOS CORP. DL-,01 US4492951045 882008 ICO 600 5 3<br />

INTEL CORP. US4581401001 855681 INL 1000 5 2<br />

INTL BUS. MACH. US4592001014 851399 IBM 400 5 2<br />

INTL PAPER US4601461035 851413 INP 400 5 3<br />

INVITROGEN CORP. DL-,01 US46185R10<strong>05</strong> 919313 IVN 200 5 3<br />

JDS UNIPHASE CORP US46612J1016 890488 UNS 8700 10 10<br />

J.P. MORGAN CHASE CO. US46625H10<strong>05</strong> 850628 CMC 800 5 2<br />

JOHNSON + JOHNSON US4781601046 853260 JNJ 400 5 2<br />

JUNIPER NETWORKS US48203R1041 923889 JNP 600 5 3<br />

Lam Research Corporation US5128071082 869686 LAR 500 5 3<br />

LAMAR ADVERTISING CO. US5128151017 902200 LA1A 400 5 3<br />

LEHMAN BROTHERS HOLDINGS<br />

INC.<br />

US5249081002 891041 LEM 200 5 3<br />

LILLY (ELI) US5324571083 858560 LLY 500 5 2<br />

LIMITED INC. US5327161<strong>072</strong> 864007 LTD 700 5 3<br />

LINCARE HOLDINGS INC. US53279110<strong>05</strong> 885352 LI2 300 5 3<br />

LINEAR TECH. CORP. US5356781063 872629 LTC 400 5 3<br />

MCI INC US5526911079 A0BMK0 OM8 600 5 3<br />

MAXIM INTEGR.PRODS US57772K1016 876158 MXI 400 5 3<br />

MAY DEPT STRS US5777781031 8517<strong>05</strong> MDZ 400 5 3<br />

MCDONALDS CORP. US5801351017 856958 MDO 900 5 2<br />

MEDIMMUNE INC. US5846991025 881824 MDU 500 5 3<br />

MEDTRONIC Inc. US585<strong>05</strong>51061 858486 MDT 300 5 3<br />

MERCK CO. US5893311077 851719 MCC 800 5 2<br />

MERRILL LYNCH US5901881087 852935 MER 300 5 3<br />

MICROSOFT CORP. US5949181045 870747 MSF 1000 5 2<br />

MICROCHIP TECH. US5950171042 8861<strong>05</strong> MCP 500 5 3

Page 8 May 23, 20<strong>05</strong><br />

Instrument ISIN WKN Mnemonic Volume Spread Home<br />

Spread Home<br />

Market closed Market open<br />

MILLENNIUM PHARMAC. Inc. US5999021034 900625 MIP 1500 0,4 0,24<br />

MONSTER WORLDWIDE INC. US6117421<strong>072</strong> 484840 TMW 600 5 3<br />

MORGAN ST., DEAN W. US6174464486 885836 DWD 600 5 2<br />

NTL INCORPORATED US62940M1045 172950 NLL 300 5 3<br />

NATL SEMICONDUCTOR US6376401039 857469 NSM 700 5 3<br />

NETWORK APPLIANCE US64120L1044 898173 NTA 500 5 3<br />

NEXTEL COMM. A US65332V1035 887172 NXCA 500 5 3<br />

NOVELLUS SYSTEMS Inc. US6700081010 875715 NVS 600 5 3<br />

OFFICE MAX US67622P1012 A0DLJT BCD 500 5 3<br />

ORACLE CORP. US68389X1<strong>05</strong>4 871460 ORC 1100 5 3<br />

PACCAR INC. US6937181088 861114 PAE 200 5 3<br />

PATTERSON COMPANIES INC. US7033951036 A0B6KB PD2 300 5 3<br />

PATTERS.-UTI DL-,01 US7034811015 9<strong>05</strong>153 PE1 600 5 3<br />

PAYCHEX INC. US7043261079 868284 PCX 500 5 3<br />

PEPSICO INC. US7134481081 851995 PEP 500 5 2<br />

PIXAR INC. US7258111035 898293 PIX 300 5 3<br />

PROCTER GAMBLE US7427181091 852062 PRG 500 5 2<br />

QLOGIC CORP. US7472771010 890222 QLG 500 5 3<br />

QUALCOMM INC. US7475251036 883121 QCI 400 5 3<br />

RAYTHEON CO. US7551115071 785159 RTN1 400 5 3<br />

ROCKWELL INTL US7739031091 903978 RWL 300 5 3<br />

ROSS STRS INC. DL-,01 US7782961038 870<strong>05</strong>3 RSO 500 5 3<br />

SBC COMMUNICTNS US78387G1031 868406 SOB 1100 5 2<br />

SARA LEE CORP. US8031111037 850788 LEE 700 5 3<br />

SEARS HOLDINGS CORP. US8123501061 A0D9H0 SEE 100 5 3<br />

SIEBEL SYS INC. US8261701028 901645 SST 1400 0,4 0,24<br />

SIGMA-ALDRICH CORP. US8265521018 863120 SIQ 300 5 3<br />

STHN CO. US8425871071 852523 SOT 400 5 3<br />

STARBUCKS CORP. US8552441094 884437 SRB 300 5 3<br />

SUN MICROS.INC. US8668101046 871111 SSY 3300 10 0,24<br />

SYNOPSYS INC. DL-,01 US8716071076 883703 SYP 800 5 3<br />

TELLABS INC. US8796641004 867899 TLA 1700 0,4 0,24<br />

TEVA PHARMACEUTICAL INDS LTD. US8816242098 883035 TEV 400 5 3<br />

TEXAS INSTR. US8825081040 852654 TII 500 5 3<br />

3M Co. US88579Y1010 851745 MMM 400 5 2<br />

TIME WARNER INC. DL.01 US8873171<strong>05</strong>7 592629 AOL 1500 5 2<br />

TOYS R US INC. (HLDG CO.) US8923351006 851422 TRU 500 5 3<br />

U.S. BANCORP. DEL. US9029733048 917523 UB5 500 5 3<br />

UTD TECHN. US9130171096 852759 UTC1 300 5 2<br />

VERISIGN INC. US92343E1029 911090 VRS 500 5 3<br />

Verizon Communications Inc. US92343V1044 868402 BAC 800 5 2<br />

VIACOM INC. B US9255243084 880486 VICB 400 5 3<br />

WAL-MART STRS US9311421039 860853 WMT 600 5 2<br />

WELLS FARGO + CO. US9497461015 857949 NWT 300 5 3<br />

WEYERHAEUSER CO. US9621661043 854357 WHC 200 5 3<br />

WHOLE FOODS MARKET INC. US9668371068 886391 WFM 200 5 3<br />

WILLIAMS COS INC. US9694571004 855451 WMB 800 5 3<br />

WYETH DL-,333 US9830241009 850229 AHP 600 5 2<br />

WYNN RESORTS LIMITED US9831341071 663244 WYR 300 5 3<br />

XM SATELLITE RADIO HOLDINGS<br />

INC<br />

US9837591018 928258 XM1A 500 5 3<br />

XILINX INC. US9839191015 880135 XIX 500 5 3<br />

XEROX CORP. US9841211033 853906 XER 1000 5 3<br />

YAHOO INC. US9843321061 900103 YHO 400 5 3

Page 9 May 23, 20<strong>05</strong><br />

Dutch Stars<br />

Instrument ISIN WKN Mnemonic Volume Spread Home<br />

Spread Home<br />

Market closed Market open<br />

Royal Dutch Petroleum NL0000009470 9075<strong>05</strong> ROY 1.100 2 1<br />

Aegon NL0000301760 858185 AEN 5.000 2 1<br />

Ahold NL0000331817 851287 AHO 8.300 0,16 0,1<br />

Fortis BE0003801181 982570 FO4 2.300 2 1<br />

Unilever NL0000009348 860028 UNI 1.000 2 1<br />

Philips NL0000009538 940602 PHI1 2.500 2 1<br />

ABN Amro NL0000301109 880026 AAR 2.700 2 1<br />

ING Groep NL0000303600 881111 INN 2.300 2 1<br />

French Stars<br />

Instrument ISIN WKN Mnemonic Volume Spread Home<br />

Spread Home<br />

Market closed Market open<br />

CRÉDIT AGRICOLE S.A. FR0000045<strong>072</strong> 982285 XCA 2.300 2 1<br />

CARREFOUR EO 2,5 FR0000120172 852362 CAR 1.300 2 1<br />

LAFARGE EO 4 FR000012<strong>05</strong>37 850646 CIL 700 2 1<br />

ST GOBAIN EO 16 FR0000125007 872087 GOB 1.100 2 1<br />

ALCATEL A EO 2 FR0000130007 873102 CGE 5.500 2 1<br />

AIR LIQUIDE EO 11 FR0000120073 850133 AIR 400 2 1<br />

TOTAL FINA ELF SA B EO 10 FR0000120271 85<strong>072</strong>7 TOTB 300 2 1<br />

OREAL (L') EO 0,2 FR0000120321 853888 LOR 900 2 1<br />

SUEZ S.A. EO 2 FR000012<strong>05</strong>29 852491 LYO 2.300 2 1<br />

SANOFI-SYNTHELABO EO 2 FR000012<strong>05</strong>78 920657 SNW 800 2 1<br />

AXA S.A. EO 2,29 FR0000120628 8557<strong>05</strong> AXA 2.600 2 1<br />

GROUPE DANONE EO 1 FR0000120644 851194 BSN 700 2 1<br />

LVMH EO 0,3 FR0000121014 853292 MOH 900 2 1<br />

VIVENDI UNIVERSAL EO 5,5 FR0000127771 591068 VVU 2.100 2 1<br />

STE GENERALE EO 1,25 FR0000130809 873403 SGE 700 2 1<br />

BNP PARIBAS EO 4 FR0000131104 887771 BNP 1.000 2 1<br />

FRANCE TELECOM EO 4 FR0000133308 906849 FTE 2.200 2 1