Annual Report 2011 - Magnitogorsk Iron & Steel Works ...

Annual Report 2011 - Magnitogorsk Iron & Steel Works ...

Annual Report 2011 - Magnitogorsk Iron & Steel Works ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2011</strong> /<br />

as of<br />

31.12.2010<br />

as of<br />

31.12.<strong>2011</strong><br />

ANNUAL REPORT<br />

About Us Sales Markets<br />

Finances<br />

Risks<br />

Social Sphere<br />

Management<br />

Information<br />

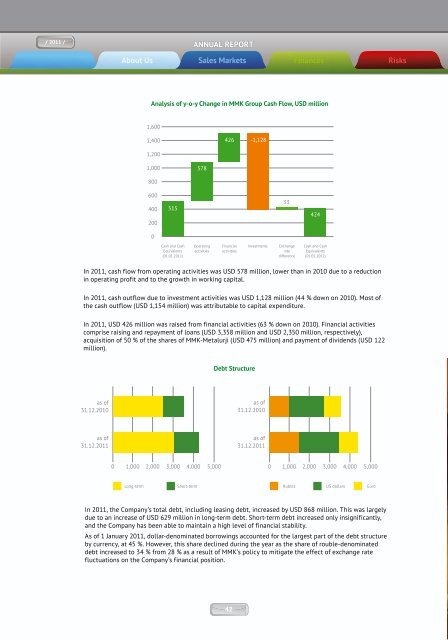

Analysis of y-o-y Change in MMK Group Cash Flow, USD million<br />

1,600<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

515<br />

Cash and Cash<br />

Equivalents<br />

(01.01.<strong>2011</strong>)<br />

0 1,000 2,000 3,000 4,000 5,000<br />

Long-term Short-term<br />

578<br />

Operating<br />

activities<br />

426<br />

Financial<br />

activities<br />

-1,128<br />

as of<br />

31.12.2010<br />

as of<br />

31.12.<strong>2011</strong><br />

33<br />

Investments Exchange<br />

rate<br />

difference<br />

424<br />

Cash and Cash<br />

Equivalents<br />

(01.01.2012)<br />

In <strong>2011</strong>, cash flow from operating activities was USD 578 million, lower than in 2010 due to a reduction<br />

in operating profit and to the growth in working capital.<br />

In <strong>2011</strong>, cash outflow due to investment activities was USD 1,128 million (44 % down on 2010). Most of<br />

the cash outflow (USD 1,154 million) was attributable to capital expenditure.<br />

In <strong>2011</strong>, USD 426 million was raised from financial activities (63 % down on 2010). Financial activities<br />

comprise raising and repayment of loans (USD 3,358 million and USD 2,350 million, respectively),<br />

acquisition of 50 % of the shares of MMK-Metalurji (USD 475 million) and payment of dividends (USD 122<br />

million).<br />

Debt Structure<br />

0 1,000 2,000 3,000 4,000 5,000<br />

Rubles US dollars Euro<br />

In <strong>2011</strong>, the Company’s total debt, including leasing debt, increased by USD 868 million. This was largely<br />

due to an increase of USD 629 million in long-term debt. Short-term debt increased only insignificantly,<br />

and the Company has been able to maintain a high level of financial stability.<br />

As of 1 January <strong>2011</strong>, dollar-denominated borrowings accounted for the largest part of the debt structure<br />

by currency, at 45 %. However, this share declined during the year as the share of rouble-denominated<br />

debt increased to 34 % from 28 % as a result of MMK’s policy to mitigate the effect of exchange rate<br />

fluctuations on the Company’s financial position.<br />

Credit ratings<br />

In May <strong>2011</strong>, Fitch raised MMK’s credit rating from BB to ВВ+ (stable outlook).<br />

In December <strong>2011</strong>, Moody`s changed the Company’s rating outlook to stable from positive, returning it to<br />

the same level as the beginning of 2010.<br />

Prudent financial management helps the Company to secure credit ratings from leading ratings agencies,<br />

and thus to finance the Company’s development using appropriate funding on acceptable terms.<br />

42 43<br />

Agency<br />

Moody`s<br />

Fitch<br />

Rating<br />

Ba3<br />

ВВ+<br />

ВВ<br />

Outlook<br />

P<br />

S<br />

N<br />

P<br />

S<br />

N<br />

P<br />

S<br />

N<br />

Jan<br />

Feb<br />

Mar<br />

Аpr<br />

May<br />

June<br />

2010 <strong>2011</strong><br />

July<br />

Aug<br />

Sept<br />

Oct<br />

Nov<br />

Dec<br />

Jan<br />

Feb<br />

Mar<br />

Аpr<br />

May<br />

June<br />

July<br />

Aug<br />

Sept<br />

Oct<br />

Nov<br />

Dec<br />

Jan<br />

2012<br />

Feb<br />

Mar