Internal consistency of risk free rate and MRP in the CAPM

Internal consistency of risk free rate and MRP in the CAPM

Internal consistency of risk free rate and MRP in the CAPM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

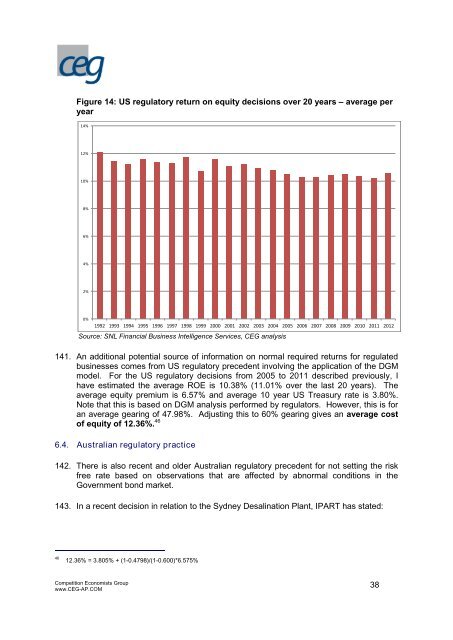

Figure 14: US regulatory return on equity decisions over 20 years – average per<br />

year<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

Source: SNL F<strong>in</strong>ancial Bus<strong>in</strong>ess Intelligence Services, CEG analysis<br />

141. An additional potential source <strong>of</strong> <strong>in</strong>formation on normal required returns for regulated<br />

bus<strong>in</strong>esses comes from US regulatory precedent <strong>in</strong>volv<strong>in</strong>g <strong>the</strong> application <strong>of</strong> <strong>the</strong> DGM<br />

model. For <strong>the</strong> US regulatory decisions from 2005 to 2011 described previously, I<br />

have estimated <strong>the</strong> average ROE is 10.38% (11.01% over <strong>the</strong> last 20 years). The<br />

average equity premium is 6.57% <strong>and</strong> average 10 year US Treasury <strong>rate</strong> is 3.80%.<br />

Note that this is based on DGM analysis performed by regulators. However, this is for<br />

an average gear<strong>in</strong>g <strong>of</strong> 47.98%. Adjust<strong>in</strong>g this to 60% gear<strong>in</strong>g gives an average cost<br />

<strong>of</strong> equity <strong>of</strong> 12.36%. 46<br />

6.4. Australian regulatory practice<br />

142. There is also recent <strong>and</strong> older Australian regulatory precedent for not sett<strong>in</strong>g <strong>the</strong> <strong>risk</strong><br />

<strong>free</strong> <strong>rate</strong> based on observations that are affected by abnormal conditions <strong>in</strong> <strong>the</strong><br />

Government bond market.<br />

143. In a recent decision <strong>in</strong> relation to <strong>the</strong> Sydney Desal<strong>in</strong>ation Plant, IPART has stated:<br />

46 12.36% = 3.805% + (1-0.4798)/(1-0.600)*6.575%<br />

Competition Economists Group<br />

www.CEG-AP.COM<br />

1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012<br />

38