Annual Report 2011 - Magnitogorsk Iron & Steel Works ...

Annual Report 2011 - Magnitogorsk Iron & Steel Works ...

Annual Report 2011 - Magnitogorsk Iron & Steel Works ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2011</strong> /<br />

ANNUAL REPORT<br />

About Us Sales Markets<br />

Finances<br />

Risks<br />

Social Sphere<br />

Management<br />

Information<br />

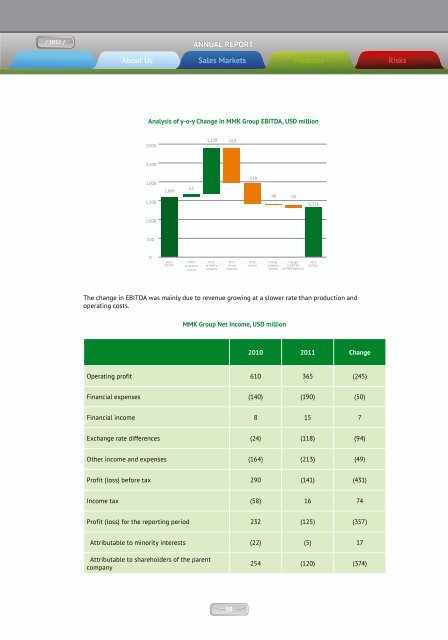

The change in EBITDA was mainly due to revenue growing at a slower rate than production and<br />

operating costs.<br />

MMK Group Net Income, USD million<br />

2010 <strong>2011</strong> Сhange<br />

Operating profit 610 365 (245)<br />

Financial expenses (140) (190) (50)<br />

Financial income 8 15 7<br />

Exchange rate differences (24) (118) (94)<br />

Other income and expenses (164) (213) (49)<br />

Profit (loss) before tax 290 (141) (431)<br />

Income tax (58) 16 74<br />

Profit (loss) for the reporting period 232 (125) (357)<br />

Attributable to minority interests (22) (5) 17<br />

Attributable to shareholders of the parent<br />

company<br />

Analysis of y-o-y Change in MMK Group EBITDA, USD million<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

1,606<br />

2010<br />

EBITDA<br />

63<br />

MMK's<br />

production<br />

volume<br />

1,229 -919<br />

Price<br />

of MMK's<br />

products<br />

Price<br />

of raw<br />

materials<br />

-539<br />

Other<br />

factors<br />

-48 -55<br />

Change<br />

in Belon's<br />

EBITDA<br />

Change<br />

in EBITDA<br />

of MMK-Metalurji<br />

1,336<br />

<strong>2011</strong><br />

EBITDA<br />

254 (120) (374)<br />

The increase in financial expenses was due to borrowed funds raised for business development. Other<br />

costs rose mainly due to an increase in social tax payments.<br />

The negative exchange rate difference of USD 118 million had a significant influence on financial<br />

performance in <strong>2011</strong>.<br />

The Company recorded a net loss of USD 125 million for the period, of which USD 120 million was<br />

attributable to shareholders of the parent company.<br />

<strong>Steel</strong> production<br />

unit of<br />

measure<br />

Thousand<br />

tonnes<br />

Russia steel segment<br />

38 39<br />

2010 <strong>2011</strong> Сhange Change (%)<br />

10,253 10,653 400 4 %<br />

Revenue from sales including USD million 7,436 8,914 1,478 20 %<br />

Sales to the Group’s<br />

companies<br />

USD million 11 178 167 в 17 x<br />

Third parties USD million 7,425 8,736 1,311 18 %<br />

EBITDA USD million 1,347 1,187 –160 –12 %<br />

EBITDA margin % 18.1 % 13.3 % –4.8 %<br />

EBITDA per ton of steel<br />

products<br />

USD/t 131 111 –20 –15 %<br />

Capital expenditures USD million 1,451 859 –592<br />

The Group’s financial performance is substantially driven by the Russian steel segment, which includes<br />

OJSC MMK and its steel producing subsidiaries in <strong>Magnitogorsk</strong>; MMK-METIZ Metalware and Sizing Plant;<br />

the downstream steel processing plants MMK-Profil-Moskva and Intercos-IV; and trading companies.<br />

Thanks to improved market conditions, in <strong>2011</strong> revenue from sales to third parties rose by 18 % year-onyear<br />

to USD 8,736 million.<br />

In <strong>2011</strong>, capex in the steel segment was USD 859 million, or 74 % of total investments. Capital<br />

expenditure focused on construction of the cold-rolling complex and other projects at the <strong>Magnitogorsk</strong><br />

production site.